What is Form IT-203-B?

Form IT-203-B is a tax document designed for nonresidents and part-year residents of New York who earn income from New York sources. This form allows individuals to accurately report and pay taxes on various types of income, including wages, investment earnings, and rental income. By using Form IT-203-B, taxpayers ensure their income from New York is correctly allocated and taxed according to state laws, helping them comply with tax regulations and avoid potential issues during tax season.

What is Form it-203-b used for?

Form IT-203-B is important for certain taxpayers in New York. It helps nonresidents and part-year residents report their income accurately. Here’s what it’s used for:

- Reporting New York-sourced income: For earnings from New York, like wages and rental income.

- Allocating workdays: To calculate days spent in New York, affecting tax obligations.

- Completing college tuition deductions: For eligible students to claim education-related expenses.

- Accurate tax compliance: Ensures correct reporting and adherence to New York tax laws.

How to fill out Form IT-203-B?

- 1

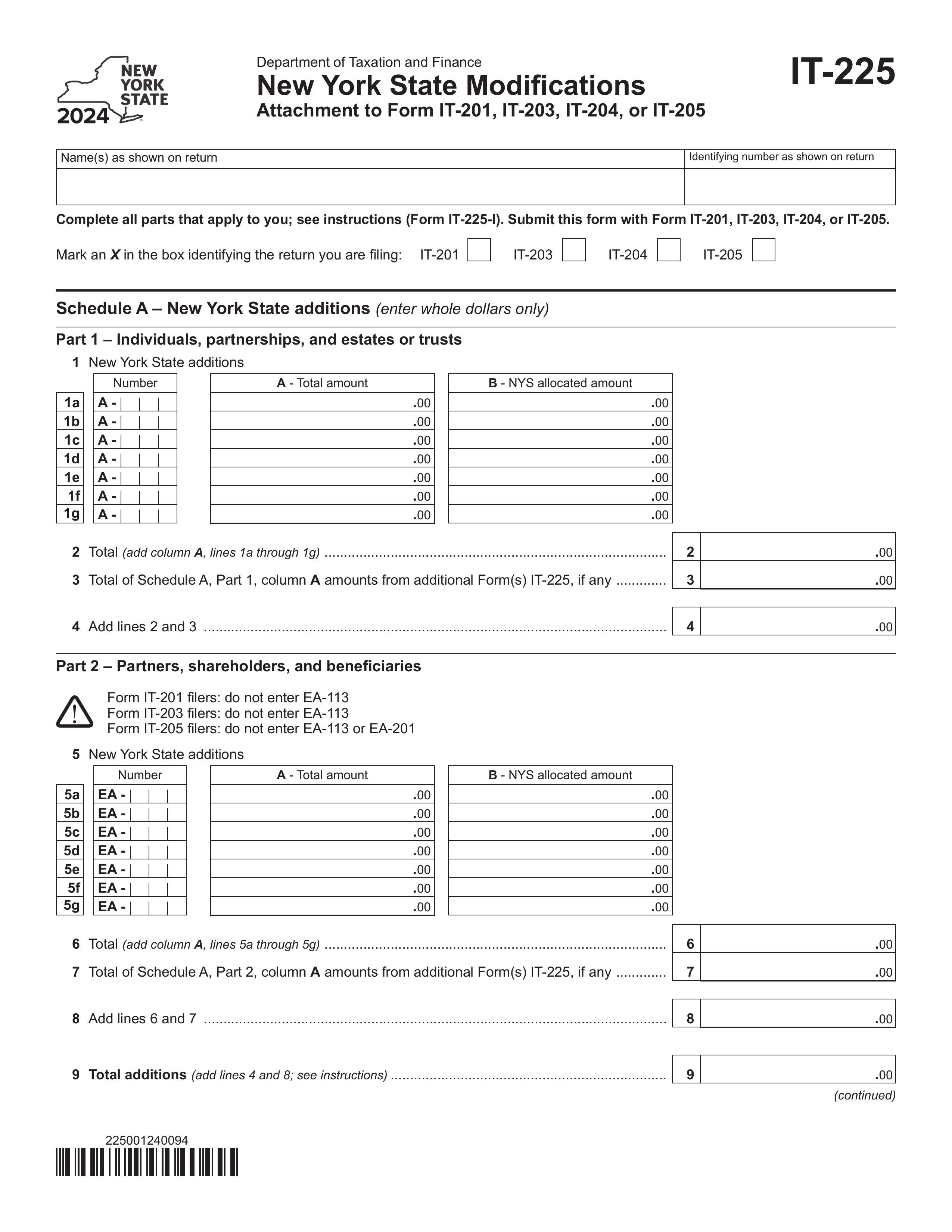

Complete general information – Fill out all relevant sections and submit Form IT-203-B with Form IT-203.

- 2

Allocate wage and salary income (Schedule A) – Complete a separate Schedule A for each job where income was earned inside and outside New York State.

- 3

Enter employment details – List total workdays, non-working days (weekends, holidays, etc.), and days worked outside New York State.

- 4

Report nonresident wages – Calculate and enter wages earned during the nonresident period.

- 5

Report New York living quarters (Schedule B) – Indicate if you maintained living quarters in New York State and provide details.

- 6

Enter days spent in New York – Record the number of days spent in the state during the tax year.

- 7

Claim college tuition deduction (Schedule C) – Provide student details and report eligible tuition expenses.

- 8

Attach and submit – Ensure accuracy and attach Form IT-203-B to Form IT-203 to prevent delays.

Who is required to fill out Form IT-203-B?

