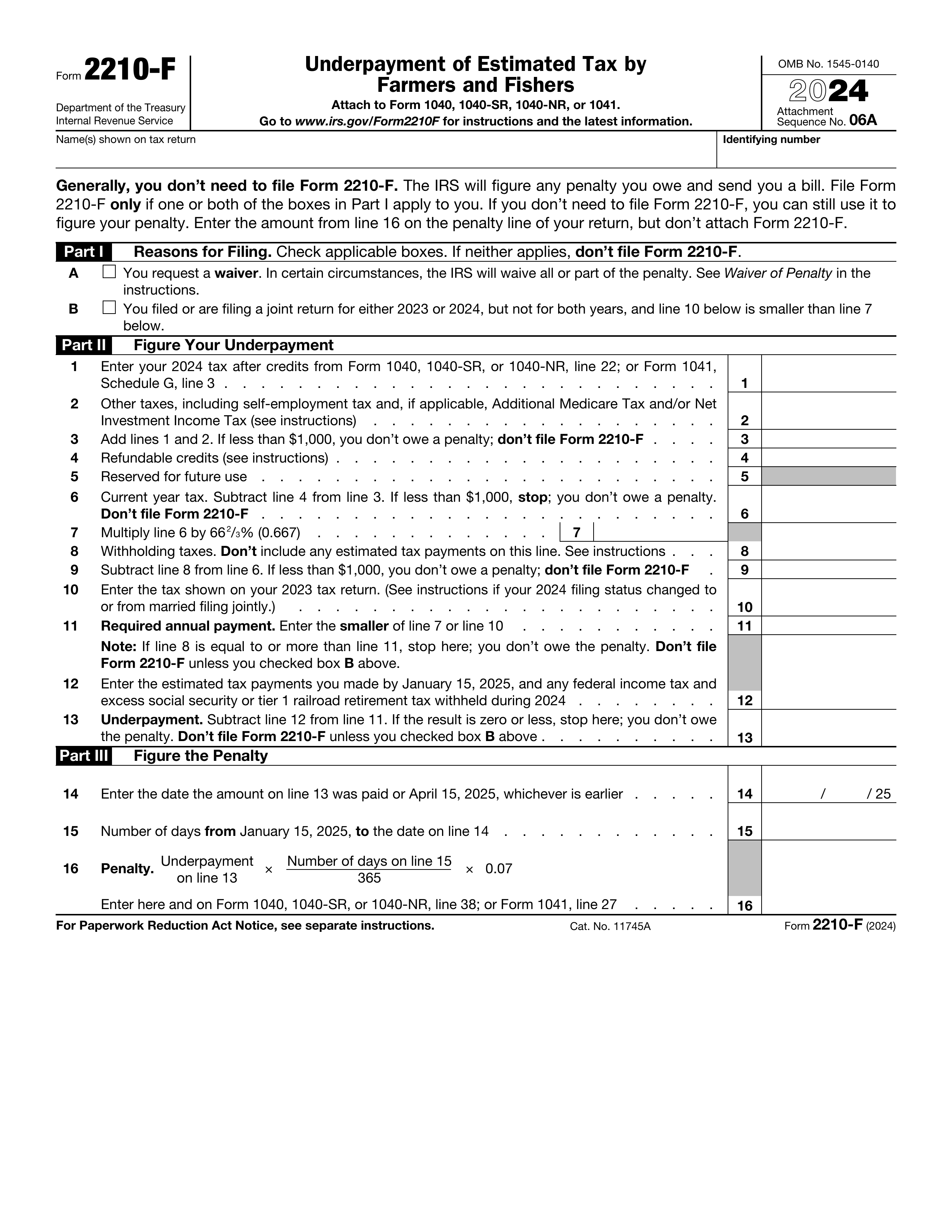

What is Form CT-2210?

Form CT-2210 is a crucial document for Connecticut taxpayers who may face penalties for underpaying their estimated income tax. This form calculates any underpayment amounts and associated penalties, ensuring that you meet your tax obligations on time. It's particularly important for self-employed individuals or those with income not regularly withheld. By completing this form, you can determine how much you owe and, if applicable, request a waiver for the penalty, helping you stay compliant and avoid unnecessary fees.

What is Form CT-2210 used for?

Form CT-2210 helps Connecticut taxpayers assess their underpayment of estimated income tax. It serves several important purposes:

- Calculating Underpayment: Determine how much estimated tax you owe.

- Avoiding Interest Penalties: Prevent extra charges on unpaid taxes.

- Reporting Underpayment: Inform the Connecticut Department of Revenue Services about your tax situation.

- Compliance with State Regulations: Ensure you meet state tax rules and avoid issues.

How to fill out Form CT-2210?

- 1

Gather financial documents related to your income tax.

- 2

Input your personal and tax information in the designated fields.

- 3

Calculate taxes owed by following the form's instructions.

- 4

Review the form for any errors or omissions.

- 5

Download the completed form to submit with your income tax return.

Who is required to fill out Form CT-2210?

Form CT-2210 is typically completed by Connecticut residents, including individuals, trusts, part-year residents, and those filing joint tax returns, who have underpaid their income tax and need to adjust estimated payments.

After completion, this form is used by taxpayers to calculate and report underpaid income tax, helping them avoid potential interest penalties and stay compliant with state tax regulations.

When is Form CT-2210 not required?

You don't need to file Form CT-2210 if your income isn't subject to Connecticut tax. This applies to nonresidents or part-year residents without Connecticut-sourced income. Additionally, if your required annual payment is zero or based on last year's tax liability, you can skip filing this form. Always check your specific situation to ensure compliance.

When is Form CT-2210 due?

The deadline for Form CT-2210 is when you underpay your estimated income tax. You need to make four equal payments by April 15, June 15, September 15, and January 15. If you miss these payments, file Form CT-2210 to calculate and pay the interest on the underpayment. Make sure to use the correct year's form to avoid processing delays.

How to get a blank Form CT-2210?

To obtain a blank Form CT-2210, simply visit our platform. Remember, PDF Guru aids in filling and downloading forms, but not in filing them.

This form is issued by the Department of Revenue Services (DRS) of the State of Connecticut.

Do you need to sign Form CT-2210?

Form CT-2210 does not require a signature. However, it's essential to complete the form accurately and attach it to your income tax return if necessary. For the most current information, checking for updates is recommended. With PDF Guru, you can fill out this form, download it for your records, and take care of the next steps manually, as our platform does not support submission.

Where to file Form ct-2210?

To submit Form CT-2210, attach it to your Connecticut income tax return if filing by mail. Alternatively, file it electronically through the Connecticut Department of Revenue Services website.

For paper submissions, send it to the designated address on the form. If mailing your tax return, remember to check the box for Form CT-2210 on the front.