What is Private Trust Form (MOD PT)?

The Private Trust Form (MOD PT) is essential for reporting changes related to private trusts. If you or your partner have engaged with a private trust in the past five years—whether through transferring funds or making gifts—you must complete this form. It ensures that all transactions are accurately documented and reported, which is vital for tax compliance and maintaining the integrity of the trust. However, you do not need to fill out this form for Special Disability Trusts or Complying Self Managed Superannuation Funds.

What is Private Trust Form used for?

The Private Trust Form (MOD PT) is essential for reporting your interactions with private trusts. Here’s what it’s used for:

- Reporting any involvement with or transfer of funds/assets to a private trust within the last 5 years.

- Declaring gifts associated with an active or vested private trust.

- Determining your share of income and assets from a private trust.

- Providing evidence of vesting if applicable.

- Excluding certain trusts like Special Disability Trusts and Complying Self Managed Superannuation Funds.

How to fill out Private Trust Form ?

- 1

Open the Private Trust Form in the PDF editor.

- 2

Fill in your details if you or your partner have dealt with a private trust in the last 5 years.

- 3

Complete the form for any gifts related to an active or vested private trust.

- 4

Avoid filling the form for Special Disability Trusts or Complying Self Managed Superannuation Funds.

- 5

Check that all required information is accurately completed.

- 6

Click Done to download your form.

Who is required to fill out Private Trust Form ?

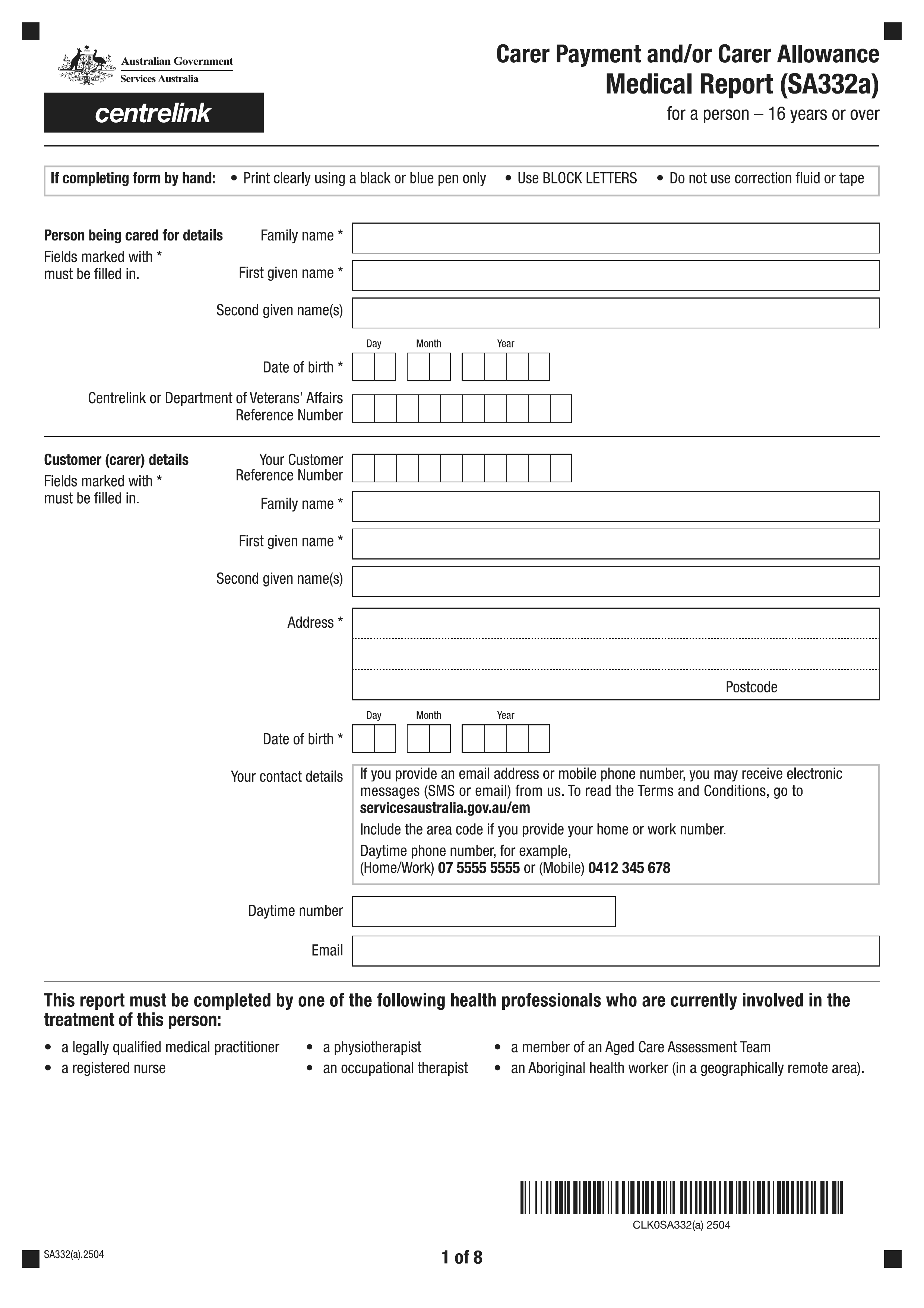

Individuals who have been involved with or transferred funds or assets to a private trust in the last 5 years are responsible for completing Form MOD PT. This includes appointors, guardians, principals, trustees, shareholders, beneficiaries, and others associated with the trust.

When is Private Trust Form not required?

Form MOD PT is not required for Special Disability Trusts or Complying Self-Managed Superannuation Funds. Additionally, if you or your partner haven't made any gifts involving an active or vested private trust in the last five years, you do not need to complete this form.

When is Private Trust Form due?

The deadline for Form MOD PT is not fixed. This form is required to report any involvement with or transfer of funds to a private trust within the last five years. Make sure to download and complete the form accurately to ensure prompt processing when needed.

How to get a blank Private Trust Form?

To get a blank Private Trust Form (MOD PT), simply visit our website. The form is issued by Services Australia and is pre-loaded in our editor, ready for you to fill out. Remember, our platform helps with filling and downloading forms, but not filing them.

How to sign Private Trust Form online?

To sign the Private Trust Form (MOD PT), you can apply an electronic signature, as indicated by official sources like Services Australia. It's always best to check for the latest updates before proceeding. Use PDF Guru to fill out the form, create your electronic signature, and download it for your records. Remember, PDF Guru does not support form submission, so you’ll need to handle that separately.

Where to file Private Trust Form?

To submit the Private Trust Form (MOD PT), return it to your local Centrelink office. You can do this either by mail or in person.

If you require assistance, services for assistive technology or interpreters are available. Use this form if you or your partner have made any gifts involving a private trust in the last five years.