What is Form IT-196?

Form IT-196 is used by New York residents, nonresidents, and part-year residents to claim itemized deductions on their state income tax returns. This form is important because it allows taxpayers to reduce their taxable income by reporting eligible expenses, such as medical costs, mortgage interest, and property taxes. By accurately filling out this form, you can potentially lower your tax bill and receive a larger refund. Understanding and using IT-196 can help you maximize your tax benefits.

What is Form IT-196 used for?

Form IT-196 is used by New York taxpayers to claim itemized deductions. It helps determine your deductions:

- to report medical expenses.

- to deduct state and local taxes.

- to claim mortgage interest.

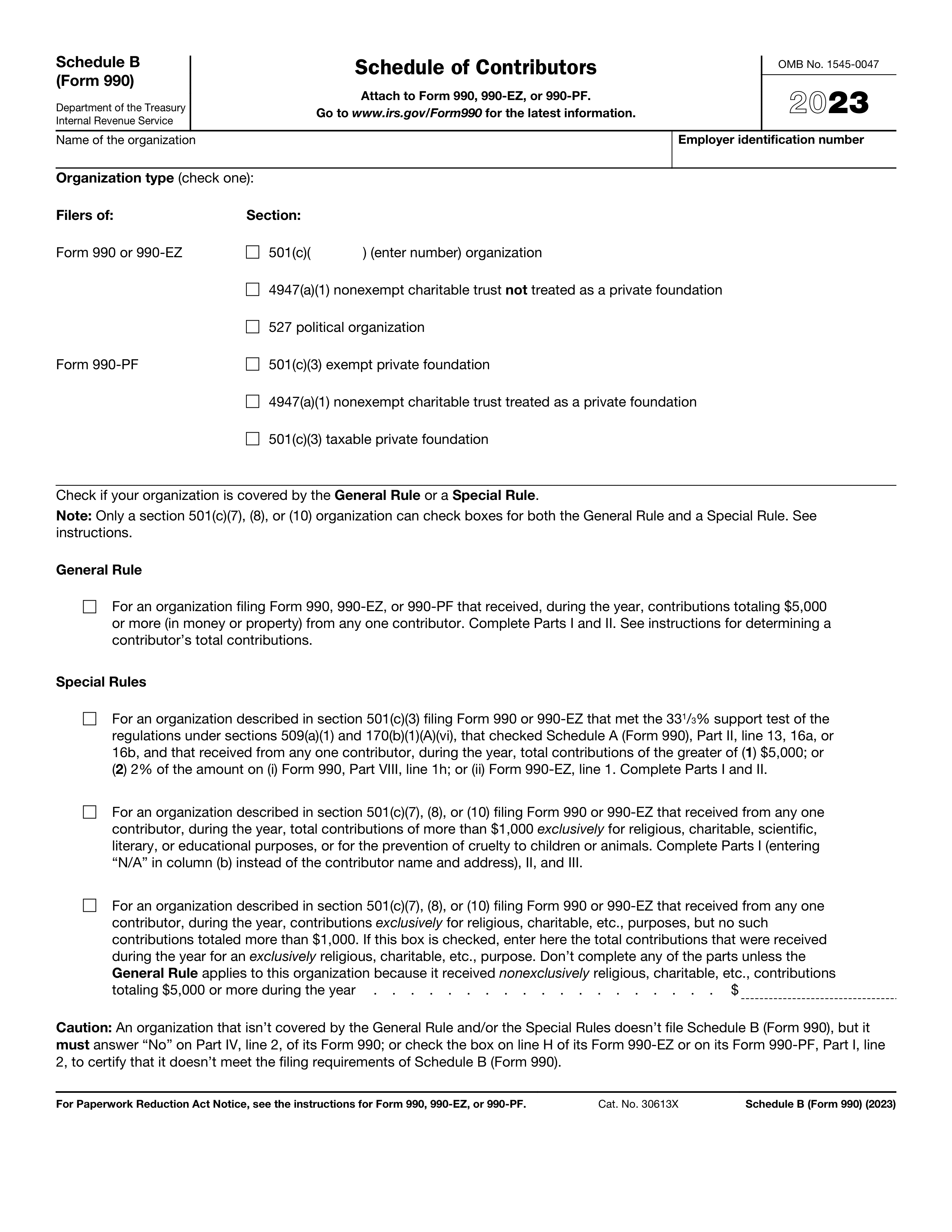

- to include charitable contributions.

- to account for unreimbursed employee expenses.

