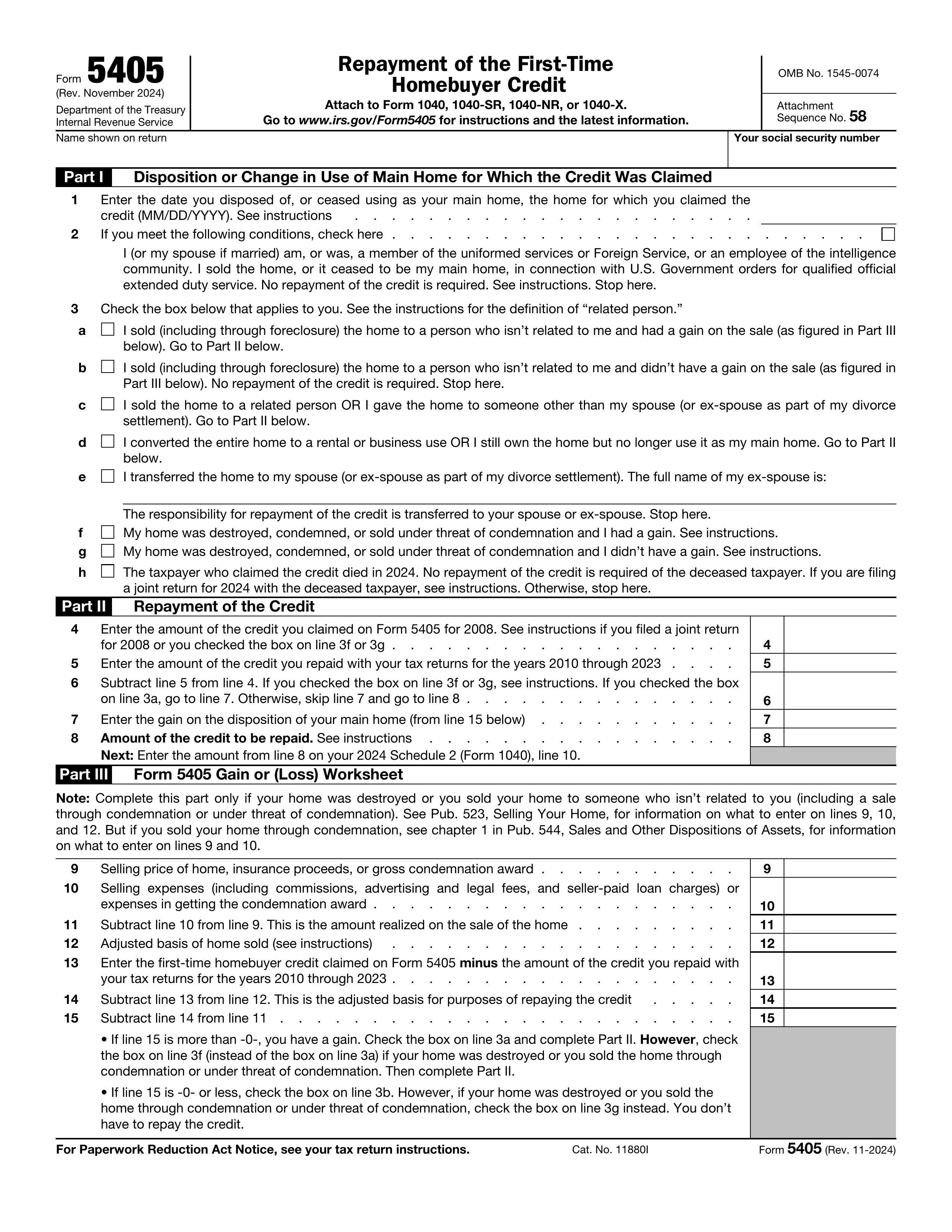

What is Form 5405?

Form 5405 is used for the First-Time Homebuyer Credit and to report any repayment of this credit. This form is important for those who purchased a home between 2008 and 2010, as it helps determine if you qualify for a credit or need to repay it. Properly filling out this form ensures you comply with IRS regulations and prevents potential penalties. It's essential to understand the requirements and implications of the credit when filing your taxes.

What is Form 5405 used for?

Here’s what it’s for:

- to claim the First-Time Homebuyer Credit.

- to report repayment if required.

How to fill out Form 5405?

- 1

Open Form 5405 in the PDF editor.

- 2

Read the instructions carefully at the top of the form.

- 3

Fill in personal details like your name and Social Security number.

- 4

Complete sections regarding the home purchase and credit amount.

- 5

Review all provided information for accuracy.

- 6

Sign the form electronically where indicated.

- 7

Download the completed form for submission to the IRS.

Who is required to fill out Form 5405?

Form 5405 must be completed by first-time homebuyers claiming the credit or repaying it. This includes individuals who purchased a home and qualified for the credit.

Homebuyers, or their estates, use the form for reporting the credit on their tax returns.

When is Form 5405 not required?

You don’t need to file Form 5405 if you purchased a home after 2008, as the repayment requirement for those purchases has expired.

Additionally, if you are only making an annual installment payment for a home purchased in 2008 that you owned and used as your main home throughout 2024, you also don’t need this form.

When is Form 5405 due?

The deadline for Form 5405 is April 15, 2025, for most taxpayers. If you filed for an extension, you can submit it by October 15, 2025. This form must be included with your federal income tax return for the year you are claiming or repaying the credit.

If you sold your home or stopped using it as your main home in 2024, you will need to file Form 5405 with your 2024 tax return. Remember, 2025 is anticipated to be the last year for repayments related to this form, as homeowners had 15 years to repay the credit starting in 2010.

How to get a blank Form 5405?

You can access a blank version of this form pre-loaded in our PDF editor on our platform. Fill it out and download your completed form for your records.

Form 5405 is issued by the IRS.

How to sign Form 5405 online?

To sign Form 5405 using PDF Guru, start by opening the form in the PDF editor. Fill out all required fields accurately, then create your electronic signature.

After completing the form, click "Done" to download it. Remember to consult official sources for any specific signature requirements related to Form 5405 to ensure compliance.

Where to file Form 5405?

Form 5405 must be submitted to the Internal Revenue Service (IRS).

Submission methods: mail, electronic or in-person.