What is Schedule 3 (Form 1040)?

Schedule 3 (Form 1040) is an important tax form that reports additional credits and payments to lower your tax bill or increase your refund. It allows you to claim nonrefundable credits, such as the Foreign Tax Credit and Education Credits, along with refundable credits like the Premium Tax Credit. By accurately filling out this form, you can report various income types and adjustments, including rental income, retirement contributions, and student loan interest deductions, which can significantly reduce your taxable income.

What is Schedule 3 (Form 1040) used for?

Schedule 3 (Form 1040) is important for reporting specific tax credits and payments. Here’s what it’s used for:

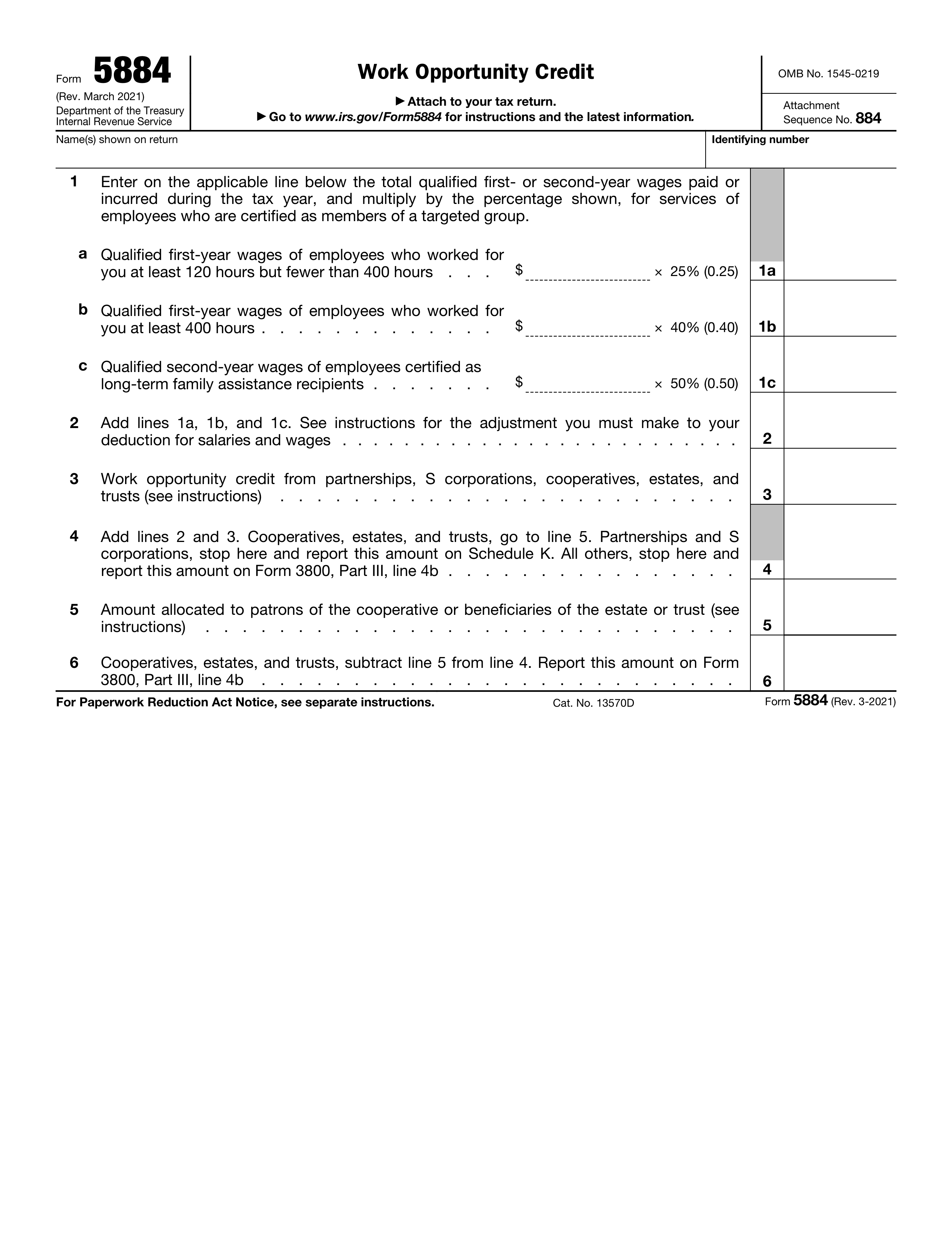

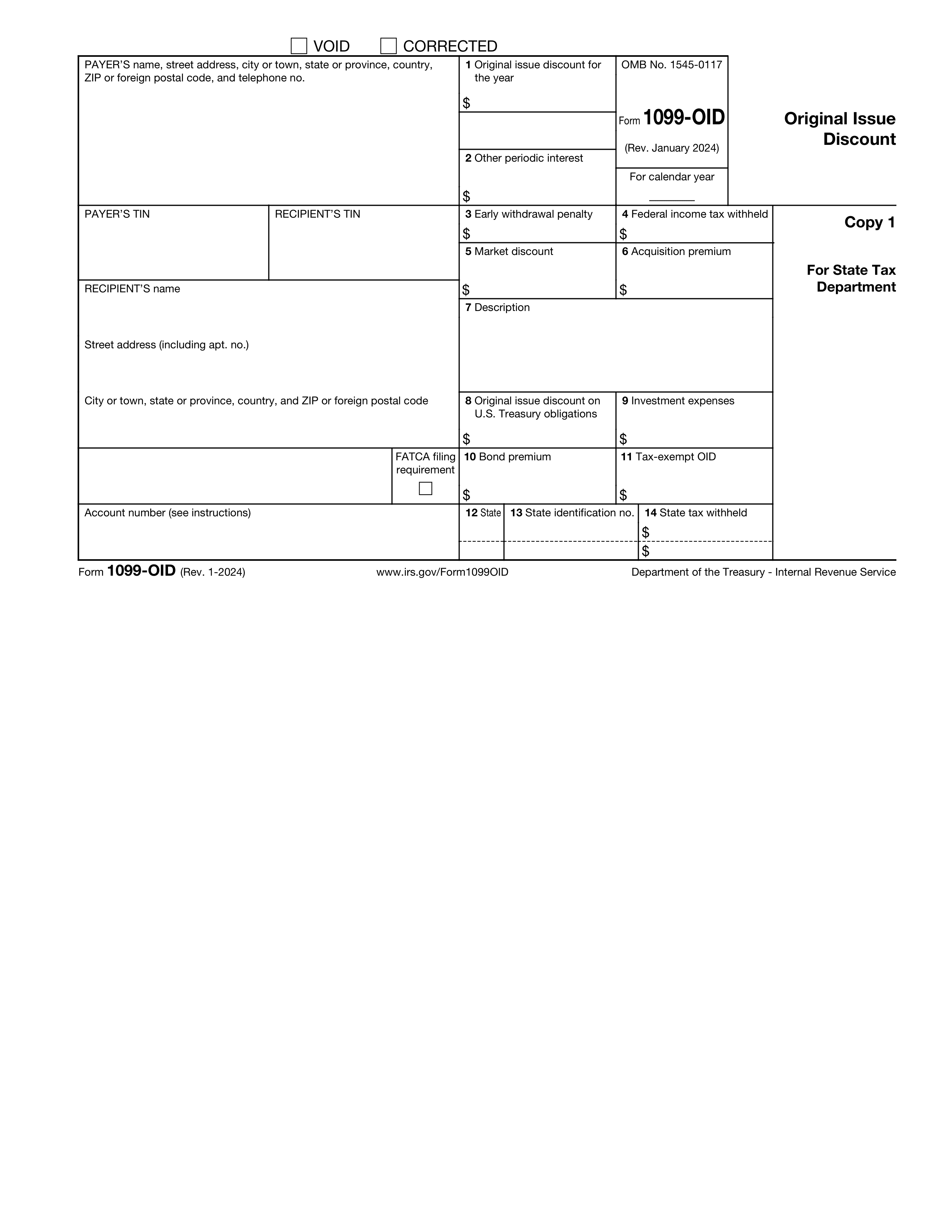

- Nonrefundable credits: Report credits like Foreign Tax Credit and Education Credits.

- Other payments and refundable credits: Report credits such as the Premium Tax Credit.

- Additional income reporting: Report income from rental real estate and partnerships.

