What is Form 1099-G?

The Form 1099-G is a tax document for individuals who have received government payments, like state tax refunds or unemployment benefits. It's essential for accurately reporting these amounts on your tax return. If you've received these types of payments, you'll need this form to ensure your taxes are complete and correct.

What is Form 1099-G used for?

The Form 1099-G is crucial for accurately reporting certain types of income. Here's what it's used for:

- To report unemployment compensation.

- To detail state or local income tax refunds.

- To list certain government payments.

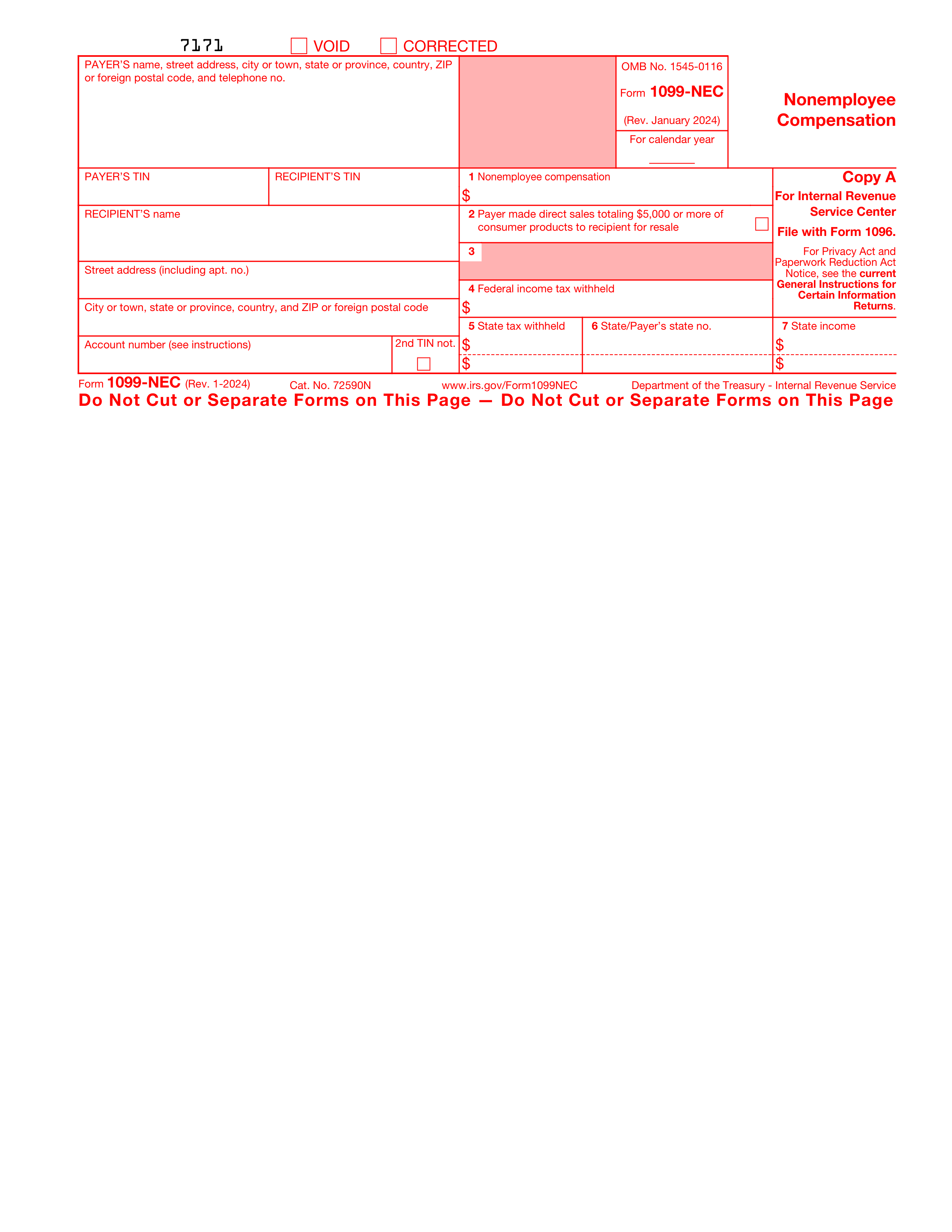

How to fill out Form 1099-G?

- 1

Start by entering your payer's information, including the federal identification number, and your name and address in the designated boxes.

- 2

Fill in the unemployment compensation amount in box 1.

- 3

If applicable, report any federal income tax withheld in box 4.

- 4

Include any state income tax withheld and the payer's state number in boxes 10 and 11.

- 5

Review all information for accuracy before proceeding with submission according to the specific instructions provided by the IRS or your state tax department.

Who is required to fill out Form 1099-G?

Form 1099-G is filled out by government agencies to report certain payments, like tax refunds.

Taxpayers use Form 1099-G to report these payments on their tax returns, affecting their tax obligations.

When is Form 1099-G not required?

If you did not receive any government payments such as state or local tax refunds, unemployment compensation, or certain federal payments, you might not need this form. Additionally, individuals who are not involved in specific government-related transactions or activities may not require Form 1099-G.

When is Form 1099-G due?

The deadline for submitting Form 1099-G is January 31st of the year following the year in which the payments were made.

This form is used to report certain government payments, such as state tax refunds and unemployment compensation. Meeting this deadline ensures compliance with IRS requirements and helps avoid potential penalties.

How to get a blank Form 1099-G?

To get a blank form 1099-G, visit our platform where the template, provided by IRS, is ready in our editor for you to fill out. You don't need to download it from anywhere else, making the process of preparing your form smooth and hassle-free. Remember, our website helps you fill out and download the form, but does not support submitting it.

Do you need to sign Form 1099-G?

Form 1099-G does not typically require a signature. Users should verify with current guidelines for any updates.

It's important to stay informed on form requirements. Checking official sources can provide the most accurate information.

Where to file Form 1099-G?

The 1099-G form can be submitted online through official tax filing websites. This method is convenient and quick.

Alternatively, it can also be sent via mail. Ensure all details are correct before sending.