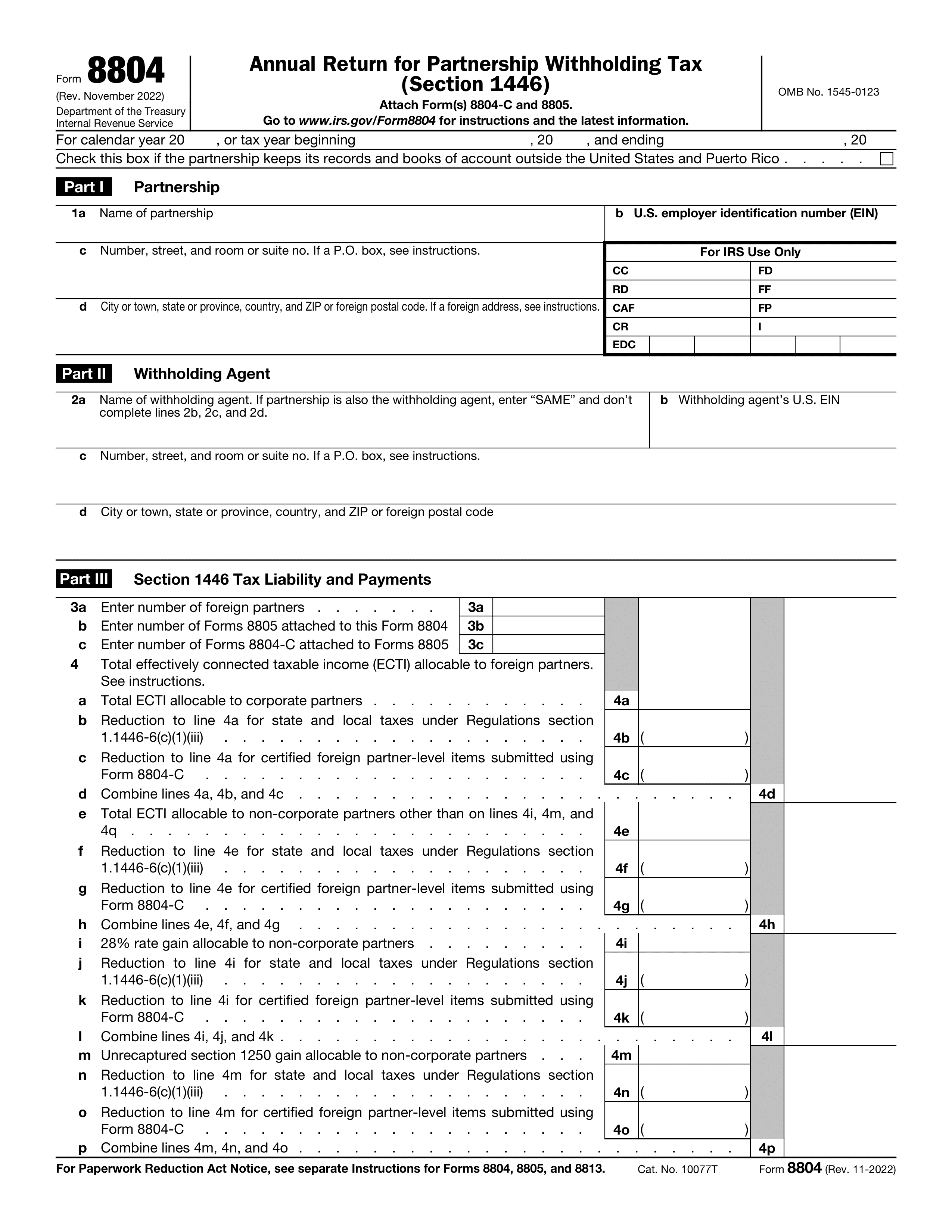

What is Form 8805?

Form 8805 is needed for foreign partners in a U.S. partnership. It reports the partner's share of income and taxes withheld. It's essential for ensuring the correct tax is paid to the U.S. government and helps in filing an accurate tax return.

What is Form 8805 used for?

Form 8805 is a critical document for nonresident aliens receiving income from U.S. sources. It serves several important functions:

- To report income effectively subject to withholding.

- To document the amount of tax withheld on that income.

- To provide necessary information to the recipient for filing their tax return.

How to fill out Form 8805?

- 1

Start by entering the payer's information at the top of the form, including their EIN.

- 2

Fill in the foreign partner's details, such as name and address.

- 3

Report the partner's share of effectively connected income (ECI) and taxes withheld.

- 4

Calculate and enter the total withholding tax based on the ECI reported.

- 5

Sign and date the form to validate it. Remember, an electronic signature is acceptable.

- 6

Download the completed form and keep a copy for your records.

- 7

Submit the form to the IRS by the required deadline, following their submission guidelines.

Who is required to fill out Form 8805?

Form 8805 is filled out by partnerships that have income effectively connected to the U.S., to report and allocate income to foreign partners.

This form is then used by the foreign partners to report their share of the income on their U.S. tax return.

When is Form 8805 not required?

Form 8805 is not required for U.S. citizens or residents. These individuals are not subject to the withholding obligations that the form addresses.

Additionally, entities or partnerships that do not have income effectively connected with a U.S. trade or business are exempt from using this form. They do not engage in activities that would generate income requiring this specific reporting.

When is Form 8805 due?

The deadline for Form 8805 is April 15th of the year following the tax year that the form covers.

Submitting Form 8805 by the due date is crucial for compliance with tax regulations. If you need more time, you can request an extension to avoid penalties. Remember to check for any updates on deadlines from official sources.

How to get a blank Form 8805?

To get a blank Form 8805, simply visit our platform, where the template is pre-loaded in our editor. This allows you to start filling it out right away without the need to download it from elsewhere. Remember, our website helps you fill out and download the form, but not file it.

How to sign Form 8805 online?

If you need to sign form 8805 online, PDF Guru has a solution. First, you need to load your form in the PDF editor provided on our platform. To do so, just click 'Fill Form.'

After filling out the necessary fields, PDF Guru allows the creation of a simple electronic signature. This completes the form, ready for download.

Where to file Form 8805?

Form 8805 can be submitted by mail, following the IRS guidelines.

For online submissions, the IRS website should be checked for current e-filing options.