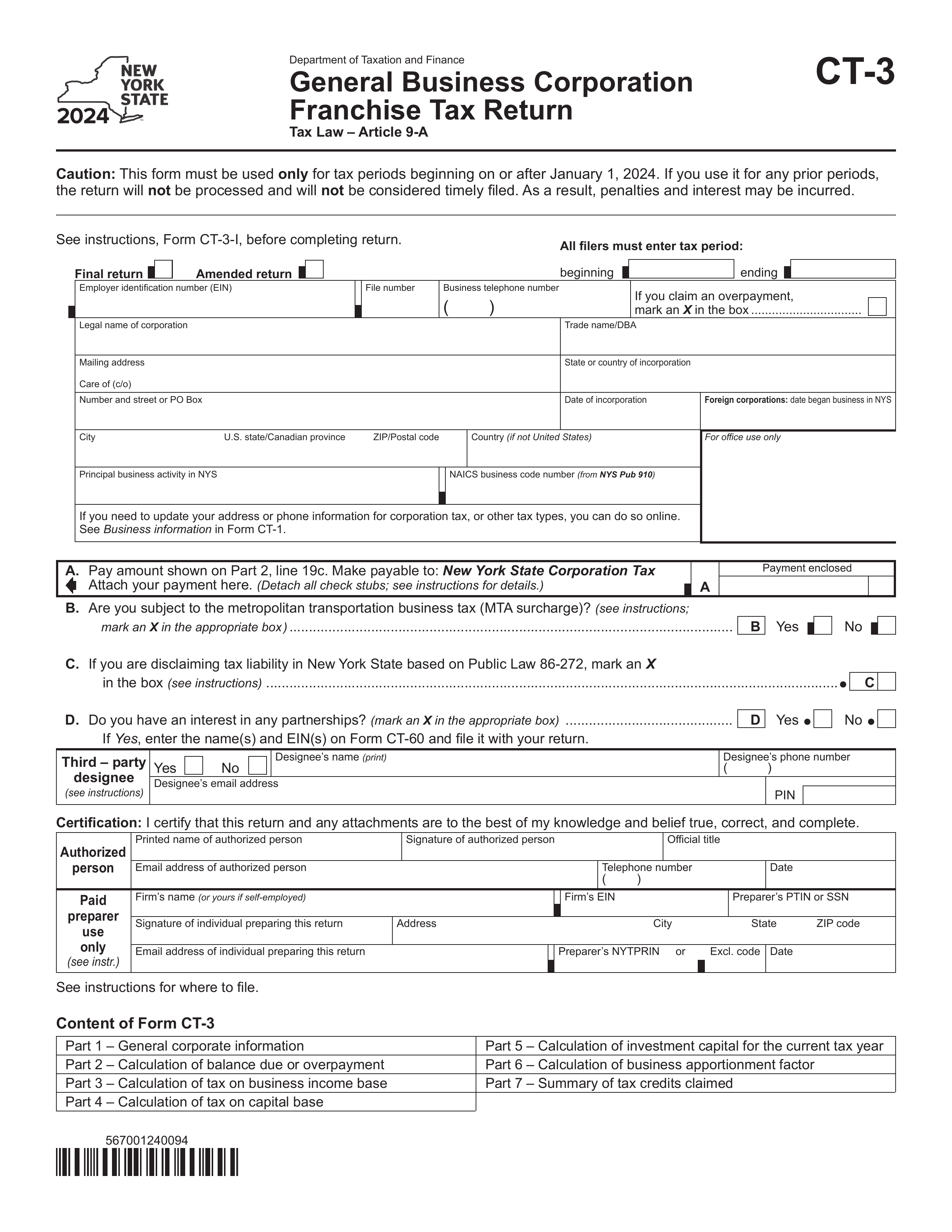

What is Form CT-3-S?

Form CT-3-S is the New York S Corporation Franchise Tax Return. It is important because it reports the income, gains, losses, and deductions of an S corporation operating in New York. This form helps the state determine the tax owed by the business. By filing it, S corporations can comply with state tax laws and maintain their status, allowing shareholders to report income on their personal tax returns. Proper completion ensures accurate tax calculation and avoids potential penalties.

What is Form CT-3-S used for?

Form CT-3-S is used by New York S Corporations to report their franchise tax. It helps to:

- to calculate the tax owed.

- to report income, gains, losses, and deductions.

- to provide information on shareholders.

How to fill out Form CT-3-S?

- 1

Open Form CT-3-S in the PDF editor.

- 2

Fill in your business's name, address, and identification number accurately.

- 3

Complete all required financial sections, including income, deductions, and credits.

- 4

Review the form for accuracy and completeness.

- 5

Sign the form electronically.

- 6

Download the completed form for submission.

- 7

Mail it to the appropriate New York tax office by the due date.

Who is required to fill out Form CT-3-S?

Business corporations electing New York S corporation status must complete Form CT-3-S for tax purposes. This includes mandated New York S corporations and federal S corporations under Article 9-A.

After completion, the form is used by the New York State Department of Taxation and Finance to assess tax liabilities.

When is Form CT-3-S not required?

Form CT-3-S is not required for C corporations, which must file Form CT-3 instead.

Additionally, S corporations that have not made the New York S election do not need to file this form. Bank S corporations should use Form CT-32-S instead of CT-3-S.

When is Form CT-3-S due?

The deadline for Form CT-3-S is March 15th of the following year for calendar year filers. For fiscal year filers, the due date is the 15th day of the 3rd month after the end of their tax year.

If the due date lands on a weekend or holiday, you must file on the next business day. You can also request a 6-month extension by filing Form CT-5.4 by the original due date.

How to get a blank Form CT-3-S?

To obtain a blank form CT-3-S, you can find it pre-loaded in our editor on our website.

This form is issued by the New York State Department of Taxation and Finance

How to sign Form CT-3-S online?

To sign Form CT-3-S, start by using PDF Guru. After filling out the required fields in the PDF editor, you can create a simple electronic signature to insert into the designated area of the form. Once you have added your signature, click "Done" to download the completed form.

Make sure to review the New York State Department of Taxation and Finance for specific signature requirements related to form CT-3-S. Following official guidelines ensures your form meets all necessary standards before submission.

Where to file Form CT-3-S?

Form CT-3-S must be submitted to the New York State Department of Taxation and Finance.

Submission methods: mail, online or in-person.