What is Form 2553?

Form 2553 is necessary for small businesses opting to be treated as an S corporation for tax purposes. This election allows businesses to pass corporate income, losses, deductions, and credits through to their shareholders for federal tax purposes. Shareholders report the flow-through of income and losses on their personal tax returns and are assessed tax at their individual income tax rates.

This can potentially lead to tax savings. It's important for businesses that meet the IRS (Internal Revenue Service) criteria and wish to be taxed under this designation.

What is Form 2553 used for?

Form 2553 is essential for certain businesses deciding on their tax treatment. Here's what it's used for:

- To elect S corporation status for tax purposes.

- To notify the IRS of the election by a small business corporation.

How to fill out Form 2553

Part I — Election information

Start by completing the general election details:

- 1

Enter the corporation’s legal name, mailing address, and EIN.

- 2

Provide the date and state of incorporation.

- 3

Specify the effective date for the S corporation election.

- 4

Select the corporation’s tax year (calendar year, fiscal year, or 52–53-week year).

- 5

Indicate whether family members are being treated as one shareholder, if applicable.

- 6

Add the name and phone number of an officer or legal representative the IRS may contact.

- 7

If the election is filed late, complete the late election statement in this section.

Shareholder consent section (Part I continuation)

This section is required for the election to be valid:

- 1

List each shareholder’s name and address.

- 2

Enter each shareholder’s Social Security number or EIN.

- 3

Provide ownership details, including the number or percentage of shares and acquisition date.

- 4

Indicate each shareholder’s tax year-end.

- 5

Ensure every listed shareholder signs and dates the consent statement.

Part II — Selection of fiscal tax year (if applicable)

Complete this part only if the corporation is not using a calendar year:

- 1

Identify whether the corporation is new, existing, or changing its tax year.

- 2

Select the reason for the fiscal year election (natural business year, ownership tax year, or business purpose).

- 3

Attach any required statements or supporting documents, if applicable.

- 4

Complete additional IRS forms if required for the chosen tax year election.

Part III — Qualified Subchapter S Trust (QSST) election (if applicable)

Fill out this part only if a QSST holds shares:

- 1

Enter the trust and beneficiary information.

- 2

Provide the date the trust acquired the shares.

- 3

Sign and date the QSST election as required.

Part IV — Late corporate classification relief (if applicable)

This part applies only in specific late-election situations:

- 1

Confirm the entity intended to be classified as an S corporation on the requested effective date.

- 2

Make the required representations regarding reasonable cause and prior filings.

- 3

Sign the declaration under penalties of perjury.

Who is required to fill out Form 2553?

Form 2553 is completed by corporations and LLCs that opt to be treated as an S corporation for tax purposes. It requires the business's authorized representative to provide accurate information. It also requires the consent and signatures of all shareholders for the election to be valid.

After submission, the IRS uses Form 2553 to determine whether the business qualifies for S corporation status, which affects its tax treatment.

When is Form 2553 not required?

Not every business entity needs to fill out Form 2553. Specifically, corporations that wish to remain as a C corporation or businesses that are structured as sole proprietorships, partnerships, or limited liability companies (LLCs) that do not want to be taxed as an S corporation are not required to complete this form.

Moreover, LLCs that are taxed as C corporations and do not wish to elect S corporation status don't need to submit Form 2553. This form is specifically for those seeking S corporation tax status.

When is Form 2553 due?

The deadline for Form 2553 is within 2 months and 15 days after the beginning of the tax year in which the election is to take effect.

For a new business, this means the form should be submitted by this deadline in the first tax year. If you're changing your election, it's important to meet this timeline to ensure your status is recognized for the upcoming tax year. The IRS may still accept a late-filed Form 2553 if the business qualifies for late election relief and provides reasonable cause.

How to get a blank Form 2553

To get an IRS-issued Form 2553 (fillable version), visit our platform where the template is pre-loaded in our editor, ready for you to complete and download for future use. Remember, while we help prepare the form, we don't assist with submitting it.

How to sign Form 2553 online

To sign Form 2553 (PDF version) with our tool, first open it in the PDF editor. Complete the necessary fields with your information.

After filling out the form, create a simple electronic signature to finalize it. Then, download your signed form by following the prompts. Before submitting it, ensure an authorized corporate officer signs it and that all shareholders have provided the required signatures, in line with IRS requirements.

Where to file IRS Form 2553?

