What is Form PT-100?

The Petroleum Business Tax Return, known as Form PT-100, is essential for businesses in the petroleum sector to report their tax responsibilities. This form allows the government to monitor the sales of petroleum products and the corresponding taxes due. Accurate completion of the PT-100 is vital for adhering to tax regulations, avoiding penalties and audits, and ensuring a level playing field in the industry. Properly filing this form is crucial for maintaining the financial well-being of petroleum businesses.

What is Form PT-100 used for?

Form PT-100 is essential for businesses in the petroleum sector. It is used for the following purposes:

- Report taxable sales of petroleum products

- Calculate the petroleum business tax owed

- Provide necessary business information to the state

- Summarize taxes computed on Forms PT-101 through PT-106

- Determine the total amount due, including any penalty and interest

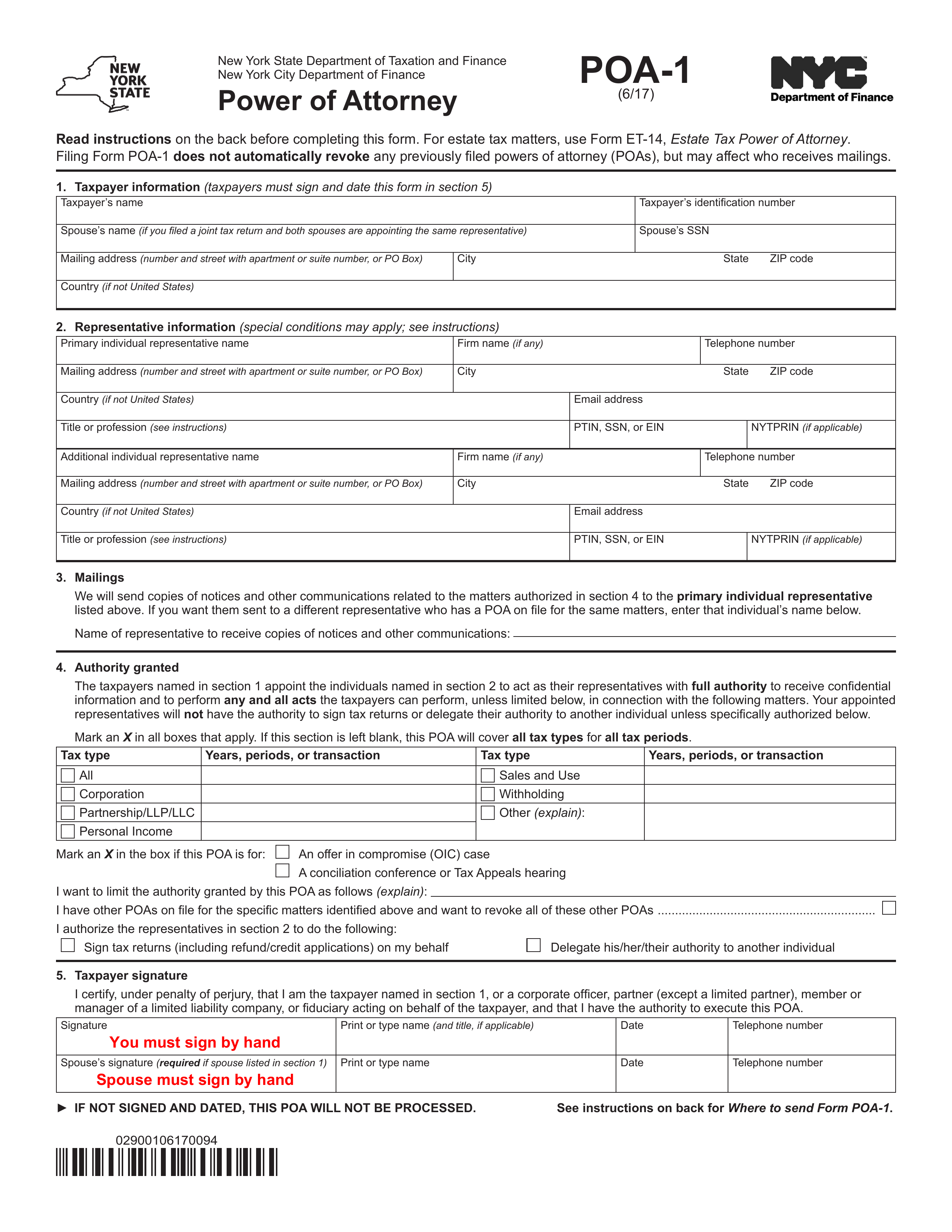

How to fill out Form PT-100?

- 1

Gather necessary information on gross receipts and tax rates.

- 2

Complete each section by filling out all fields accurately.

- 3

Double-check entries to ensure no errors or missing information.

- 4

Enter business details, including legal name and mailing address if not preprinted.

- 5

Summarize taxes by calculating total taxes due, including penalties and interest.

