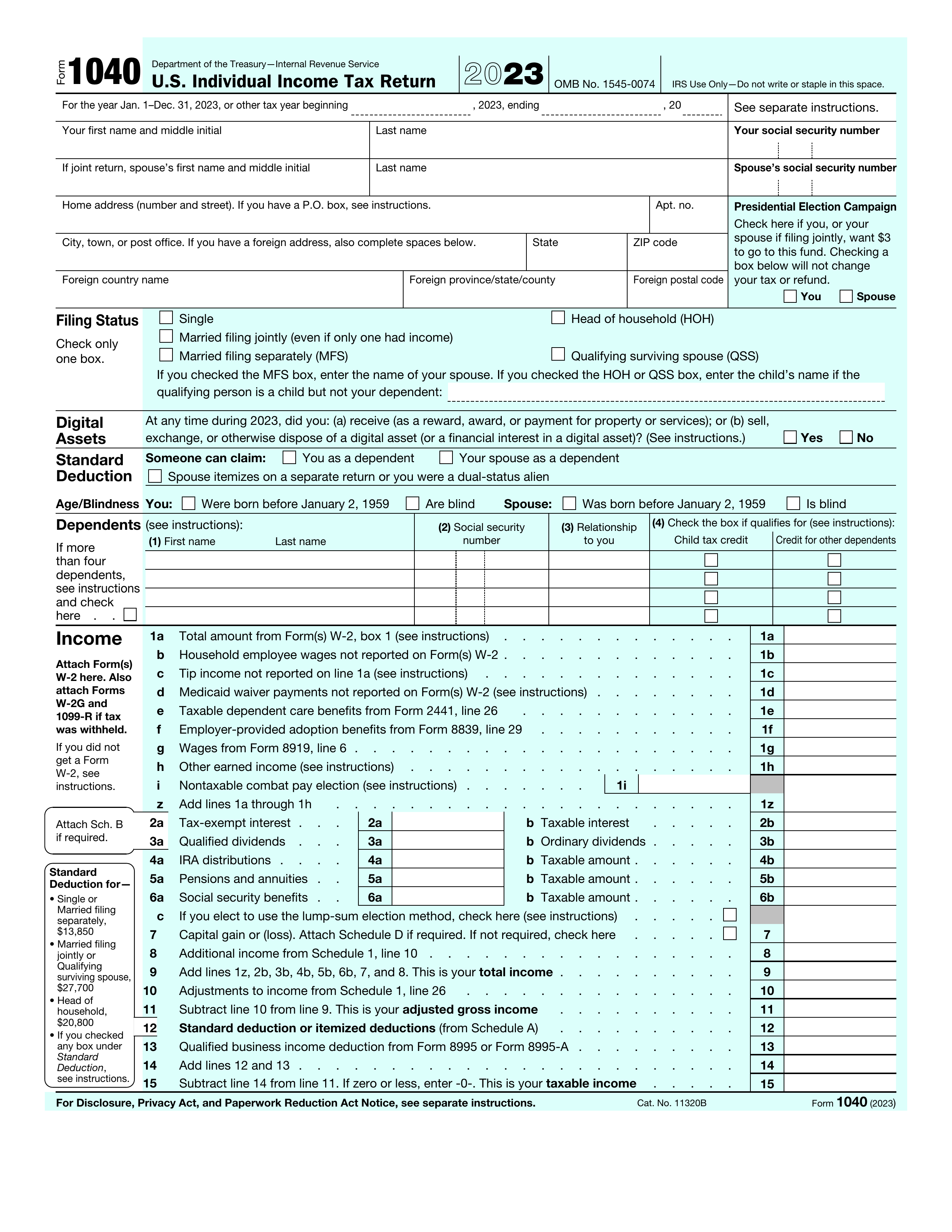

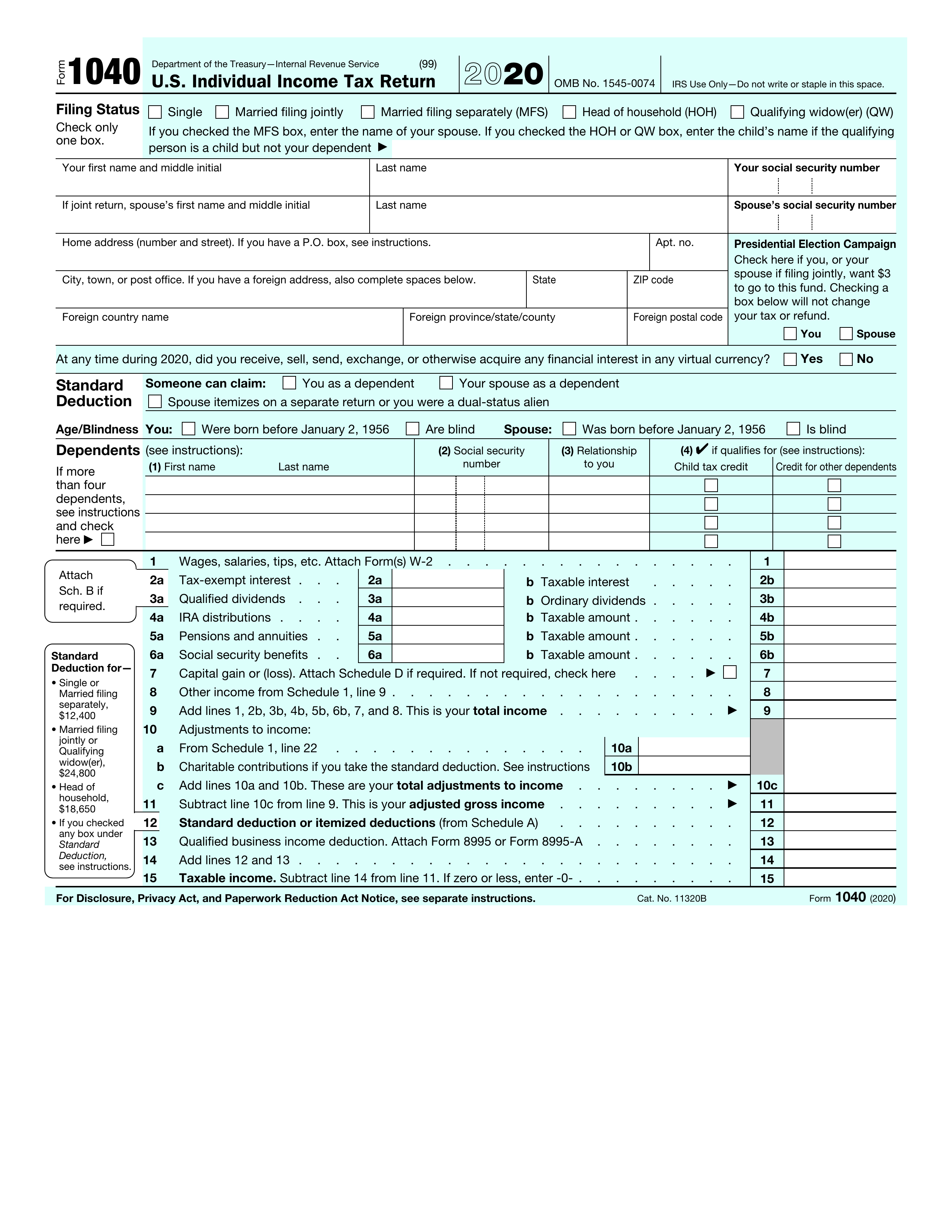

What is Form 1040?

Form 1040 is the U.S. Individual Income Tax Return. It is essential for reporting your income, claiming deductions, and figuring out if you will receive a tax refund or owe money to the government. This form plays a vital role in determining your tax liability and makes sure you follow tax laws. By completing Form 1040, you help the IRS manage tax collections and ensure that you pay the right amount of taxes based on your income.

What is the 2022 version of Form 1040 used for?

You may need to complete Form 1040 for the year 2022 for several reasons:

- Amending a previous year's return: Correct errors or add missed deductions from 2022.

- Requesting a refund: Claim a refund due for 2022 within three years of the filing deadline.

- Business or loan applications: Provide past tax returns for loan approvals.

- Visa applications: Required for compliance in nonresident alien visa applications.

How to fill out Form 1040?

- 1

Gather necessary documents, including income and deduction records.

- 2

Choose the correct form, 1040 or 1040-SR.

- 3

Complete each section accurately following IRS instructions.

- 4

Review entries for errors or omissions.

- 5

Download the completed form for submission to the IRS as required.

Who is required to fill out Form 1040 for 2022?

Individuals who need to file the 2022 Form 1040 may include those with specific income levels, self-employed individuals, or anyone claiming certain tax credits or deductions. Additionally, employees may file an older version due to payroll system requirements or to maintain previous withholding methods.