File IRS Form 2553 by mail or fax. The correct mailing address or fax number depends on the corporation’s principal business location and can be found in the IRS Form 2553 instructions.

Forms related to 2553

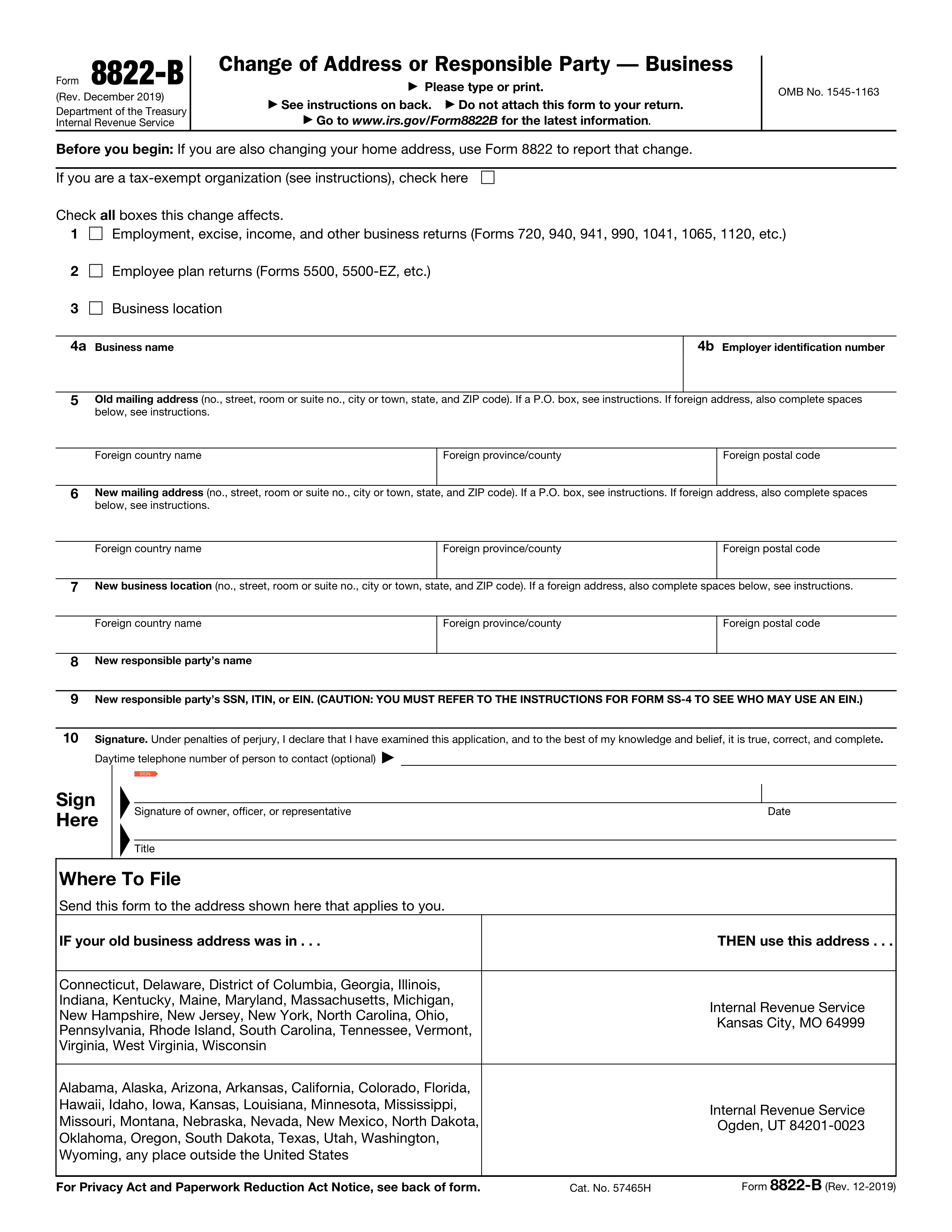

- Form 8832 — Entity Classification Election This form is used to determine how a business entity is classified for federal tax purposes (for example, as a corporation or as a disregarded entity). LLCs often need to file Form 8832, either before or at the same time as Form 2553, to be treated as a corporation, which is a prerequisite for electing S corporation status.