How to fill out Form IT-196?

- 1

Review the form instructions carefully to understand what deductions you can claim.

- 2

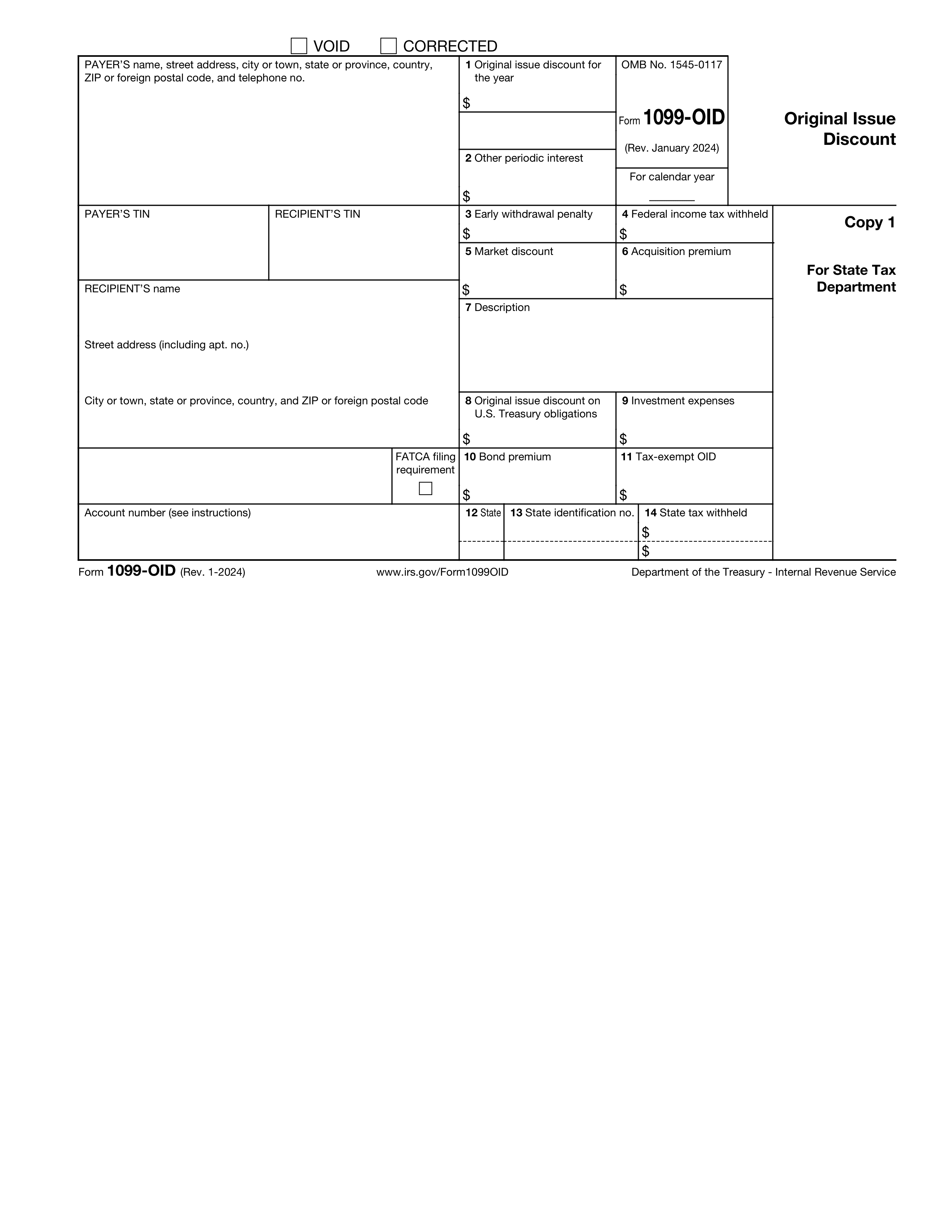

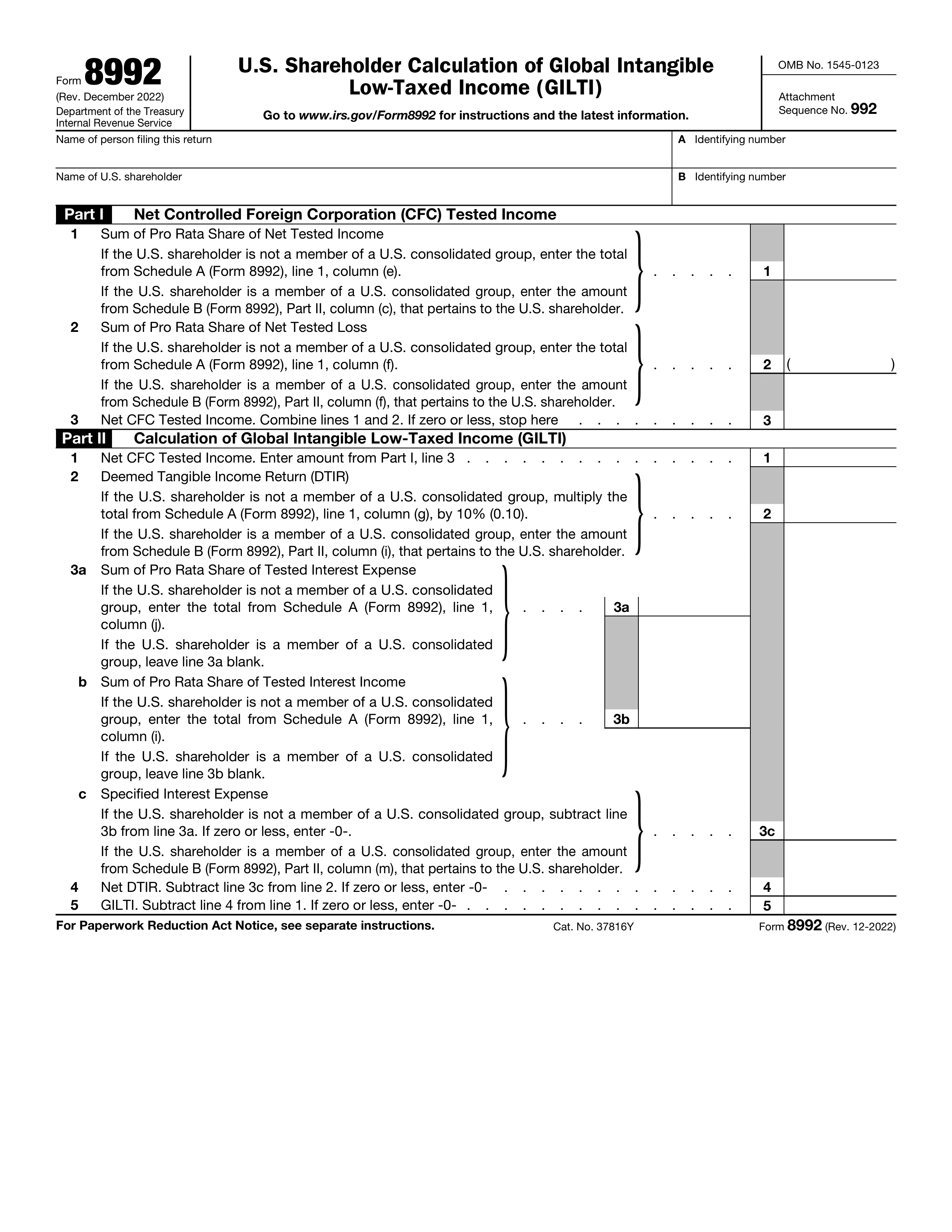

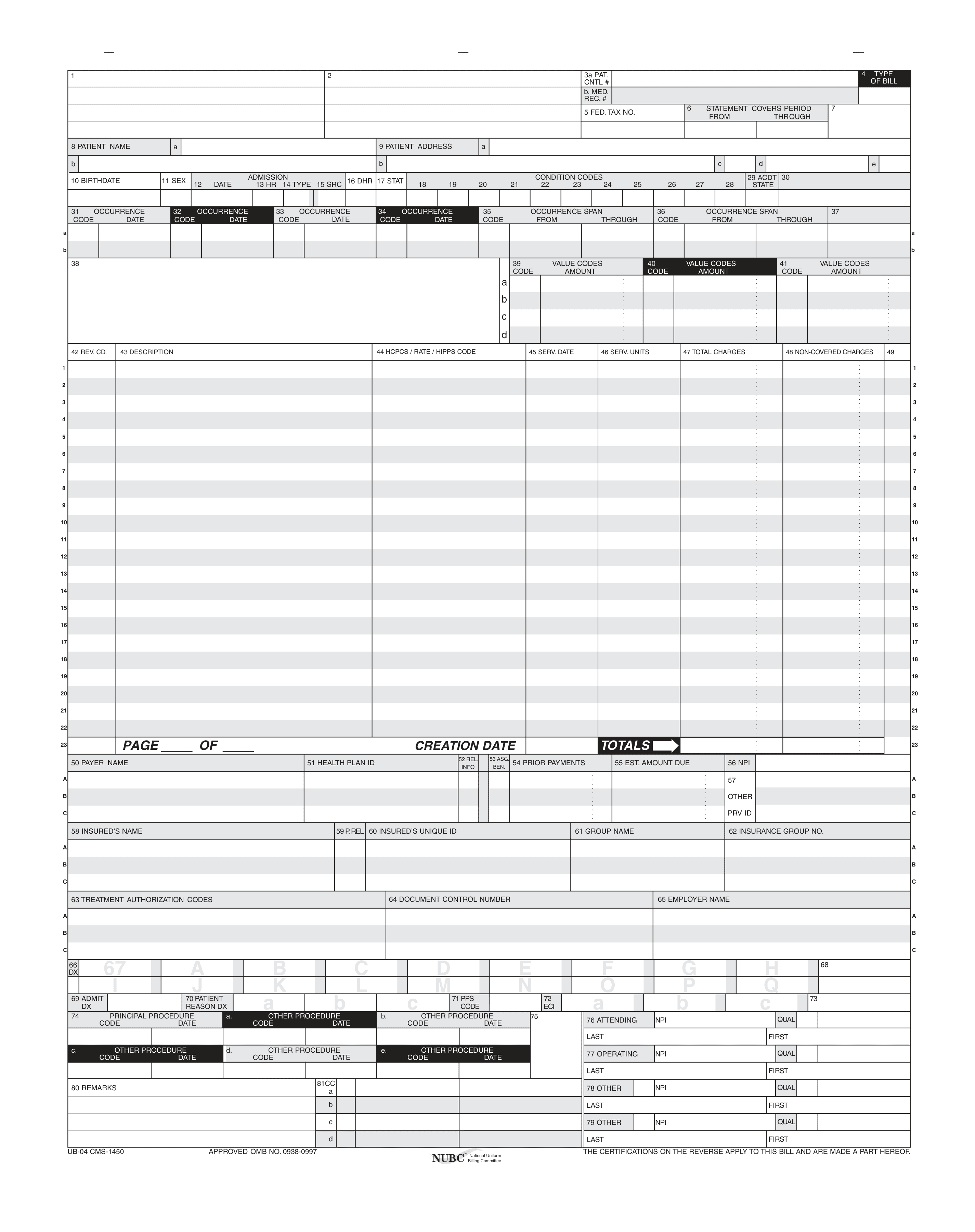

Gather necessary documents like W-2s and 1099s to support your deductions.

- 3

Fill in your personal information at the top of the form.

- 4

Enter each itemized deduction in the appropriate sections, following the guidelines.

- 5

Double-check your entries for accuracy and completeness.

- 6

Calculate your total deductions and ensure they align with your tax situation.

Who is required to fill out Form IT-196?

New York residents, nonresidents, and part-year residents must complete form IT-196 for itemized deductions. This form helps in reporting eligible deductions to reduce taxable income in New York State.