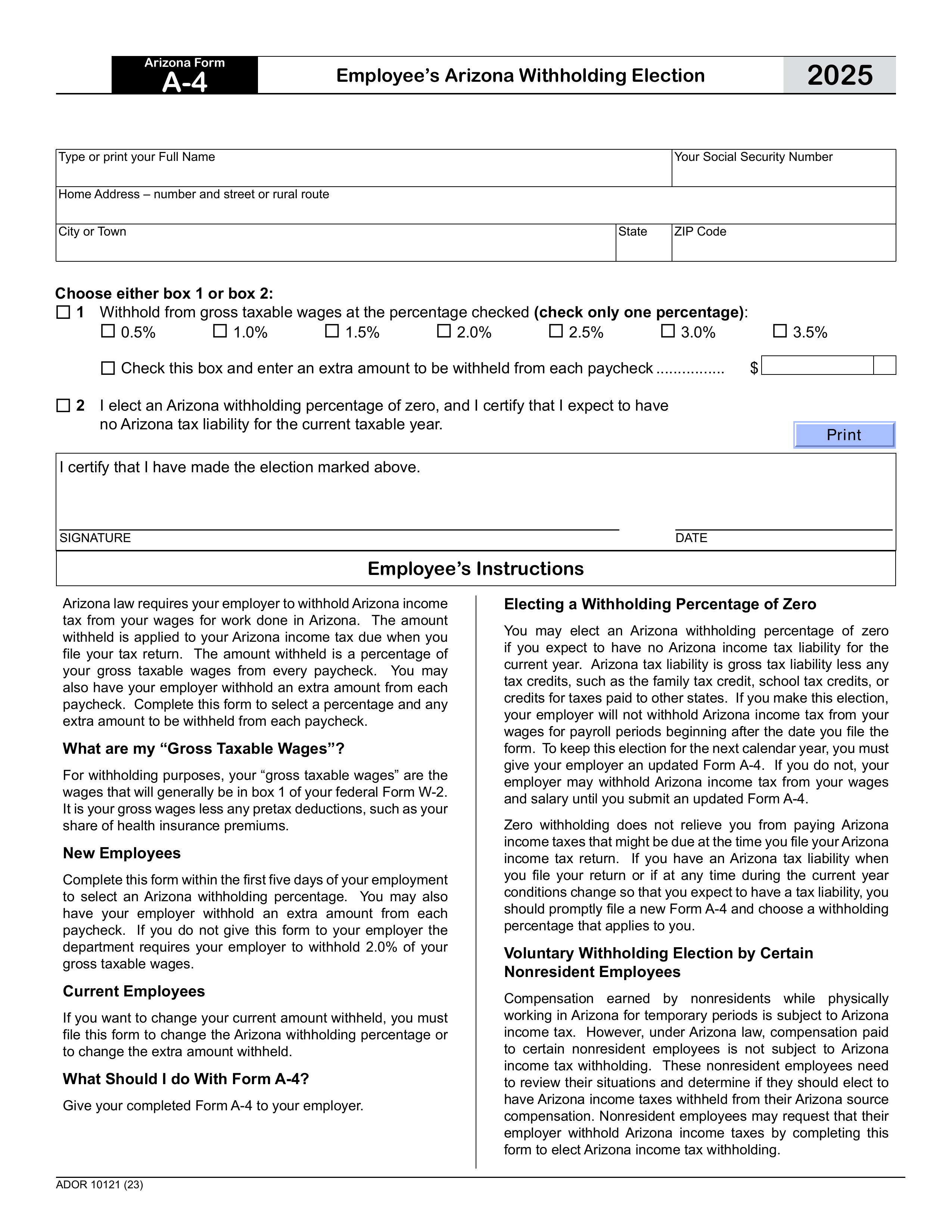

Who is required to fill out Form PT-100?

Distributors of motor fuel, liquefied petroleum gas fuel permittees, distributors of diesel motor fuel, residual petroleum product businesses, and aviation fuel businesses are responsible for completing Form PT-100.

These businesses use the form to summarize taxes and determine the total amount due, ensuring compliance with petroleum business tax obligations.

When is Form PT-100 not required?

Form PT-100 is not required if you don't own taxable business personal property. You also don't need it if you've claimed exemptions without changes in property status or transactions needing reassessment. Additionally, businesses with no significant property improvements or valuation changes may skip this form.

When is Form PT-100 due?

The deadline for Form PT-100 is the 20th day of the month following the end of the filing period. For instance, if your filing period ends in January 2025, you must submit the form by February 20, 2025. Timely filing is important to avoid any penalties.

How to get a blank Form PT-100?

To get a blank Form PT-100, simply visit our website. The New York State Department of Taxation and Finance issues this form, and we have it pre-loaded in our editor for you to fill out. Remember, our platform helps with filling and downloading, but not filing forms.

How to sign Form PT-100?

To sign Form PT-100, you need to provide a handwritten signature. The return must be dated and signed by an authorized individual, such as the owner, partner, or president of the business. It's important to check for the latest updates to ensure compliance. After completing the form with PDF Guru, download it and then add your signature before submitting it through the appropriate channels, as our platform does not support submission.

Where to file Form PT-100?

To submit the Petroleum Business Tax Return, you can file electronically via the Petroleum Business Tax Web File. Methods like Electronic Data Interchange (EDI) or Web Electronic Funds Transfer (EFT) are available for payments.

If you prefer to file by mail, be sure to send your completed return to the address specified by the Texas Comptroller. Always double-check for the latest submission guidelines to ensure compliance.