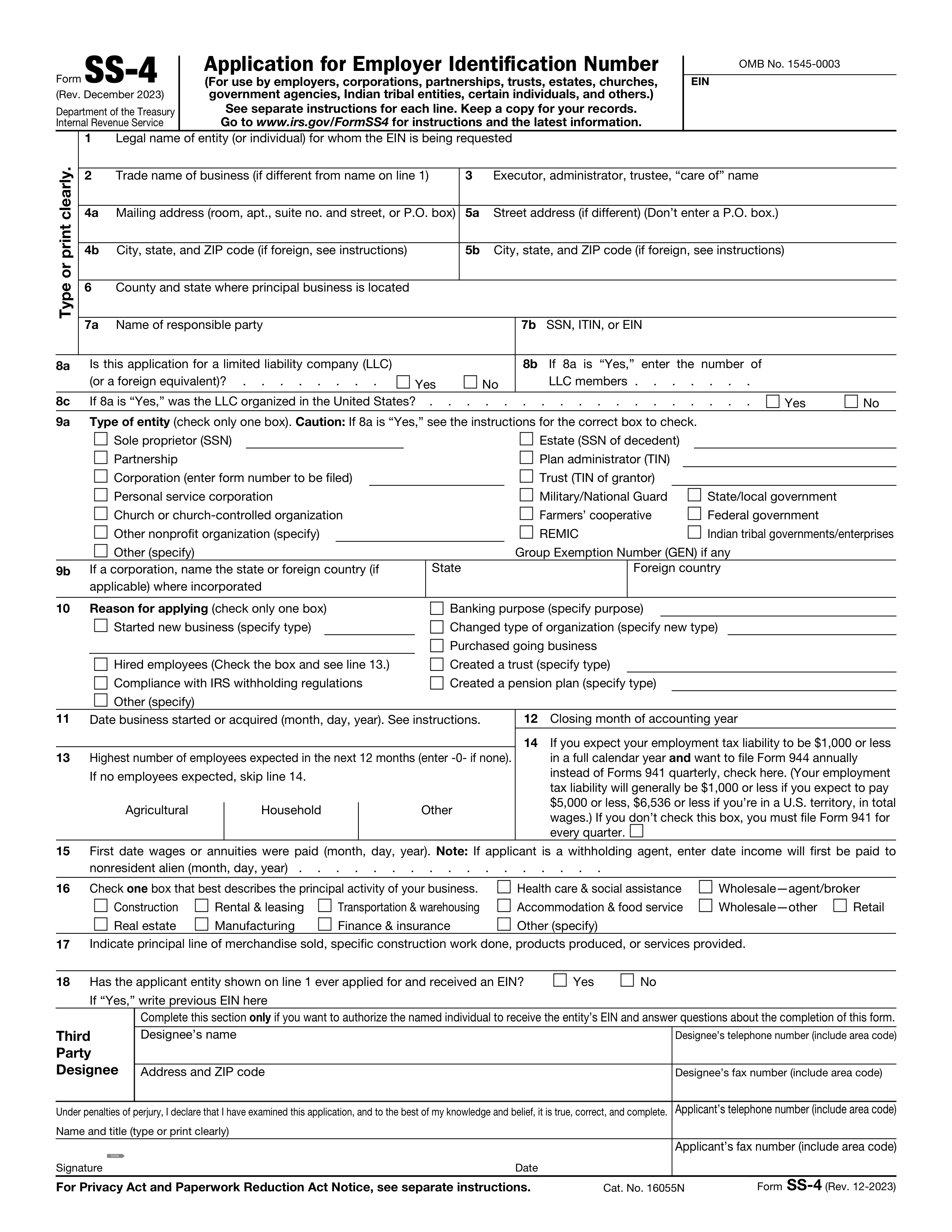

- Form SS-4 — Application for Employer Identification Number (EIN) Form SS-4 is used to obtain an EIN from the IRS. An EIN is required to complete Form 2553, so new businesses typically file Form SS-4 first or apply for an EIN online before submitting the S corporation election.

