What is a K-1 Tax Form?

The K-1 Tax Form is important for reporting income, deductions, and credits from partnerships, S corporations, estates, or trusts. It tells individual partners or shareholders how much money to report on their personal tax returns. Understanding your K-1 is crucial because it affects your overall tax bill and ensures you comply with IRS regulations. If you receive a K-1, make sure to review it carefully and include the information when filing your taxes to avoid issues with the IRS.

What is the K-1 Tax Form used for?

The K-1 Tax Form is used to report income, deductions, and credits from partnerships and S corporations:

- to inform partners or shareholders of their share of income.

- to help individuals report their tax responsibilities.

- to provide necessary details for accurate tax filing.

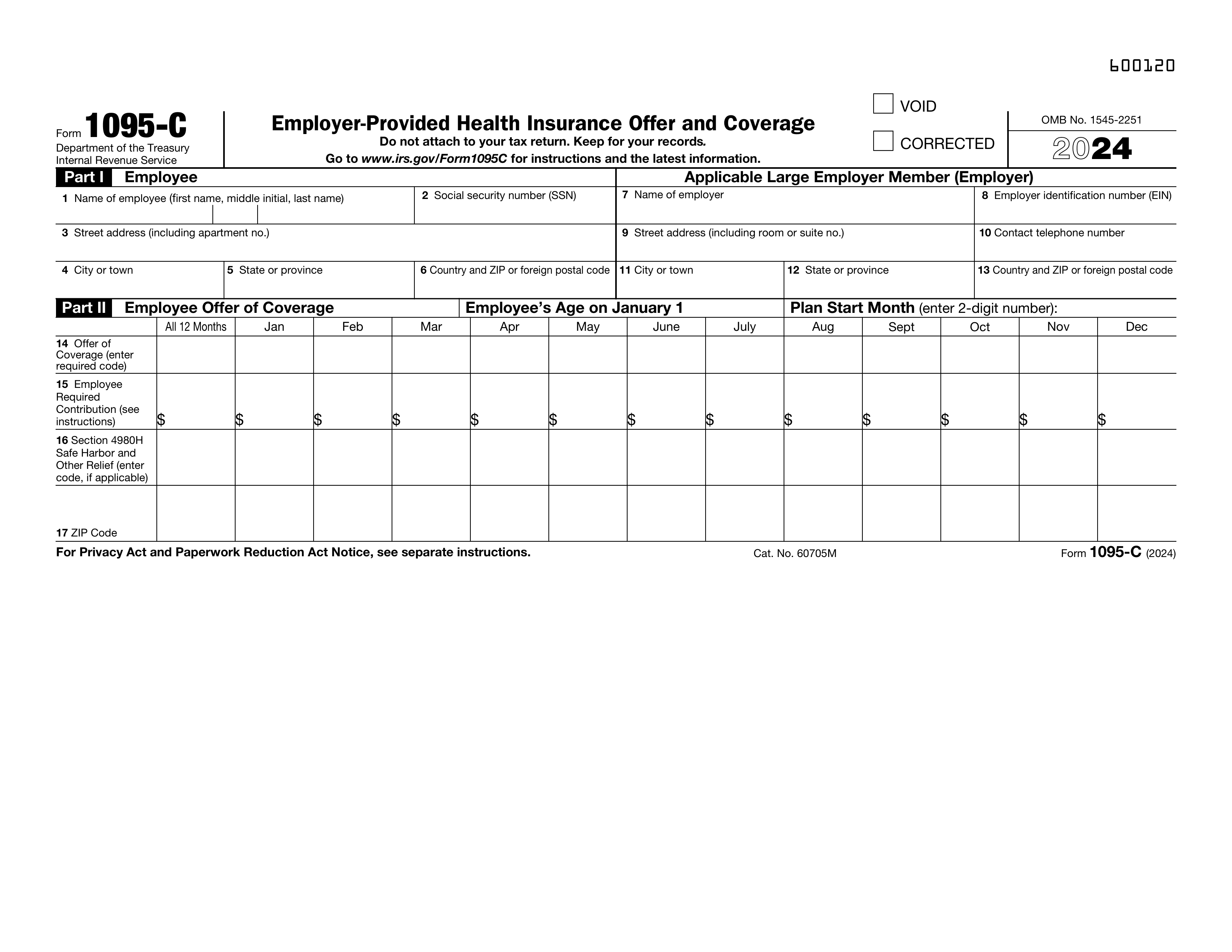

How to fill out the K-1 Tax Form?