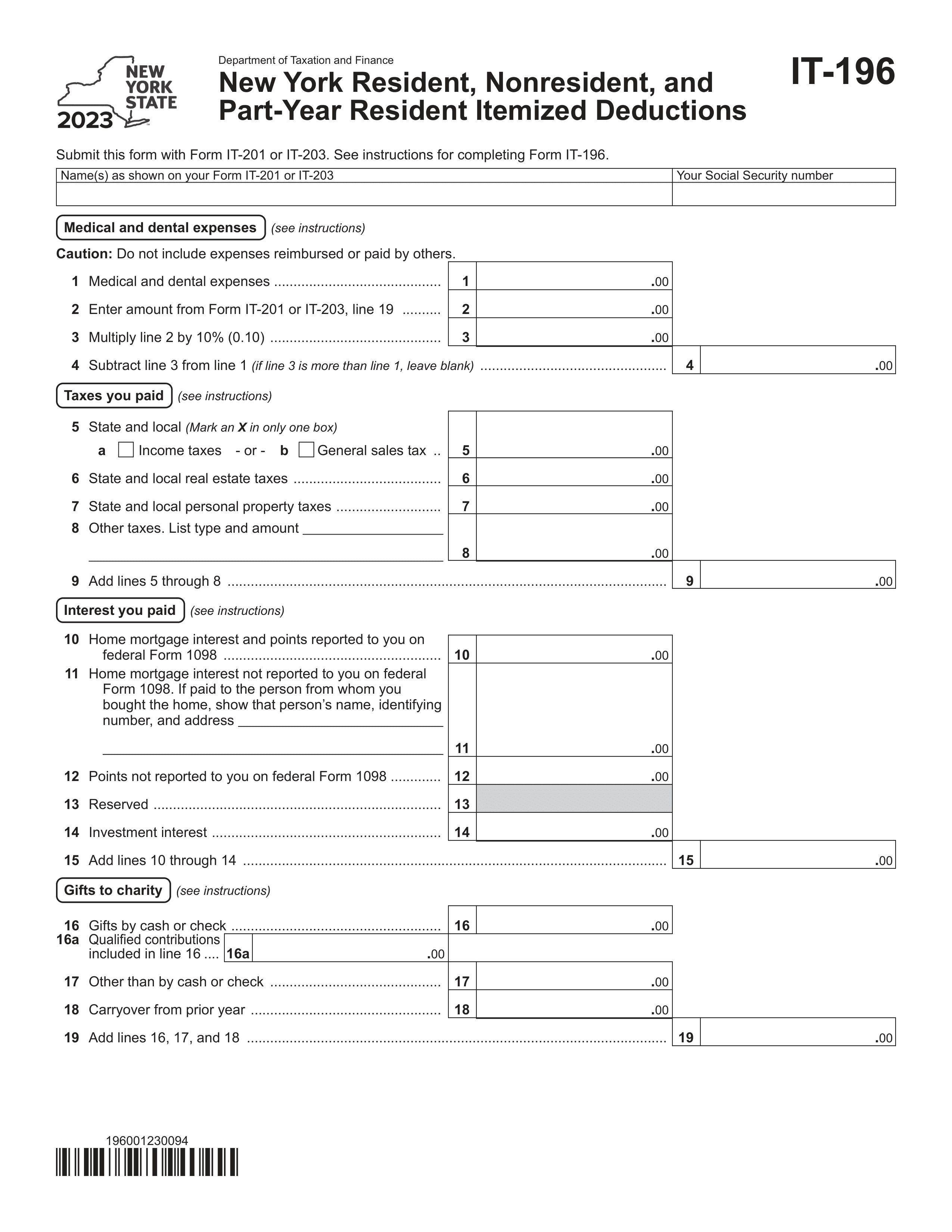

- Deductions and adjustments: Report adjustments like contributions to retirement accounts and student loan interest.

How to fill out Schedule 3 (Form 1040)?

- 1

Identify non-refundable and refundable credits and payments you need to report.

