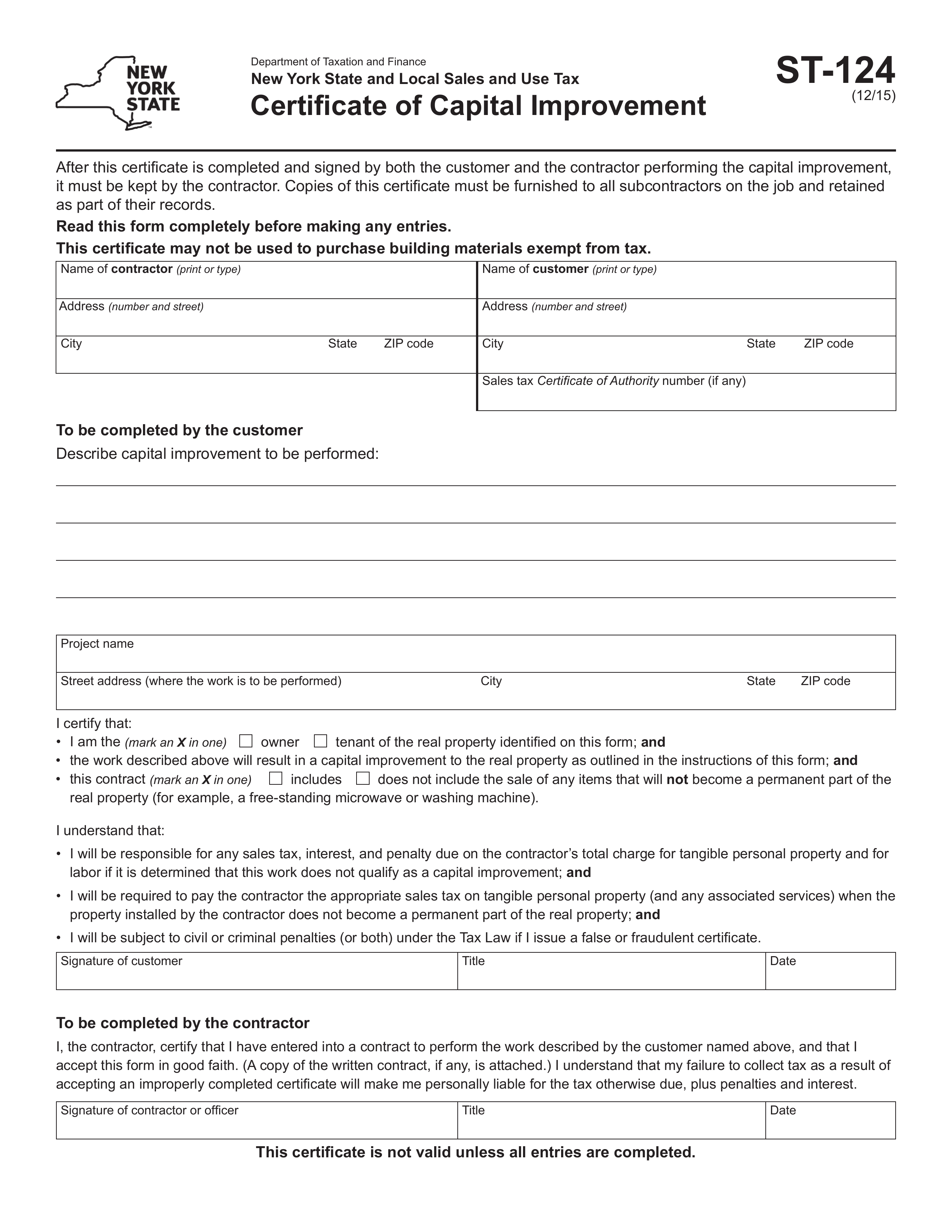

What is Form ST-121?

Form ST-121, the Exempt Use Certificate, is important for businesses and organizations in New York State. It allows exempt entities, like certain nonprofits, to purchase goods without paying sales tax. This form helps ensure that eligible purchases are not taxed, saving money for these organizations. To use it, the buyer must complete the form and give it to the seller. Understanding and using ST-121 correctly helps maintain compliance with tax laws and supports the mission of exempt organizations.

What is Form ST-121 used for?

Form ST-121 is used in New York to claim exemption from sales tax for specific purchases. Here’s what it’s used for:

- to claim exemptions for purchases made by exempt organizations.

- to purchase items for resale without paying sales tax.

- to certify that items are for exempt use, like manufacturing.

How to fill out Form ST-121?

- 1

Open Form ST-121 in the PDF editor.

- 2

Fill in your name, address, and other required identifying information.

- 3

Provide the seller's name and address.

- 4

Specify the type of property or service being purchased.

- 5

Sign the form using an electronic signature.

- 6

Review all entered information for accuracy.

- 7

Download the completed form for submission according to your local tax authority's guidelines.

Who is required to fill out Form ST-121?

Form ST-121 must be completed by purchasers such as manufacturers and businesses making tax-exempt purchases.

Sellers use the completed form to validate the tax-exempt status of the purchase.

When is Form ST-121 not required?

Form ST-121 isn't needed for buying motor fuel or diesel motor fuel that’s exempt from tax, unless specified otherwise in the instructions.

Also, if you're purchasing tangible personal property that stays tangible after installation, you don't need this form. Farmers and commercial horse boarding operators should use Form ST-125 for their specific purchases instead.

When is Form ST-121 due?

The deadline for Form ST-121 is when the purchaser must give the completed form to the seller at the time of purchase or within 90 days after delivery of the property or service. For blanket certificates covering multiple transactions, the form should be provided before the first purchase.

Additionally, sellers must obtain a properly completed exemption certificate from the customer no later than 90 days after delivering the property or performing the service. It’s important for sellers to keep the exemption certificate for at least three years after the last return due date or the date the return was filed, whichever is later.

How to get a blank Form ST-121?

To obtain a blank ST-121, you can access it through our website, where we have a pre-loaded version ready for you to fill out.

This form is issued by the New York State Department of Taxation and Finance.

How to sign Form ST-121 online?

To sign form ST-121 online using PDF Guru, start by loading the form in the PDF editor. Fill out all necessary fields to ensure complete and accurate information is provided.

Once you have filled out the form, create a simple electronic signature. After signing, click "Done" to download the completed form. Always check with official sources for specific signature requirements before finalizing your document.

Where to file Form ST-121?

Form ST-121 must be submitted to the seller or vendor from whom you are making a tax-exempt purchase.

Submission methods: mail, fax, electronic or in-person.