- 1

Review the instructions for Form K-1 carefully to understand what information is needed.

- 2

Enter your partnership or S corporation name and employer identification number (EIN).

- 3

Fill in your personal information, including your name, address, and Social Security number.

- 4

Report your share of income, deductions, and credits in the respective boxes.

- 5

Double-check all entries for accuracy.

- 6

Save your work and prepare for submission based on IRS guidelines.

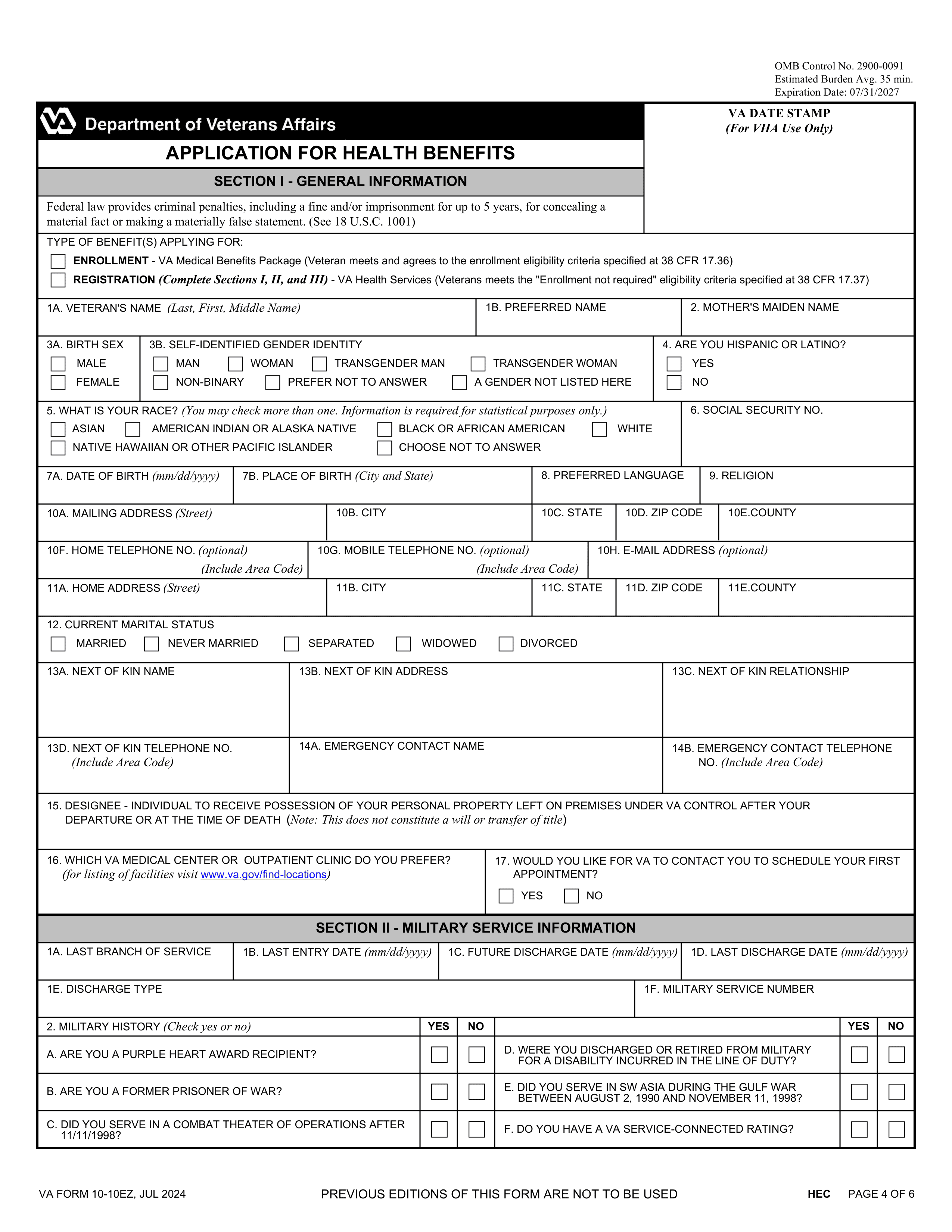

Who is required to fill out Tax Form K-1?

Partners in partnerships and shareholders in S corporations complete Form K-1 for tax reporting.

Taxpayers use the information on the form to report income on their individual tax returns.

When is the K-1 Tax Form not required?

