What is Form 4952?

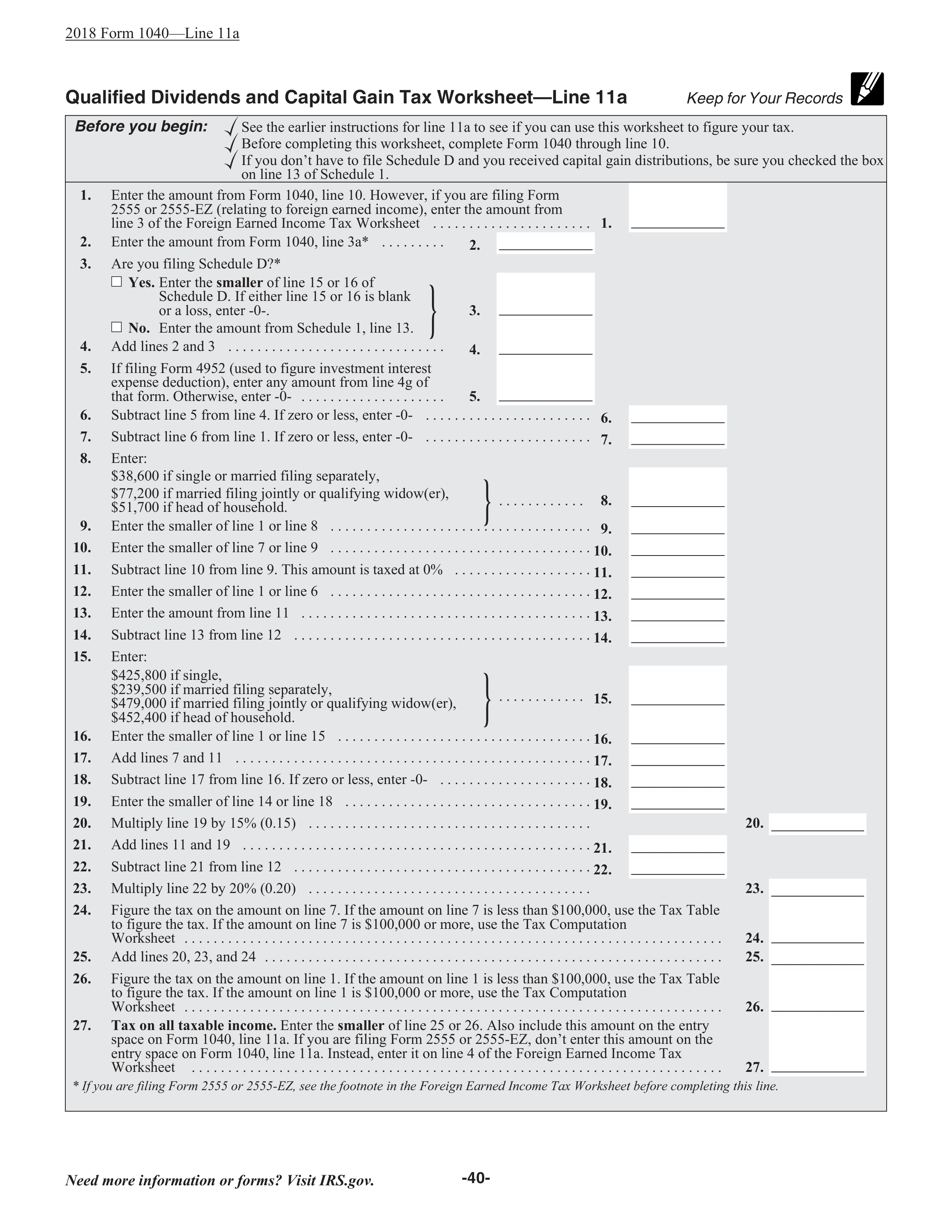

Form 4952, Investment Interest Expense Deduction, is a tax form that allows you to claim a deduction for interest paid on loans used to invest in taxable assets. This form helps you calculate your total investment interest expense and determine your net investment income, while also identifying any disallowed investment expenses that can be carried forward. By using this form, you can lower your taxable income by deducting the interest paid on investments, which may help reduce your overall tax bill. Remember, you can only use this form if you itemize deductions on Schedule A.

What is Form 4952 used for?

Form 4952 is important for managing investment-related expenses. Here’s what it helps with:

- Calculate Total Investment Interest Expense: Find out the total interest paid on investment loans.

- Determine Net Investment Income: Figure out total investment income after adjustments.

- Carry Forward Disallowed Expenses: Track any disallowed interest expenses for future years.

- Claim Deduction: Deduct net investment interest expense on Schedule A as an itemized deduction.

How to fill out Form 4952?

- 1

Enter your name and ID number in the Taxpayer Information section.

- 2

Report the investment interest expense paid or accrued for the current year on Line 1.

- 3

Input any disallowed investment interest from the prior year on Line 2.

- 4

Add Lines 1 and 2 to find your Total Investment Interest Expense on Line 3.

- 5

Calculate your net investment income in Part II.

- 6

Determine your investment interest expense deduction based on the figures from Part III.

Who is required to fill out Form 4952?

Individuals, estates, and trusts are responsible for completing Form 4952 to claim a deduction for their investment interest expense.

Those required to fill out Form 4952 use it to determine deductible investment interest expenses and carry forward amounts, ensuring compliance with IRS regulations for maximizing tax deductions.

When is Form 4952 not required?

You don't need to file Form 4952 if your investment income from interest and ordinary dividends, minus qualified dividends, exceeds your investment interest expense. Also, if you have no other deductible investment expenses or didn't incur investment interest to generate tax-exempt income, you can skip this form.

When is Form 4952 due?

The deadline for Form 4952 is April 15, the same as your tax return. If you file for an extension, the form is due by the extended deadline. You do not need to file it if your investment income exceeds your interest expenses and you have no other deductible investment expenses.

How to get a blank Form 4952?

To get a blank Form 4952, Investment Interest Expense Deduction, simply visit our website. The Internal Revenue Service (IRS) issues this form, and we have it ready for you to fill out. Remember, our platform aids in filling and downloading forms but does not support filing.

Do you need to sign Form 4952?

You do not need to sign Form 4952. This form is designed to help you calculate and report your investment interest expense, but it does not require your signature. It's always a good idea to check the latest updates to ensure you have the most current information. With PDF Guru, you can fill out this form, download it for your records, and handle any other necessary steps outside of our platform.

Where to file Form 4952?

You must file Form 4952 by attaching it to your federal income tax return (such as Form 1040). According to official IRS instructions, Form 4952 is not filed separately; it is included as part of your tax return package and submitted to the IRS by the same method — either electronically or by mail — according to the instructions for your main tax return.