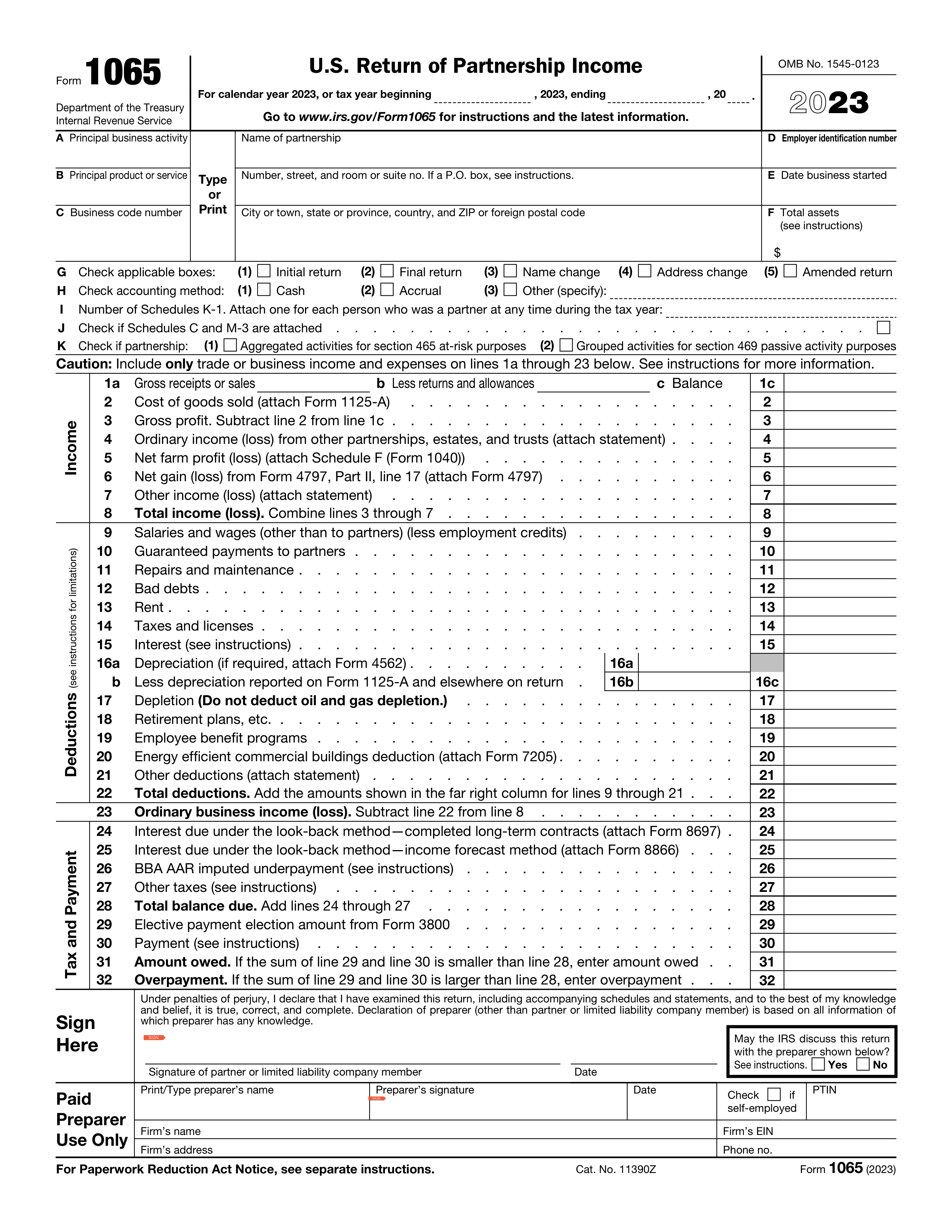

- Form 1120-S — U.S. Income Tax Return for an S Corporation This is the annual federal income tax return filed after the S corporation election is accepted. Once Form 2553 is approved, the business must report its income, deductions, and credits each year using Form 1120-S instead of a standard corporate return.

- Schedule K-1 (Form 1120-S) — Shareholder’s Share of Income Schedule K-1 is issued to each shareholder of an S corporation. It reports the shareholder’s share of income, losses, deductions, and credits that pass through from the business and must be included on the shareholder’s personal tax return.

- Form 941 — Employer’s Quarterly Federal Tax Return If the S corporation has employees, Form 941 is used to report wages paid and employment taxes withheld during each quarter. Many businesses begin filing this form after electing S corporation status and starting payroll.

- Form 940 — Employer’s Annual Federal Unemployment (FUTA) Tax Return Form 940 is required if the S corporation pays wages subject to federal unemployment tax. It is typically filed annually once the business meets FUTA filing thresholds.

- Form 8716 — Election to Have a Tax Year Other Than a Required Tax Year This form is required only in specific situations when a corporation elects a fiscal tax year that is not the standard calendar year. Form 8716 may need to be filed together with or in connection to Part II of Form 2553.