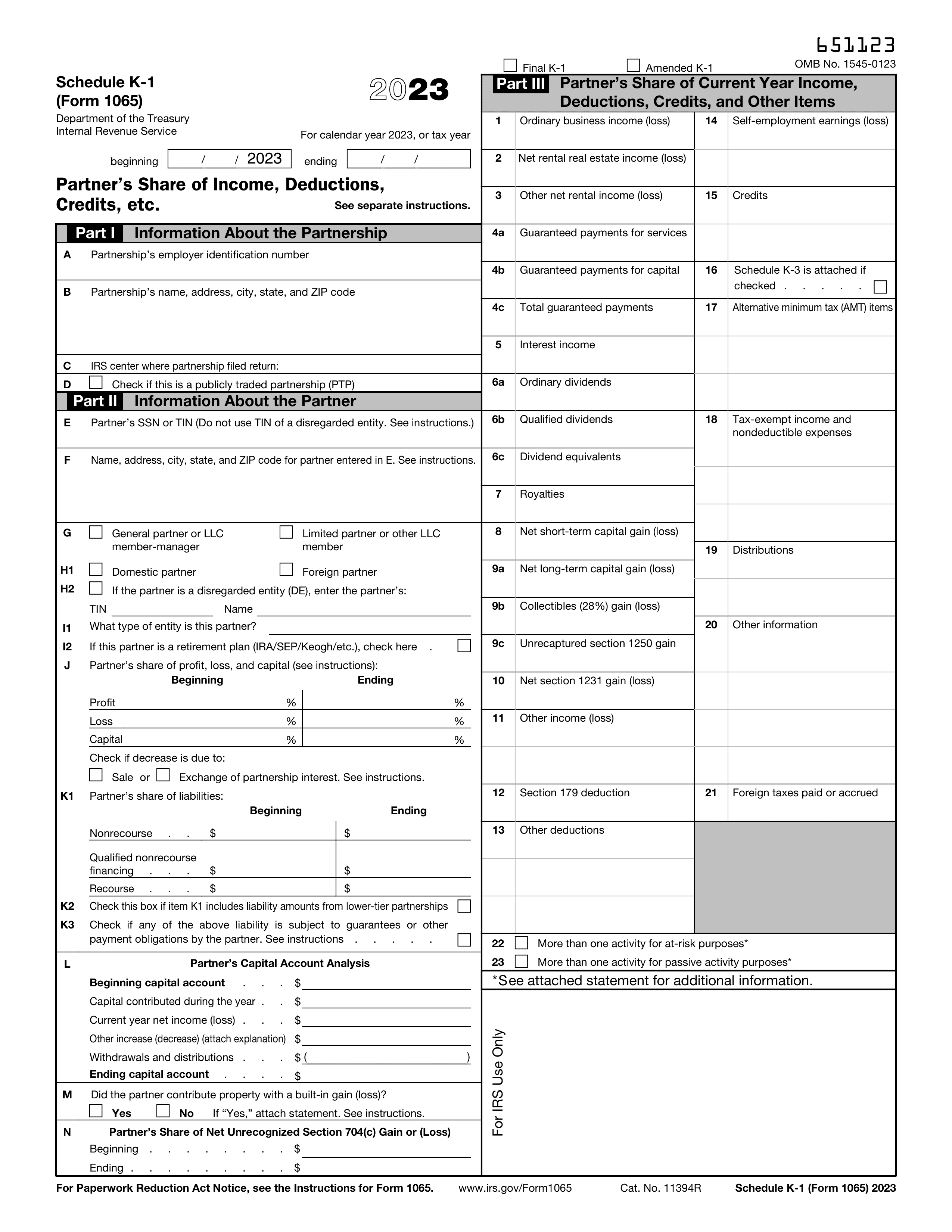

What is Form 1065 Schedule K-2?

Schedule K-2 (Form 1065) is used by partnerships to report international tax information related to partners' distributive shares. This form helps the IRS track income, deductions, and credits that partners earn from foreign activities. It's important because it ensures that partners comply with U.S. tax laws regarding international income, helping to avoid potential penalties. Completing Schedule K-2 accurately supports fair tax reporting and helps partners understand their tax obligations related to international investments.

What is Form 1065 Schedule K-2 used for?

Schedule K-2 is used by partnerships to report international tax items. Here’s what it helps to do:

- to report partners' distributive share items.

- to provide information on foreign income.

- to outline foreign taxes paid or accrued.

- to disclose foreign currency transactions.

How to fill out Form 1065 Schedule K-2?

- 1

Review the form instructions to understand each section.

- 2

Enter partnership information at the top of the form.

- 3

Fill in the distributive share items for each partner, including foreign income.

- 4

Double-check all figures for accuracy and completeness.

- 5

Consult IRS guidelines for any specific international tax rules.

- 6

Complete any additional schedules if required.

Who is required to fill out Form 1065 Schedule K-2?

Partners in partnerships are responsible for completing Schedule K-2 Form 1065 to report international items. This form is essential for accurate tax reporting and compliance.

Afterward, the IRS and partners use this form to ensure proper tax treatment of international income and deductions.

When is Form 1065 Schedule K-2 not required?

Schedule K-2 Form 1065 is not required if the partnership does not have any foreign partners or foreign activities. Partnerships that operate solely within the U.S. borders do not need to file this form.

Additionally, if there are no items of international relevance to report, partners can skip Schedule K-2 altogether. Always check the latest IRS guidelines to confirm your specific filing requirements.

When is Form 1065 Schedule K-2 due?

The deadline for Schedule K-2 Form 1065 is March 15, for partnerships that follow the calendar year. If your partnership has a fiscal year, the form is due on the 15th day of the third month after the end of your fiscal year.

Make sure to file this form along with your Form 1065. It’s important to meet the deadline to avoid penalties and ensure compliance with IRS regulations.

How to get a blank Form 1065 Schedule K-2?

To get a blank Schedule K-2 Form 1065, Partners’ Distributive Share Items—International, simply visit our website. The form is pre-loaded in our editor, ready for you to fill out. After completing the form, you can download it for your records.

Do you need to sign Form 1065 Schedule K-2?

Form Schedule K-2 (Form 1065) does not require a signature according to official sources. However, it’s always wise to verify with the IRS for any updates.

Tax rules can change, and staying informed helps minimize your risk. Always check the IRS website for the latest information before filing.

Where to file Form 1065 Schedule K-2?

Filing Schedule K-2 Form 1065 can be done by mailing it to the IRS. Ensure you send it to the correct address based on your location.

Currently, this form cannot be filed online. Always check the IRS website for the latest filing instructions and updates.