Taxpayers use this form to claim deductions for expenses like medical costs, mortgage interest, and property taxes.

When is Form IT-196 not required?

If you do not itemize your deductions on your New York State tax return, you do not need to file form IT-196. This applies if you choose the standard deduction instead of calculating your itemized deductions.

Additionally, individuals who qualify for certain tax credits, like the Earned Income Credit, may not need to complete this form if their filing status does not require itemizing deductions.

When is Form IT-196 due?

The deadline for form IT-196 is generally April 15th of the year following the tax year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day.

For taxpayers who file for an extension, the form is due by the extended deadline, which is usually October 15th. It's important to keep track of these dates to avoid late penalties.

How to get a blank Form IT-196?

To get a blank form IT-196, simply visit our website and click on the "Fill Form" option. The blank IT-196 form will load in our editor, allowing you to fill it out directly.

Do you need to sign Form IT-196?

Form IT-196, used for itemized deductions in New York, does not require a signature based on available information. However, it's wise to double-check with the IRS for the most current requirements.

Always verify any updates regarding tax forms to stay compliant and avoid mistakes. Staying informed can help minimize liability for any misinformation.

Where to file Form IT-196?

Form IT-196 can be filed by mail. You should ensure all sections are filled out correctly before sending it to the appropriate address.

Currently, New York does not allow online filing for Form IT-196. Always check the official New York State Department of Taxation website for updates.