You don’t need a K-1 Tax Form if you do not have income from partnerships, S corporations, estates, or trusts. Individuals who only receive wages or salaries from employment won’t receive this form.

If you are a member of a limited liability company (LLC) that is taxed as a sole proprietorship, you also won’t receive a K-1. Understanding these cases helps clarify your tax situation and avoid unnecessary paperwork.

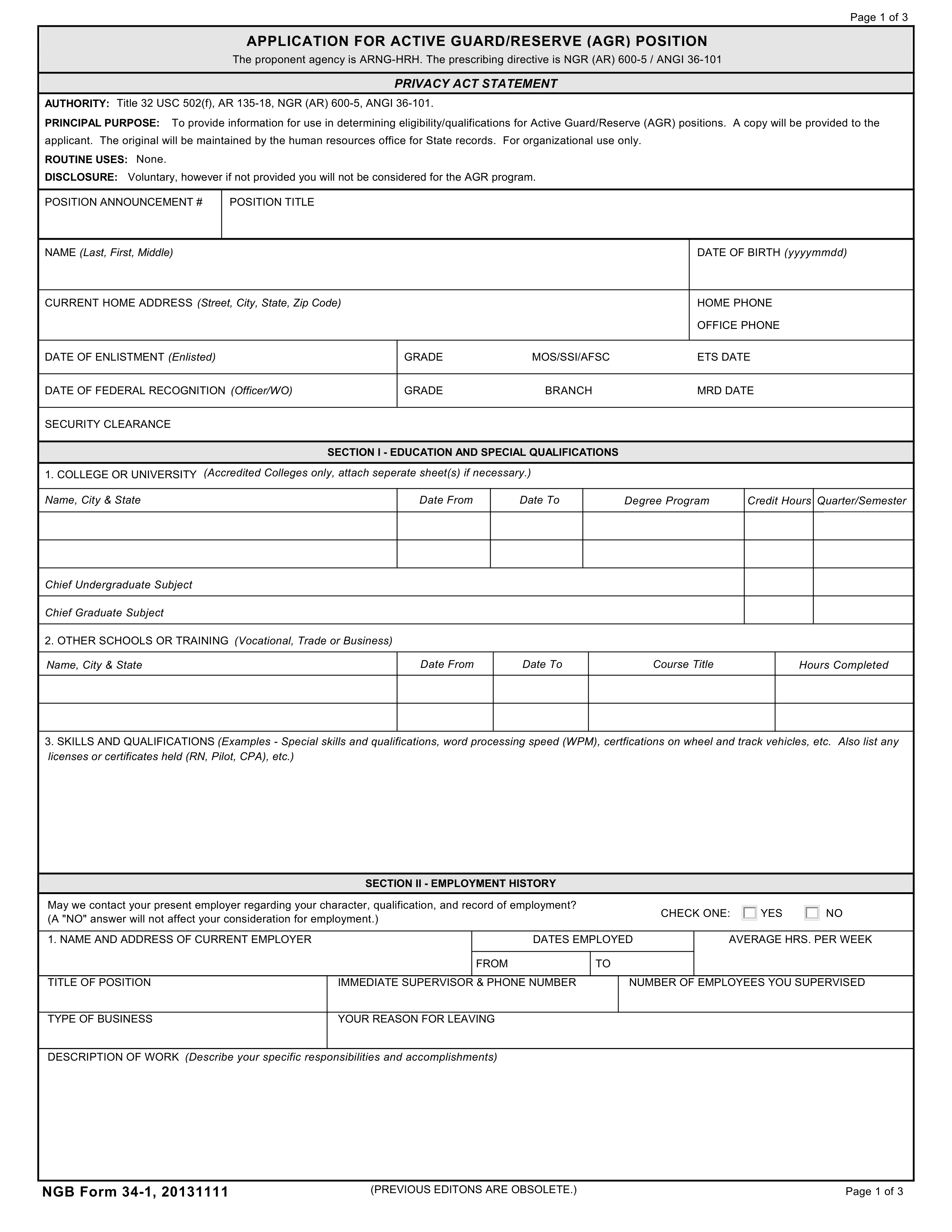

When is K-1 Tax Form due?

The deadline for Form K-1 is March 15 for partnerships and S corporations. This form reports income, deductions, and credits from these entities to their partners or shareholders.

If you receive a K-1, make sure to include the information on your personal tax return. It’s important to file accurately and on time to avoid penalties.

How to get a blank K-1 Tax Form?