When should you file Form 1040 (2022)?

If you're filing the 2022 version of Form 1040 now, the normal deadline was April 18, 2023. If you filed for an extension, you have until October 16, 2023. If you need to file late or amend your return, be aware of potential penalties. Generally, you can amend returns for up to three years from the original filing date or two years from when the tax was paid, whichever is later.

How to get a blank Form 1040 for the year 2022?

To obtain a blank Form 1040 for the year 2022, visit our website. The Internal Revenue Service (IRS) issues this form annually for individual taxpayers. Our platform automatically loads the blank version, so you can start filling it out without needing a separate download. Remember, PDF Guru aids in filling and downloading but not filing forms.

How to sign Form 1040 for 2022?

When filling out Form 1040 for the 2022 tax year, remember that only a handwritten signature is valid for paper submissions. Digital, typed, or simple electronic signatures won't be accepted. If you e-file, sign using a Self-Select PIN or a practitioner PIN with Form 8879. PDF Guru allows you to fill out and download your form, but it does not support submission. Always check for the latest updates to ensure compliance with the IRS.

Where to file Form 1040 for the year 2022?

To submit the 2022 Form 1040, you must mail it, as e-filing is not an option for prior-year returns.

Ensure you send it to the correct IRS address based on your state. Refer to IRS instructions for the precise mailing details, especially if including a payment.