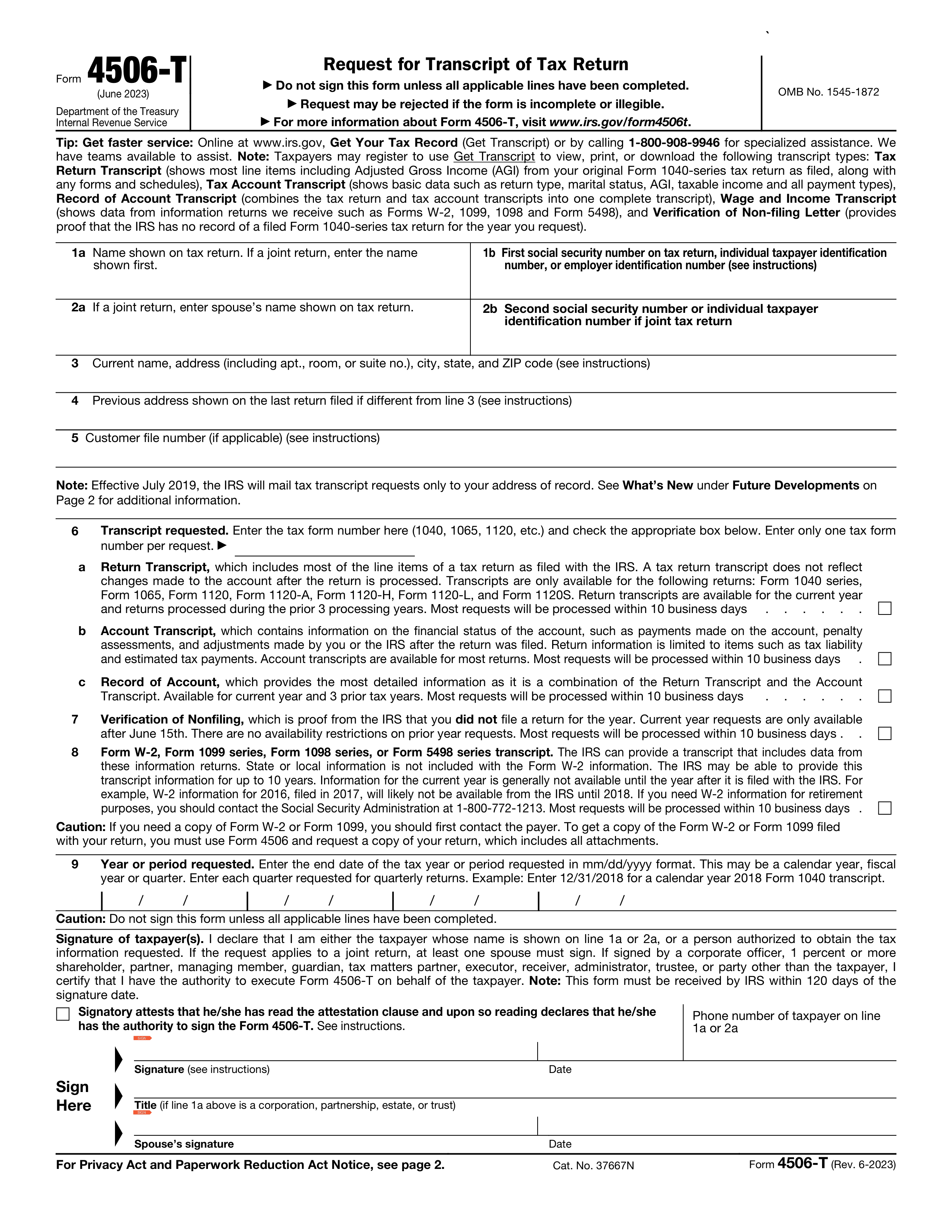

What is a 4506-C form?

Form 4506-C, officially known as the IRS Request for Transcript of Tax Return, is essential for individuals or entities needing their tax transcript for income verification. This is often required when applying for loans, mortgages, or financial aid. It allows lenders or relevant parties to verify your income without needing the entire tax return, making the process more efficient for both parties involved.

What is a 4506-C form used for?

Form 4506-C is essential for retrieving past tax records. Here's what it's used for:

- To request a copy of your tax return information

- To authorize a third-party to receive this information

How to fill out a 4506-C form?

- 1

Start by entering your personal information in the top section, including your name, Social Security Number, and address.

- 2

Specify the type of tax return you're requesting in section 6 by checking the appropriate box.

- 3

Fill out the tax form number you need in section 7.

- 4

Enter the year(s) or period(s) for the tax return(s) in section 9.

- 5

Sign and date the form in section 8 to validate your request.

- 6

Review the form for accuracy before downloading.

Who is required to fill out Form 4506-C?