To get a blank K-1 Tax Form, issued by IRS, simply visit our platform. The form is pre-loaded in our editor, ready for you to fill out. Once completed, you can download the filled form for your records.

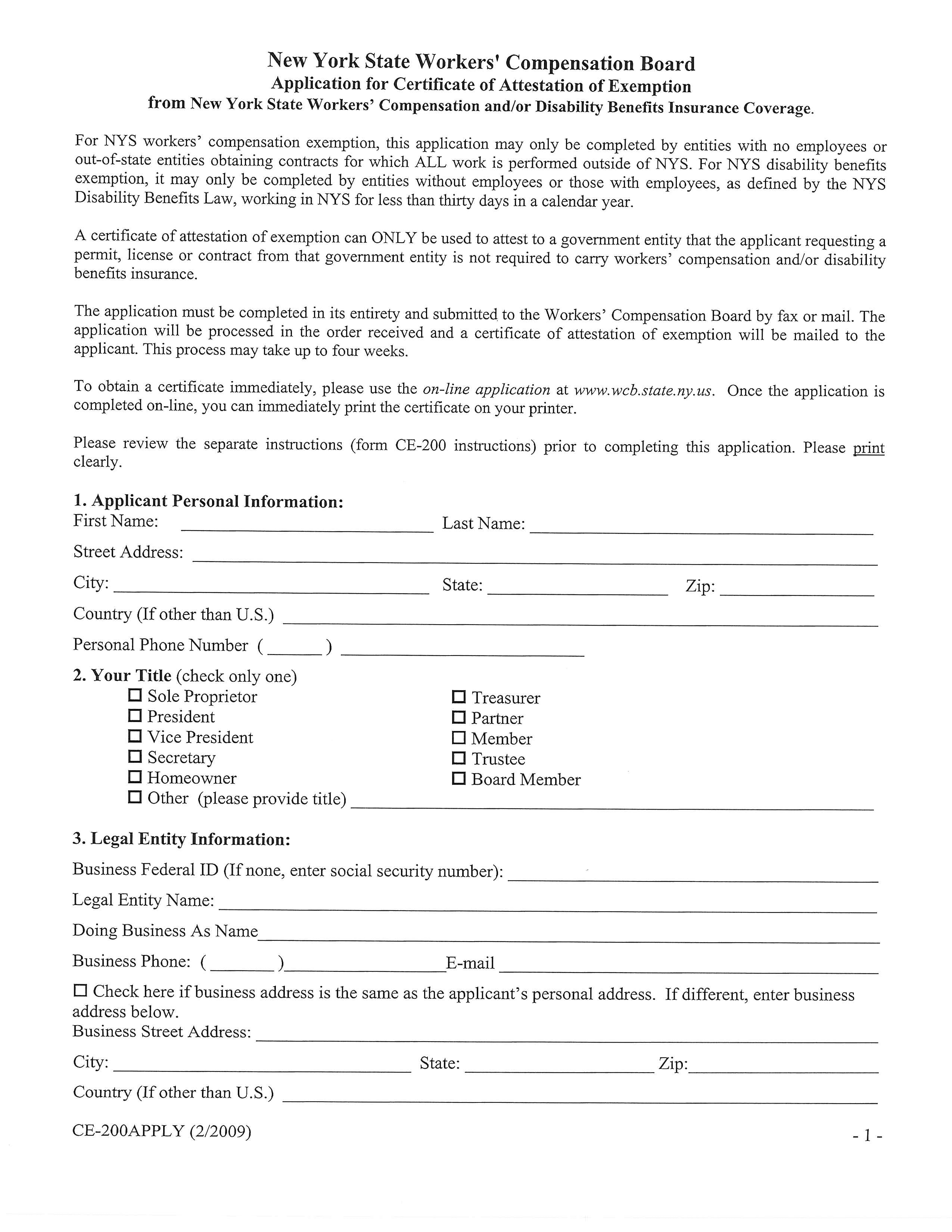

Do you need to sign Form K-1?

No, you do not need to sign Schedule K-1. The partnership return (Form 1065) as a whole must be signed by a partner or member, but individual Schedules K-1 do not require signatures.

Always check the IRS website for the most current information on tax forms. Staying informed helps you avoid potential issues with your filings.

Where to file Form K-1?

Form K-1 must be filed by mail with the IRS if you are a partner in a partnership or a shareholder in an S corporation.

Electronic filing is encouraged and can be done using IRS-approved software. Ensure all information is accurate before mailing to avoid delays in processing your tax return.