What is Form IT-225?

Form IT-225 is a New York State tax form designed to report adjustments to your federal adjusted gross income that aren't explicitly listed on your tax return. This includes income modifications such as interest from U.S. government agencies or certain partnership income. Submitting this form is vital to ensure that you accurately report all income, helping you avoid incorrect tax assessments and potential penalties. Proper completion of Form IT-225 is essential for maintaining compliance with state tax regulations.

What is Form IT-225 used for?

Form IT-225 helps New York taxpayers adjust their income for state tax purposes. Here’s what it does:

- Reporting New York additions: Lists state-specific income that isn’t covered on your main tax return.

- Reporting New York subtractions: Identifies state-specific deductions not included on your main tax return.

- Accurate tax compliance: Ensures your tax details are correct to avoid penalties.

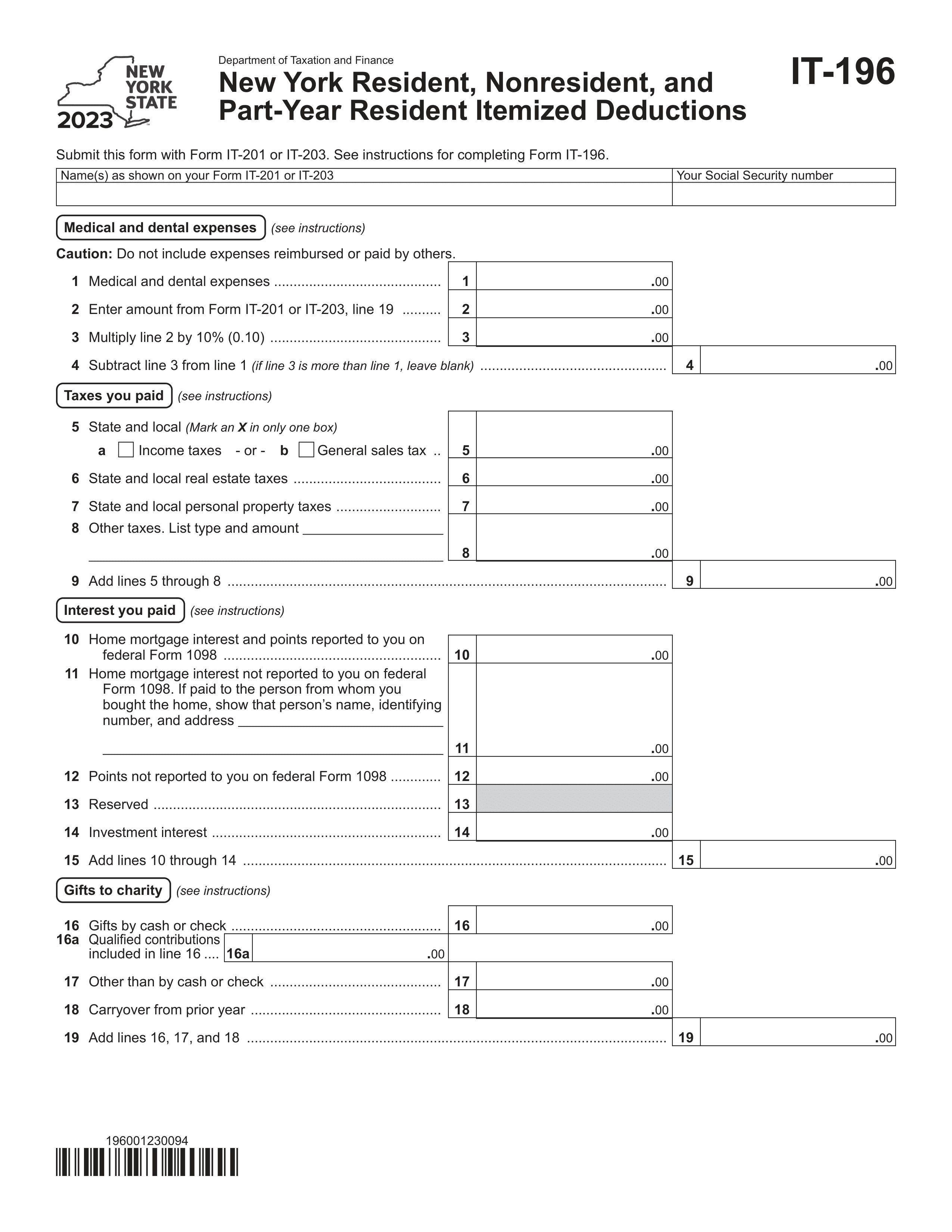

- Submission with primary tax returns: Must be filed alongside your main tax forms like IT-201 or IT-203.

How to fill out Form IT-225?

- 1

Gather necessary financial documents and information.

- 2

Identify your filing status (individual, partnership, estate/trust).

- 3

Complete Schedule A for additions and Schedule B for subtractions.

- 4

Ensure accurate names and identification numbers.

- 5

Enter your name and SSN or EIN as shown on your main tax return.

- 6

Mark an X in the appropriate box for the related return.

- 7

Submit the completed form with your primary tax return.

Who is required to fill out Form IT-225?

Form IT-225 must be completed by the following individuals and entities individuals filing Form IT-201 (New York State Resident Income Tax Return) or IT-203 (Nonresident and Part-Year Resident Income Tax Return), as well as partnerships filing Form IT-204 and estates or trusts filing Form IT-205. Additionally, S corporation shareholders who need to report specific modifications.

When is Form IT-225 not required?

You don't need to file Form IT-225 if you have no New York State additions or subtractions beyond what's on your main return. This applies to individuals without a K-1 from a partnership or those not benefiting from an estate or trust. If your modifications are already included in your return, skip filing Form IT-225.

When is Form IT-225 due?

The deadline for Form IT-225 is the same as your main tax return. You need to submit it along with Form IT-201, IT-203, IT-204, or IT-205. If you file your main return by April 15th, Form IT-225 is also due on that date. Make sure to include it to ensure your tax filings are complete.

How to get a blank Form IT-225?

To access a blank Form IT-225, simply visit our website. Remember, our platform helps you fill and download forms, but it does not support filing them.

This form is issued by the New York State Department of Taxation and Finance.

Do you need to sign Form IT-225?

Form IT-225, New York State Modifications, does not require a signature. It must be filled out accurately and submitted along with your main tax return to report any additions or subtractions to your federal adjusted gross income. For the most reliable information, always check for the latest updates from official sources. You can use PDF Guru to fill out and download the form, but remember, submission is not supported through our platform.

Where to file Form IT-225?

To submit Form IT-225, attach it to your main tax return for the New York State Department of Taxation and Finance.

You can send it by mail or through other approved channels. Mark the appropriate box on your form.