What is Form 7004?

Form 7004 is an official document that businesses use to request a six-month extension for filing specific tax returns, including those for partnerships, corporations, and trusts. By submitting this form, businesses can avoid late filing penalties and gain extra time to prepare their tax paperwork. This extension is crucial for effective time management and helps prevent penalties for missing the original filing deadline. Be sure to complete the form accurately and file it on or before the regular due date of the tax return to ensure compliance.

What is Form 7004 used for?

Form 7004 is important for businesses needing more time to file their taxes. Here’s what it does:

- Requests up to 6 months more to file business income tax returns.

- Helps avoid penalties for late filing.

- Allows businesses to estimate and pay taxes by the original deadline.

- Documents extensions for various business tax returns simply.

How to fill out Form 7004?

- 1

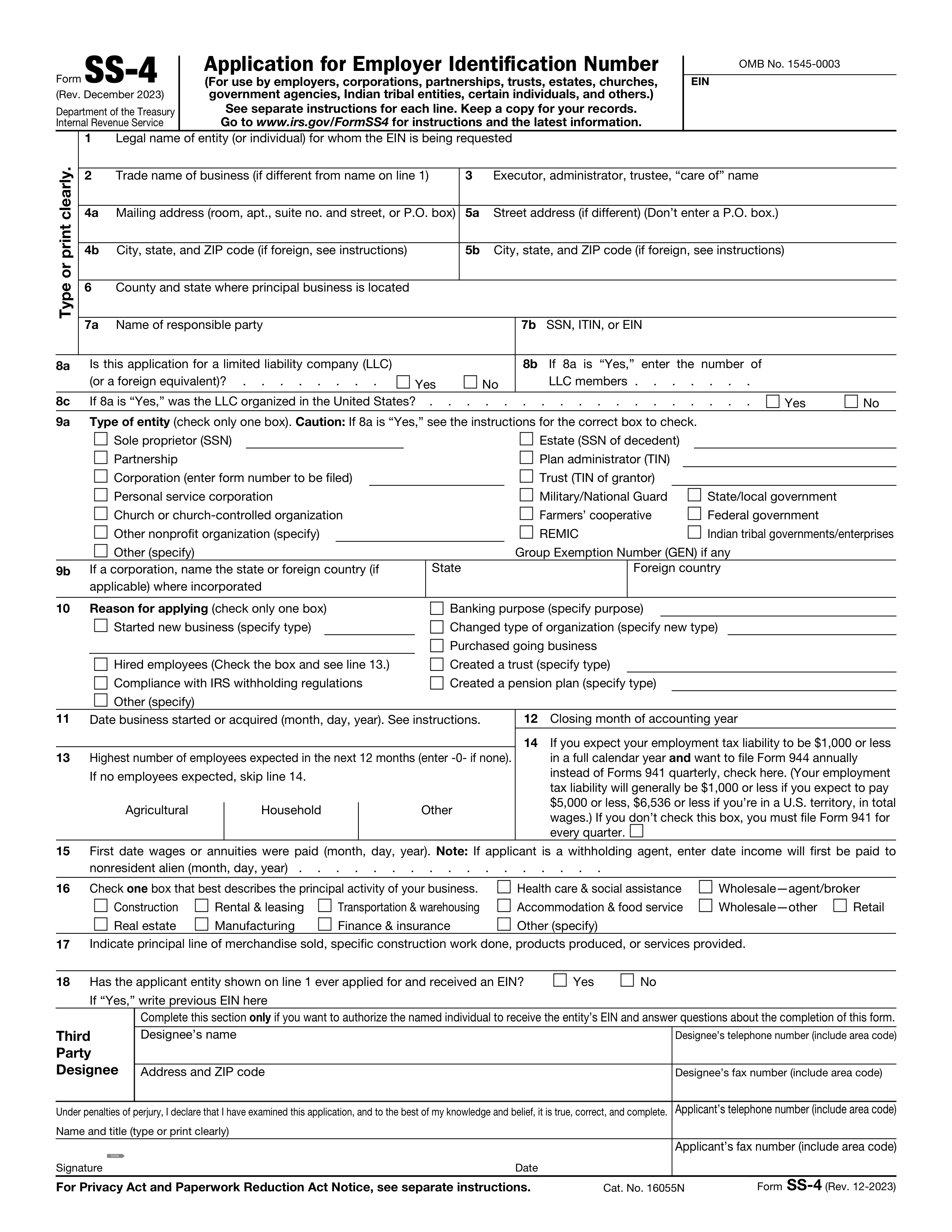

Gather Information: Enter your business's legal name, address, EIN, and Social Security number (if applicable).

- 2

Determine the Right Form Code: Fill in the correct code in Part I for the tax return you are extending.

- 3

Complete Part II: Provide your business details, including the year, tax liability, payments, credits, and balance due.

- 4

File by Due Date: Download Form 7004 before the due date of your tax return.

Who is required to fill out Form 7004?

Certain foreign and domestic corporations, as well as specific partnerships, are responsible for completing Form 7004. This includes partnerships keeping records outside the U.S., foreign corporations with a U.S. office, and domestic corporations with books outside the U.S. and Puerto Rico.

When is Form 7004 not required?

