What is a W-2C form?

The W-2C form is necessary when you need to correct information on a previously submitted W-2 form. Employers use it to amend details like an employee's income, tax withholdings, or personal information. If you've noticed errors on your W-2 or if your employer informs you of inaccuracies in your wage report, filling out a W-2C form is the next step to ensure your tax records are accurate.

What is a W-2C form used for?

The form W-2C is crucial for correcting previously submitted W-2 information. Here's what it's used for:

- To correct wages and tax statements.

- To update employee information.

- To amend previously reported Social Security or Medicare tax.

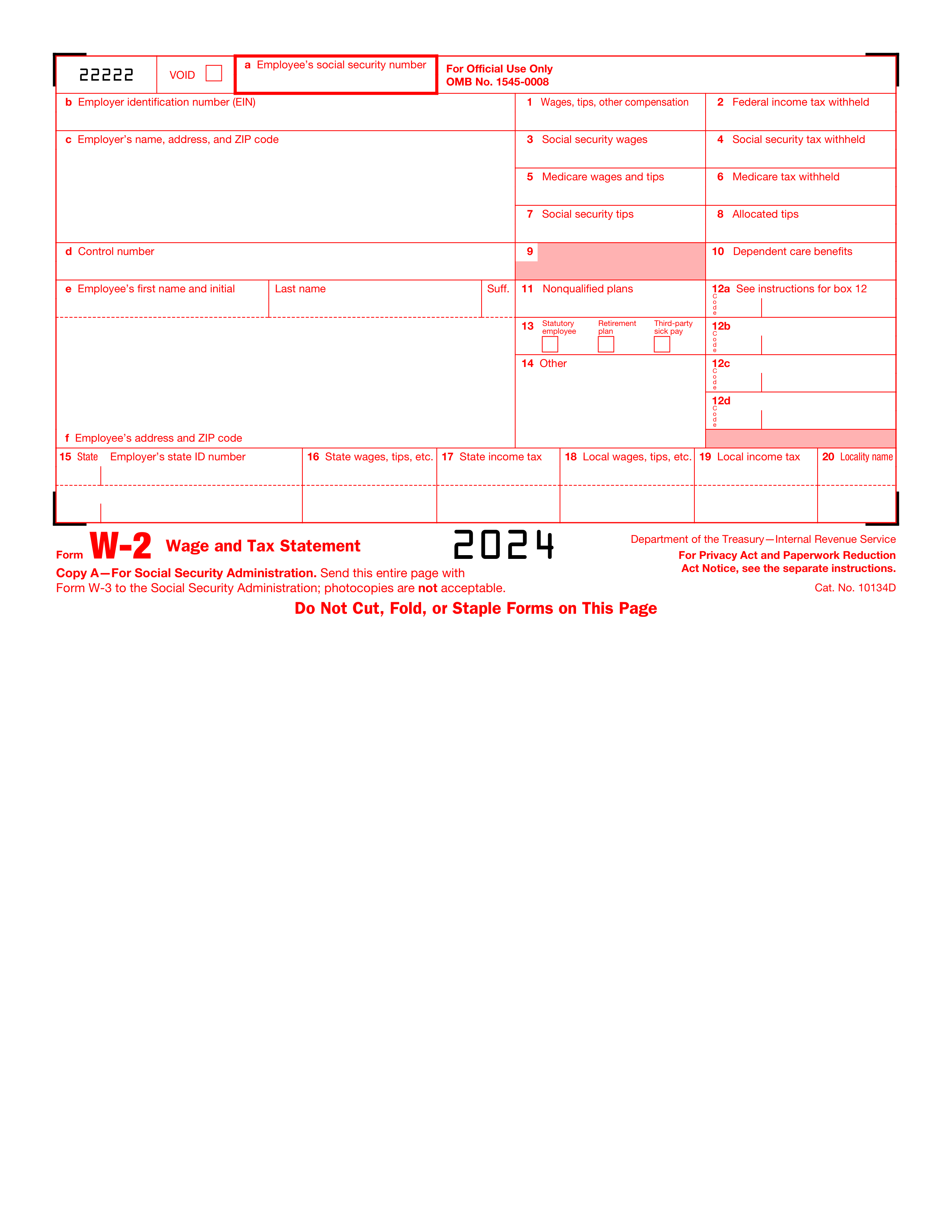

How to fill out a W-2C form?

- 1

Start by entering your employer identification number (EIN) , name, and address in the designated sections.

- 2

Fill in the employee's details such as SSN, name, and address.

- 3

Correct the information that was reported incorrectly on the original W-2 form. Specify the year of the W-2 you're correcting.

- 4

Enter the corrected amounts for wages, tax withheld, and other information in the correct boxes.

- 5

Review all changes to ensure accuracy.

- 6

Sign and date the form electronically if this method is accepted.

- 7

Distribute copies to the employee, SSA, and retain a copy for records.

Who is required to fill out Form W-2C?

Employers are responsible for filling out Form W-2C to correct errors on a previously filed W-2.

The IRS, employees, and Social Security Administration use Form W-2C for tax records and benefits calculations.

When is a W-2C form not required?

The Form W-2C is not necessary for individuals who have not received a W-2 form due to being self-employed or working as independent contractors.

This form is also not required for those who have no discrepancies in their original W-2 forms regarding their income, tax withholdings, and personal information.

When is a W-2C form due?

The deadline for the Form W-2C is not set to a specific date. Instead, it should be submitted as soon as possible after discovering an error on the original W-2 form.

Employers need to correct the information promptly to ensure both the IRS and the employee receive accurate tax information.

How to get a blank W-2C form?

To get a blank form W-2C, simply visit our platform where we have a template pre-loaded in our editor, ready for you to fill out. Remember, while we help you prepare and download the form, we don't assist in filing it.

How to sign W-2C form online?

Signing your Form W-2C online with PDF Guru is a process that ensures convenience. Start by loading your form into the PDF editor on our platform.

After filling out the necessary fields, you can create a simple electronic signature to complete the form. Click 'Done' to proceed with downloading your signed document.

Where to file a W-2C?

The W-2C form can be submitted online through the SSA's Business Services Online (BSO).

Alternatively, the W-2C can also be sent by mail if preferred. Ensure to follow official guidelines for mailing.