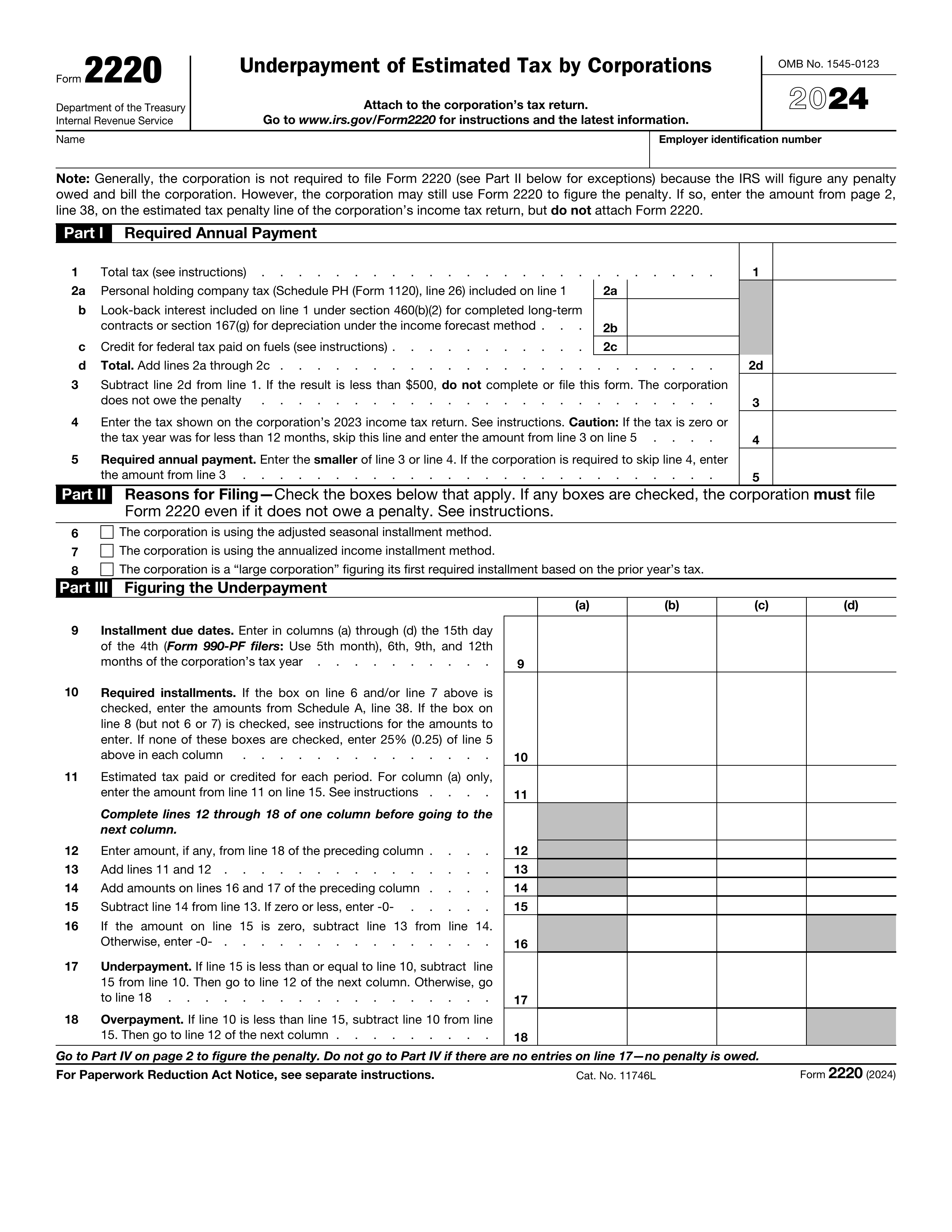

What is Form 2210-F?

Form 2210-F is specifically designed for farmers and fishermen to assess whether they underpaid their estimated taxes and to calculate any potential penalties. This form helps identify if additional payments are necessary due to insufficient quarterly tax contributions. It plays a crucial role in ensuring that these taxpayers fulfill their tax obligations, particularly given the fluctuations in their income related to seasonal work. By filing this form, they can avoid extra penalties or interest charges, making it an essential tool for managing their tax responsibilities.

What is Form 2210-F used for?

Form 2210-F helps you figure out if you owe a penalty for not paying enough estimated tax. Here’s what it does:

- Determine Underpayment: Calculate how much estimated tax you underpaid.

- Waiver Application: Request a penalty waiver for valid reasons, like a disaster or disability.

- Annualized Income Method: Use this method to lower or avoid penalties.

- Penalty Calculation: Calculate the penalty based on the amount you underpaid and the interest rate.

How to fill out Form 2210-F?

- 1

Check if you need to file Form 2210-F by confirming at least two-thirds of your gross annual income comes from farming or fishing.

- 2

Complete lines 1 through 11 by entering the amount from Form 1040, line 22, and calculating your required annual payment.

- 3

Figure your underpayment using lines 10 and columns a) through d) to calculate the total amount of your underpayment.

- 4

Calculate the penalty using the worksheet in Part II, Section B, to determine the underpayment penalty amount.

- 5

Attach documentation if requesting a waiver, providing reasons and supporting evidence.

Who is required to fill out Form 2210-F?

Farmers and fishermen who have not made or have underpaid their estimated tax payments are responsible for completing Form 2210-F. They need to assess their underpayment and potential penalties.

Individuals using the annualized income installment method or requesting a penalty waiver due to unusual circumstances also utilize this form. It is typically attached to their tax return if needed.

When is Form 2210-F not required?

You don't need to file Form 2210-F if your underpayment results from a federally declared disaster. Additionally, if you're a farmer or fisherman who meets certain income thresholds and pays your taxes by March 1, or has enough withholding, you may also skip this form. Always check the latest guidelines to ensure compliance.

When is Form 2210-F due?

The deadline for Form 2210-F is April 15th of the following year, which is the same as your income tax return. If April 15th falls on a weekend or legal holiday, the IRS extends the deadline to the next business day. Make sure to file on time to avoid penalties!

How to get a blank Form 2210-F?

To obtain a blank Form 2210-F, simply visit our website. Please remember, PDF Guru aids in filling and downloading but not filing forms.

This form is issued by the Internal Revenue Service (IRS) of the Department of the Treasury

Do you need to sign Form 2210-F?

Form 2210-F does not require a signature. The IRS will typically calculate any penalties owed and issue a bill if necessary. Always check for the latest updates to ensure compliance. With PDF Guru, you can fill out this form, download it for your records, and manage all your PDF editing needs, but remember that submission isn't supported through our platform.

Where to file Form 2210-F?

To submit Form 2210-F, attach it to your tax return. You can file your return to IRS online or by mail.

If mailing, follow the specific instructions for your tax return form. Include a statement explaining why you are filing it.