Form 7004 is not required for partnerships maintaining books outside the U.S. and Puerto Rico, foreign corporations with U.S. offices, domestic corporations keeping books outside the U.S. and Puerto Rico, and domestic corporations earning principal income from U.S. possessions. If your entity falls under these categories, you don't need to file Form 7004 for an automatic extension.

When is Form 7004 due?

The deadline for Form 7004 is the original tax return due date. For corporations, it is the 15th day of the fourth month after the fiscal year ends. For partnerships and S corporations, it’s the 15th day of the third month after the fiscal year ends. Be sure to mark your calendar to avoid any late penalties.

How to get a blank Form 7004?

To obtain a blank Form 7004, Application for Automatic Extension of Time to File Certain Business Income Tax, Information, and Other Returns, simply visit our platform. The IRS issues this form, and we have a pre-loaded version ready for you to fill out. Remember, our website aids in filling and downloading but not filing forms.

Do you need to sign Form 7004?

No, you do not need to sign Form 7004, according to the official IRS instructions. You simply complete and file Form 7004 to request an automatic extension; only your main tax return requires a signature when you file it.For filling out this form, PDF Guru is your go-to tool. You can fill it out easily and download it for later use. Just remember, PDF Guru does not support submission or online sharing of forms. Always check for the latest updates.

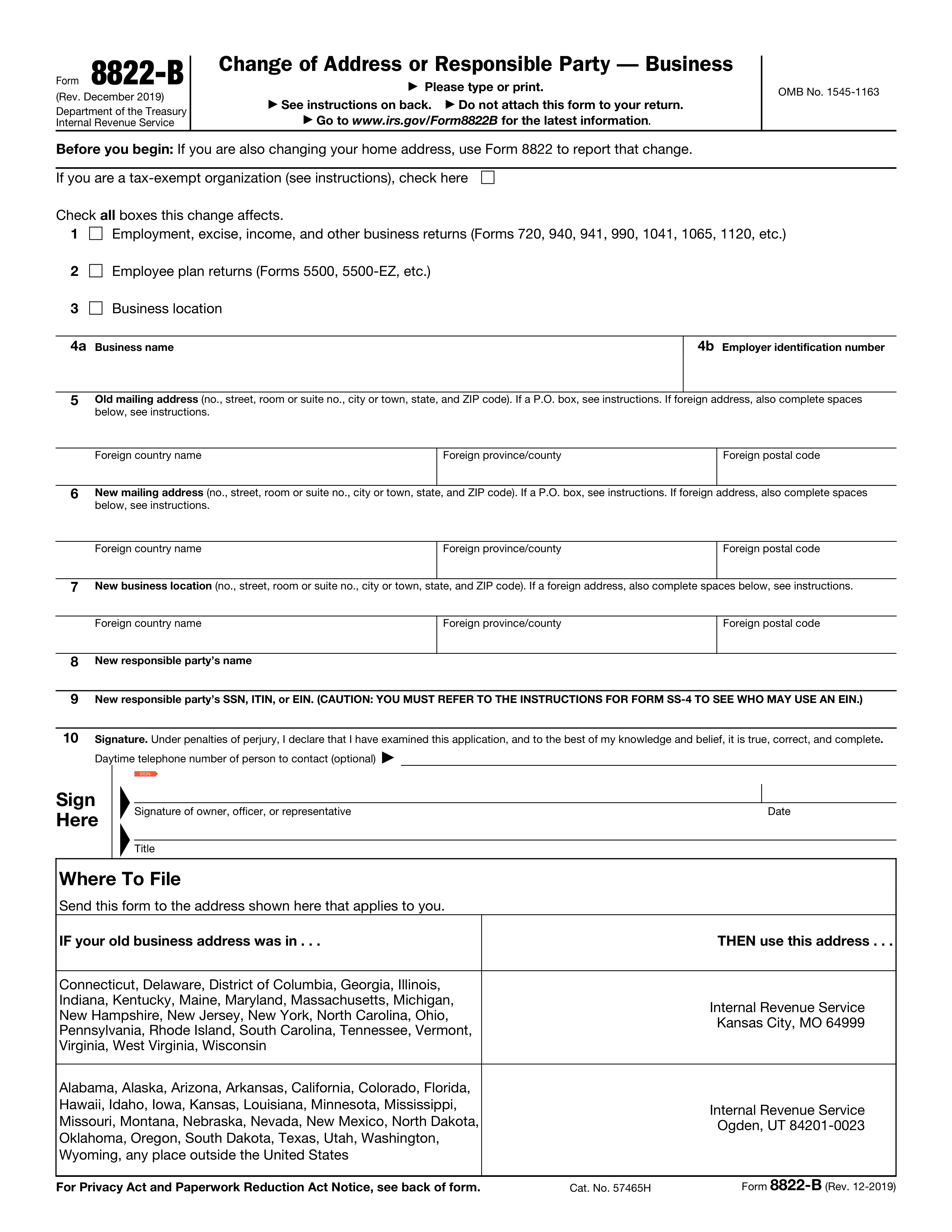

Where to file Form 7004?

To submit Form 7004, U.S. citizens and residents should mail it to the IRS Center in Kansas City, MO. Businesses in certain states follow the same procedure.

If you’re located in foreign countries or U.S. possessions, send the form to Ogden, UT. You can also e-file through the Modernized e-File (MeF) platform.