What is Form 1120S?

Form 1120S is a tax document required for S corporations in the United States. It's used to report the income, losses, and dividends of the corporation. This form helps the IRS understand the financial activities of the S corporation and ensures that taxes are accurately calculated and reported. Businesses that have elected the S corporation status must fill out this form annually. It's an essential step for these companies to comply with federal tax obligations and avoid penalties.

What is Form 1120S used for?

Form 1120S is an essential document for S corporations. It serves multiple purposes, including:

- To report the income, gains, losses, deductions, and credits of the corporation.

- To determine the tax liability of the corporation.

- To share each shareholder’s portion of the income, deductions, and credits.

How to fill out Form 1120S?

- 1

Start by entering the corporation's name, EIN, and address in the designated fields.

- 2

Complete the income and deductions sections with accurate financial details.

- 3

Fill in the tax computation area to determine the corporation's tax liability.

- 4

List shareholders' names and shares in the allocated sections.

- 5

Sign and date the form with an electronic signature if accepted.

- 6

Review all information for accuracy before downloading.

Who is required to fill out Form 1120S?

Form 1120S is filled out by S corporations for tax reporting. It outlines their income, losses, and dividends.

Shareholders use Form 1120S to understand their share of the corporation's income and losses for their personal tax returns.

When is Form 1120S not required?

Not all businesses need to complete Form 1120S. Sole proprietorships, for instance, do not use this form as they report their business income and expenses on their personal tax returns.

Similarly, partnerships also avoid using Form 1120S. Instead, they file Form 1065, which is the tax document specifically designed for partnership income reporting.

Lastly, C corporations have their own form, Form 1120, and thus do not need Form 1120S. This distinction is crucial for businesses to understand in order to comply with tax filing requirements accurately.

When is Form 1120S due?

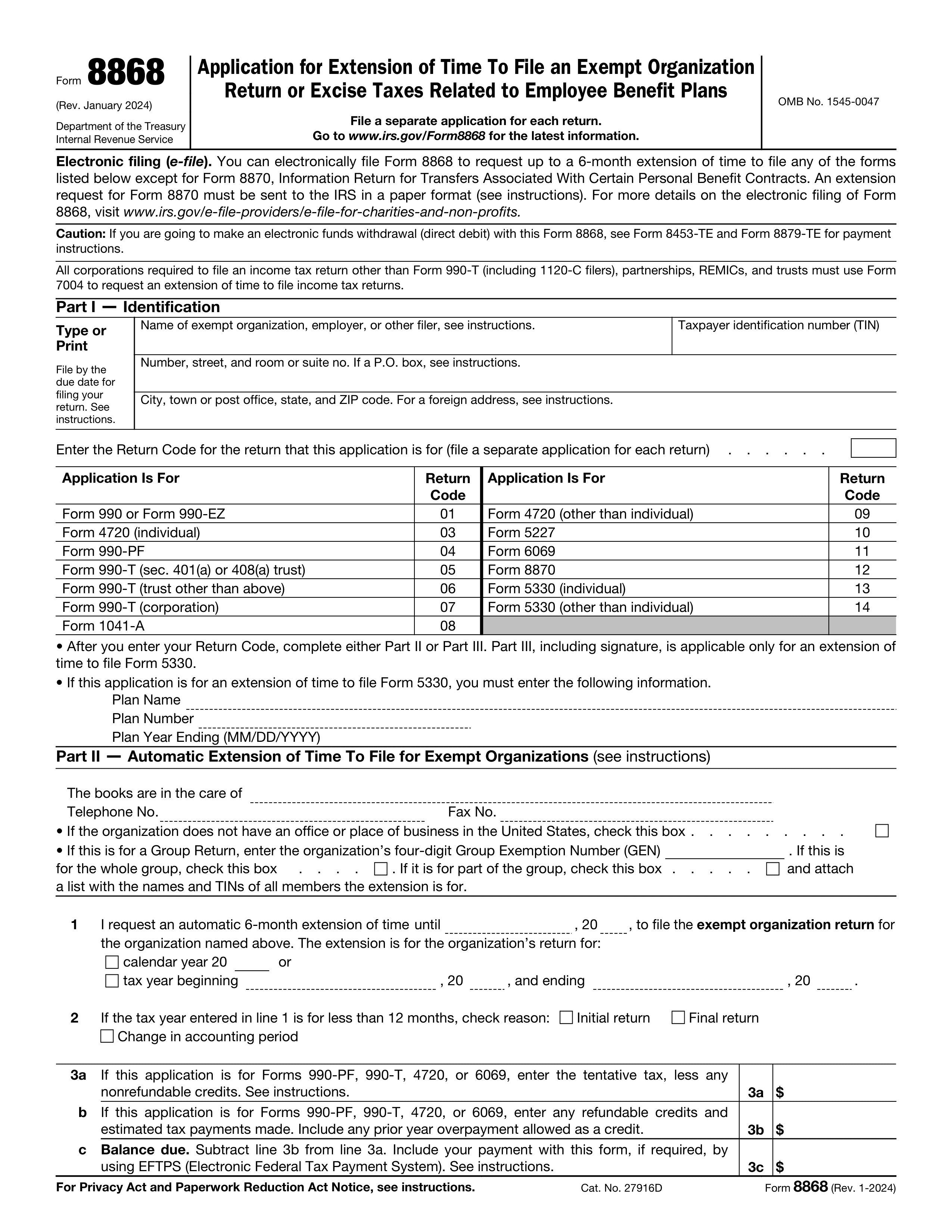

The deadline for Form 1120S is March 15.

This is for companies operating on a calendar year basis. If you need more time, you can request a six-month extension, which moves the due date to September 15. Remember to check for any updates on the official IRS website to ensure you're meeting the current requirements.

How to get a blank Form 1120S?

To get a blank Form 1120S, visit our platform where the template is pre-loaded in our editor, ready for you to fill out and download for your use. Remember, our website helps with creating the form, but does not handle submitting it for you.

How to sign Form 1120S online?

To sign Form 1120S on PDF Guru, first complete all required fields. Then, add your electronic signature where indicated.

After signing, click 'Done' to download your signed form. Remember, PDF Guru offers a subscription for accessing its editing tools.

Where to file Form 1120S?

Form 1120S can be submitted online through IRS e-file providers. This method is quick and secure.

Alternatively, it can also be sent via mail to the IRS, following the address guidelines for the state in which your business is located.