- 2

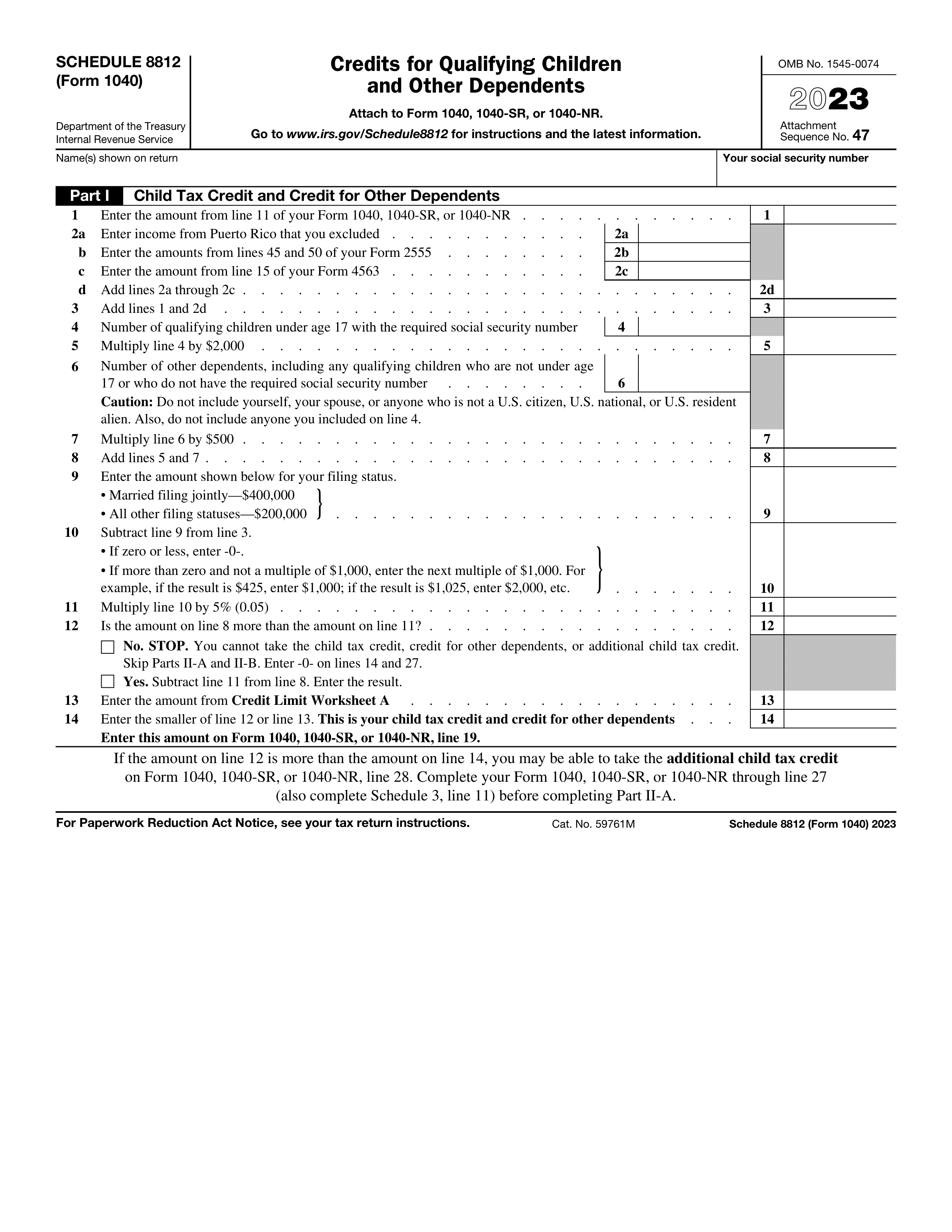

Complete Part I for non-refundable credits such as the Foreign Tax Credit and Child and Dependent Care Credit.

- 3

Fill out Part II for refundable credits like the net premium tax credit.

- 4

Calculate totals for refundable credits and report them on your Form 1040.

- 5

Attach Schedule 3 to your main tax return form as required.

Who is required to fill out Schedule 3 (Form 1040)?

Individuals who need to complete Schedule 3 (Form 1040) include those claiming nonrefundable credits like the Foreign Tax Credit, as well as those with refundable credits such as the net premium tax credit. It also applies to those reporting other payments not listed elsewhere.

Form Schedule 3 is used by individuals filing their tax returns with Form 1040, 1040-SR, or 1040-NR. It is attached when there are entries for credits and payments, ensuring accurate tax reporting.

When is Schedule 3 (Form 1040) not required?

You don’t need to file Schedule 3 (Form 1040) if you lack nonrefundable credits or additional payments. This applies if you haven’t claimed credits such as foreign tax, education, or child and dependent care expenses. Additionally, if you haven’t made payments like estimated taxes or excess social security tax withheld, skip this form altogether.

When is Schedule 3 (Form 1040) due?

The deadline for Schedule 3 (Form 1040) is April 15. If you apply for an extension, the new due date will be October 15. Make sure to submit your form by these dates to avoid penalties.

How to get a blank Schedule 3 (Form 1040)?

To access a blank version of Schedule 3 (Form 1040), which is issued by the Internal Revenue Service (IRS) for reporting additional credits and payments, simply visit our website. PDF Guru aids in filling and downloading, but not filing forms. Get started today to complete your tax tasks efficiently.

Do you need to sign Schedule 3 (Form 1040)?

You do not need to sign Schedule 3 (Form 1040) as it is attached to your Form 1040, which is the only document that requires a signature. After filling out your forms with PDF Guru, make sure to review all the information before signing your Form 1040. For the latest updates on form requirements, it's always a good idea to check the IRS website. Remember, PDF Guru helps you fill out and download your forms, but it does not support submission.

Where to file Schedule 3 (Form 1040)?

You must file Schedule 3 (Form 1040) by attaching it to your federal income tax return (such as Form 1040, 1040-SR, or 1040-NR). According to official IRS instructions, Schedule 3 is not filed separately; it is included as part of your tax return package and submitted to the IRS by the same method — either electronically or by mail — following the filing instructions for your main tax return.