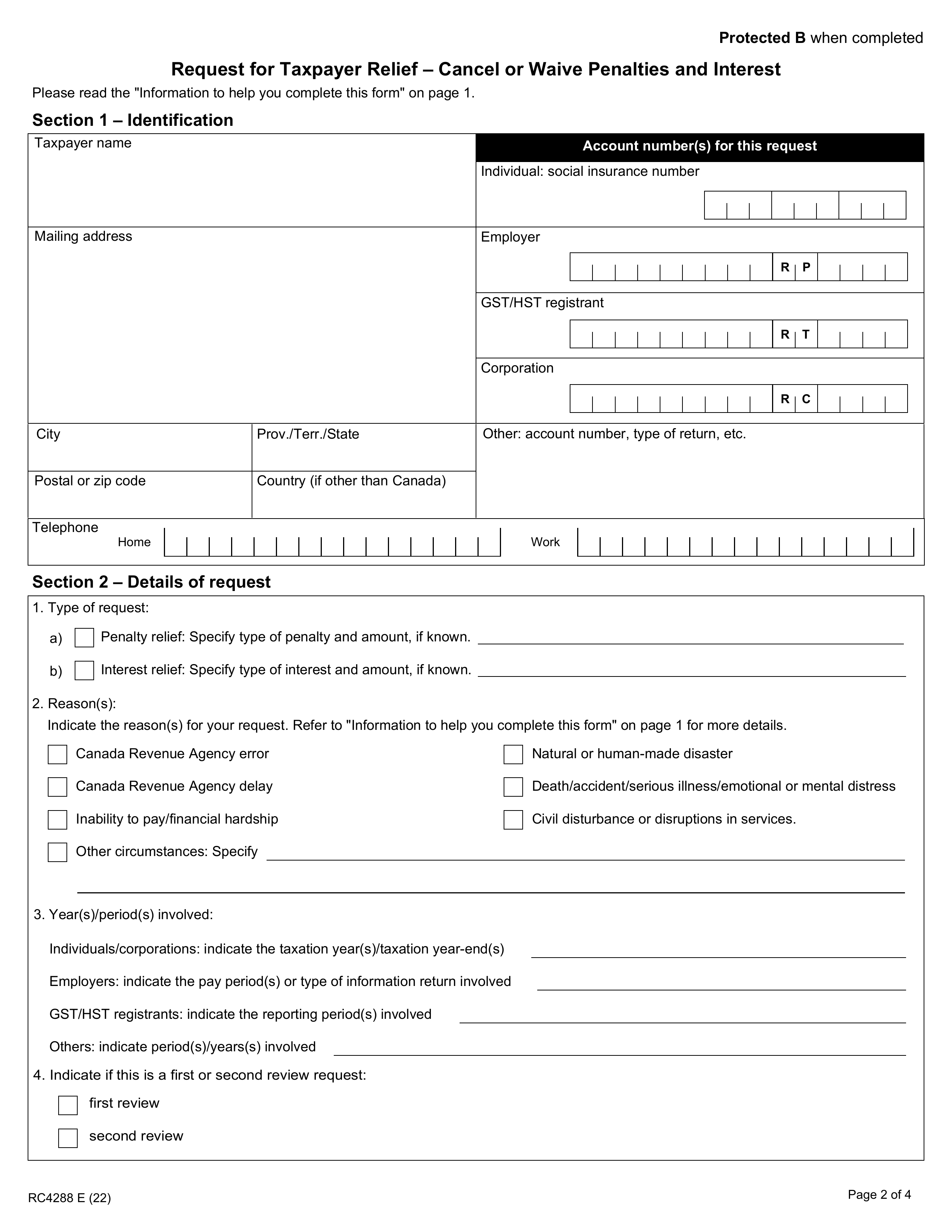

What is Form RC1?

Form RC1, Request for a Business Number and Certain Program Accounts, is essential for businesses in Canada looking to register with the Canada Revenue Agency (CRA). This form allows businesses to obtain a Business Number (BN) and set up crucial accounts such as GST, Payroll, and Corporate. Filling out Form RC1 helps identify the business and its activities, enabling better management of operations and tax obligations. Completing this form is a vital step for any business aiming to operate legally and efficiently in Canada.

What is Form RC1 used for?

Form RC1 is important for businesses in Canada. It is used for several key registrations:

- Registering for a Business Number (BN): Obtain a unique identifier from the Canada Revenue Agency (CRA).

- Registering for GST/HST: Apply for a Goods and Services Tax/Harmonized Sales Tax account.

- Registering for Payroll Deductions: Apply for a payroll deductions program account.

- Registering for Corporate Income Tax: Apply for a corporate income tax account.

- Registering for Import/Export Accounts: Apply for import/export accounts.

How to fill out Form RC1?

- 1

Fill in Part A: Enter your general business information, including ownership and operation types.

- 2

Complete Part B: If applicable, register for a GST/HST program account.

- 3

Complete Part C: If applicable, register for a payroll deductions program account.

- 4

Complete Part D: If applicable, register for a corporation income tax program account.

- 5

Complete Part E: If applicable, register for an information return program account.

- 6

Complete Part F: If applicable, request a charity program account.

- 7

Fill in Part G: Provide all required information in the certification section.

Who is required to fill out Form RC1?

Form RC1 must be completed by businesses registering for a Business Number and specific CRA accounts, such as GST, Payroll, and Corporate. This includes corporations and non-resident corporations looking to operate in Canada.

Businesses needing to manage their tax-related activities will use this form to obtain the necessary registrations.

When is Form RC1 not required?

Form RC1 is not required if you're not registering for a CRA program account (e.g. GST/HST, payroll, import/export). It’s also unnecessary if registration is done automatically through provincial incorporation or if there's no taxable activity in Canada.

When is Form RC1 due?

The deadline for Form RC1 is immediate upon deciding to register for a Business Number and the necessary CRA accounts. You can submit it by post, fax, or by calling the CRA at 1-800-959-5525 with your registration details. The exact due date may vary based on your specific situation.

How to get a blank Form RC1?

To get a blank Form RC1, simply visit our website. The Canada Revenue Agency issues this form, and we have a blank version ready for you to fill out. Remember, our platform helps with filling and downloading forms, but not filing them.

How to sign Form RC1 online?

To sign Form RC1, Request for a Business Number and Certain Program Accounts, you need a handwritten signature. After filling out the form using PDF Guru, you can download it for your records. Remember to check for the latest updates on signing requirements to ensure compliance. While PDF Guru allows you to fill and download the form, submission must be completed through the appropriate official channels.

Where to file Form RC1?

Once you’ve completed Form RC1, you can submit it by mail or fax to your local tax services office or tax centre.

For a quicker option, register over the phone using the Business enquiries line, or use Business Registration Online for online submission.