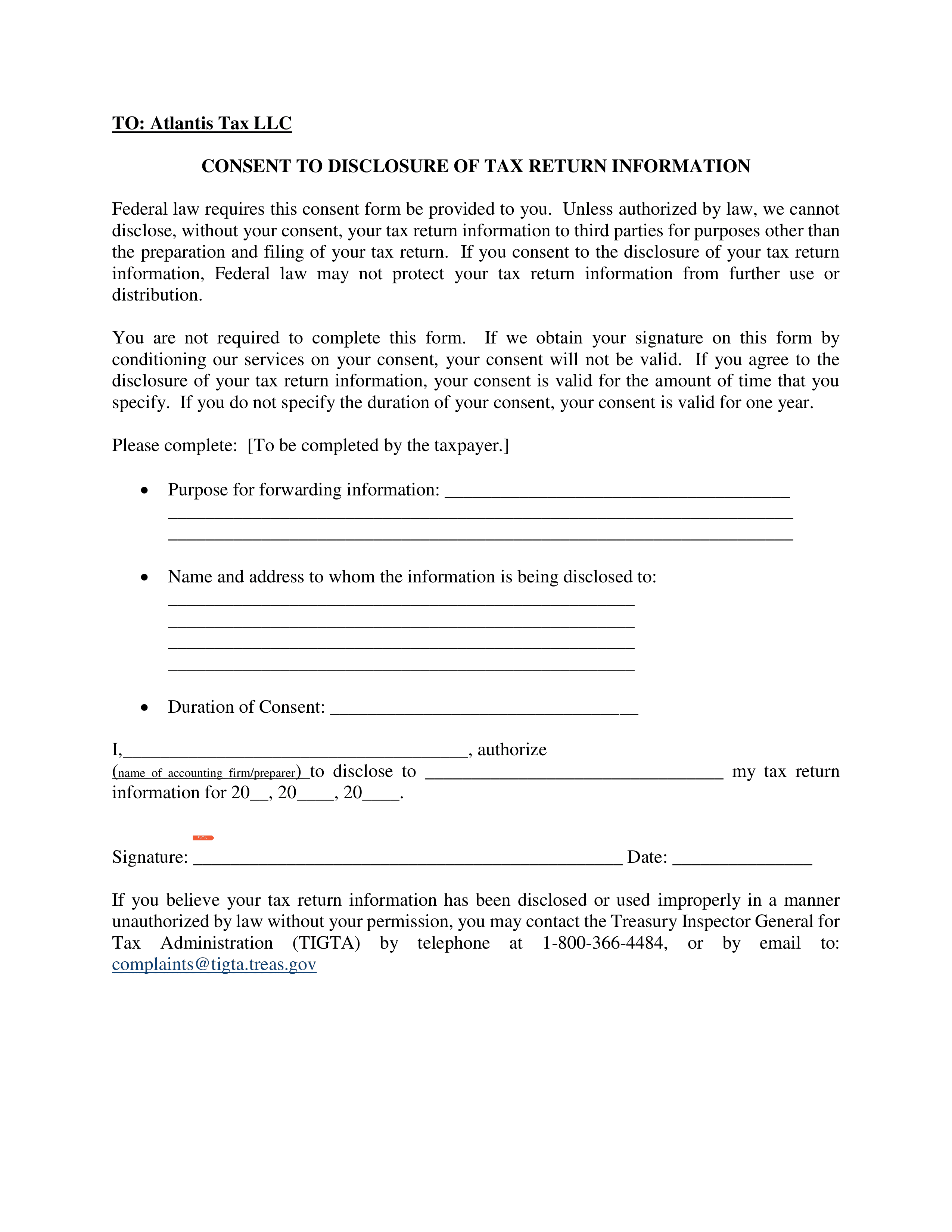

Form 4506-C is primarily filled out by taxpayers who need to authorize a third party to access their tax transcripts from the IRS for purposes such as loan applications.

Lenders and authorized third parties will use this form to obtain the taxpayer's income verification from the IRS, facilitating processes like mortgage or student loan applications.

When is a 4506-C form not required?

Not everyone needs to fill out Form 4506-C. For instance, individuals who are not requesting tax transcripts for income verification purposes may not find this form necessary.

Organizations or third parties that already have direct access to income verification through other means also might not require this form. Individuals or entities that can obtain the needed information through alternative documentation should consider those options.

When is a 4506-C form due?

The deadline for Form 4506-C is not fixed and varies depending on the reason for requesting the tax information. It should be submitted when the information is needed for the specific purpose, such as loan application or tax preparation.

Make sure to plan ahead and submit Form 4506-C in a timely manner to ensure you have the necessary tax information when required.

How to get a blank 4506-C form?

To get a blank form 4506-C, simply visit our platform. We have the template ready in our editor for you to fill out. Remember, while our website assists in filling out and downloading the form, it does not support filing the form.

How to sign 4506-C form online?

To sign form 4506-C with PDF Guru, first complete all required fields. Then, add your signature in the designated signing area.

After filling out the form and signing, click Done to proceed with downloading your document. Remember to choose a subscription plan before downloading.

Where to file a 4506-C?

Form 4506-C can be submitted online via the IRS's e-Services. This method provides a convenient way to send your request directly to the IRS.

Alternatively, you can also mail this form to the IRS. Ensure all information is correct and complete before sending it to the provided address.