Nonresident individuals and part-year residents with income from New York State sources are responsible for completing Form IT-203-B. They must file this form if their New York adjusted gross income surpasses their standard deduction or if they wish to claim a refund of withheld taxes.

After filling out Form IT-203-B, users rely on it to allocate income, claim deductions for college tuition expenses, and determine their New York State tax liability based on their income from New York sources.

When is Form IT-203-B not required?

You don't need to file Form IT-203-B if you are non-resident or part-year resident who have no income from New York State sources and your New York adjusted gross income is below the state standard deduction. Additionally, if you aren't claiming a refund for any New York State, New York City, or Yonkers income taxes withheld or any refundable or carryover credits, filing this form isn't necessary.

When is Form IT-203-B due?

Form IT-203-B is due at the same time as Form IT-203, which is the main nonresident and part-year resident income tax return for New York State. For the 2024 tax year, the due date would be April 15, 2025. However, if you file for an extension, you would have until October 15, 2025, to submit your return and any accompanying forms, including IT-203-B.

How to get a blank Form IT-203-B?

To obtain a blank IT-203-B, visit our platform. Remember, PDF Guru helps with filling out and downloading forms, but does not assist with filing them.

This form is issued by the New York State Department of Taxation and Finance.

Do you need to sign Form IT-203-B?

Yes, Form IT-203-B, does require a signature if you have income sourced from New York. This includes wages and investment earnings. Always check for the latest updates on tax forms to ensure compliance. With PDF Guru, you can fill out this form, add your signature, and download it for your records. However, please note that submission is not supported.

Where to file Form IT-203-B?

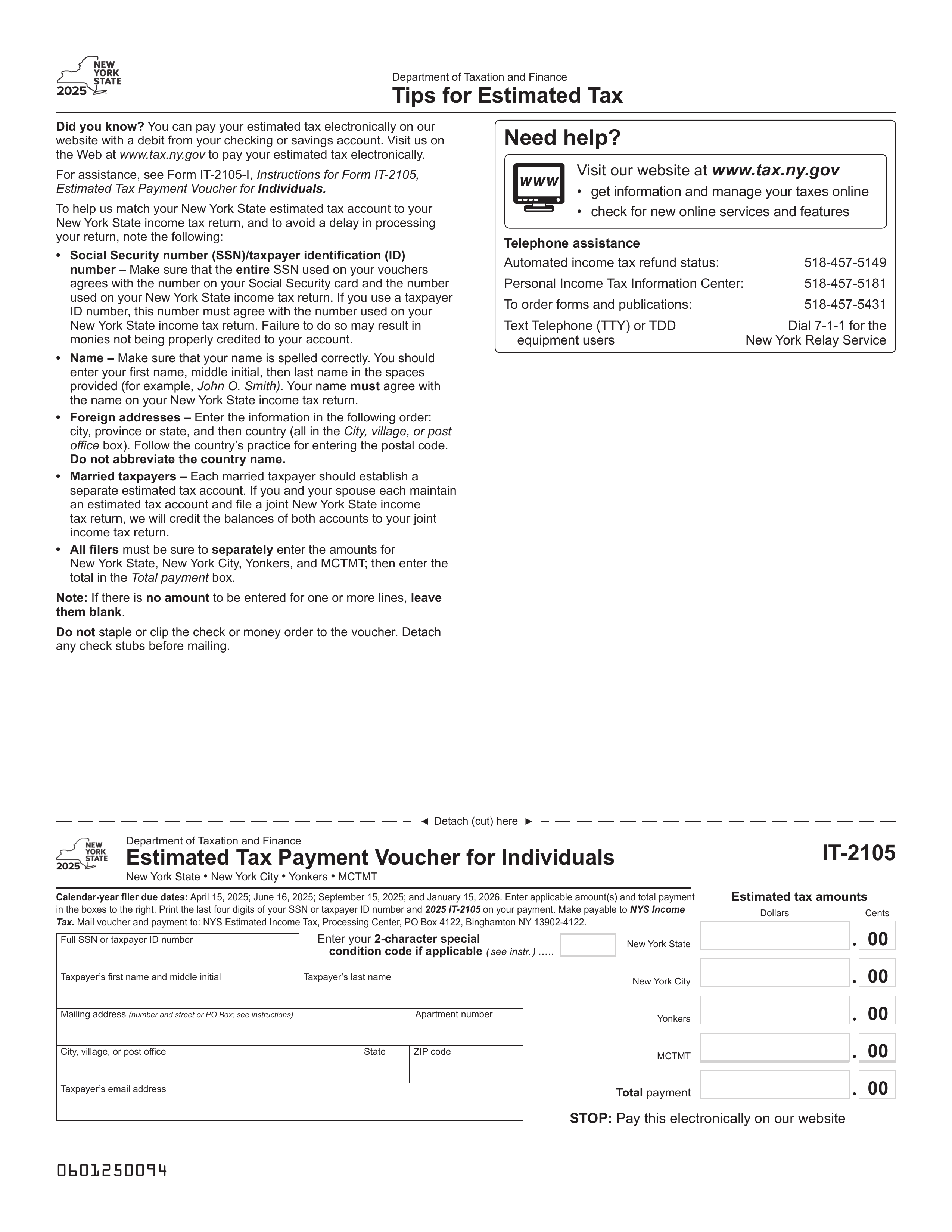

To submit Form IT-203-B, you have two options: electronic filing or mailing. For electronic submission, visit the New York State Department of Taxation and Finance's online services.

If you choose to mail your form, send it to the address provided by the New York State Department of Taxation and Finance. Find the correct address and detailed instructions on their official website at www.tax.ny.gov. Note that the form must be filed as an attachment to Form IT-203.