What is Form 8806?

Form 8806 is an IRS document that corporations use to report major changes in ownership or capital structure. This includes situations where control of the company is acquired or when there are significant alterations in how assets and liabilities are handled. By filing this form, corporations help the IRS monitor these important transactions and maintain compliance. Additionally, it allows companies to choose to publish transaction details, aiding brokers in their reporting obligations. Timely filing of Form 8806 is essential to prevent fines and penalties.

What is Form 8806 used for?

Form 8806 is important for corporations involved in significant changes. Here’s what you need to know:

- Reporting Acquisitions: Informs the IRS about control acquisitions of a corporation.

- Capital Structure Changes: Highlights major shifts in a corporation's capital setup.

- Tax Compliance: Ensures adherence to IRS rules regarding these transactions.

- Shareholder Information: Details the fair market value of stocks and property exchanged.

- Broker Reporting: Helps brokers meet their reporting duties.

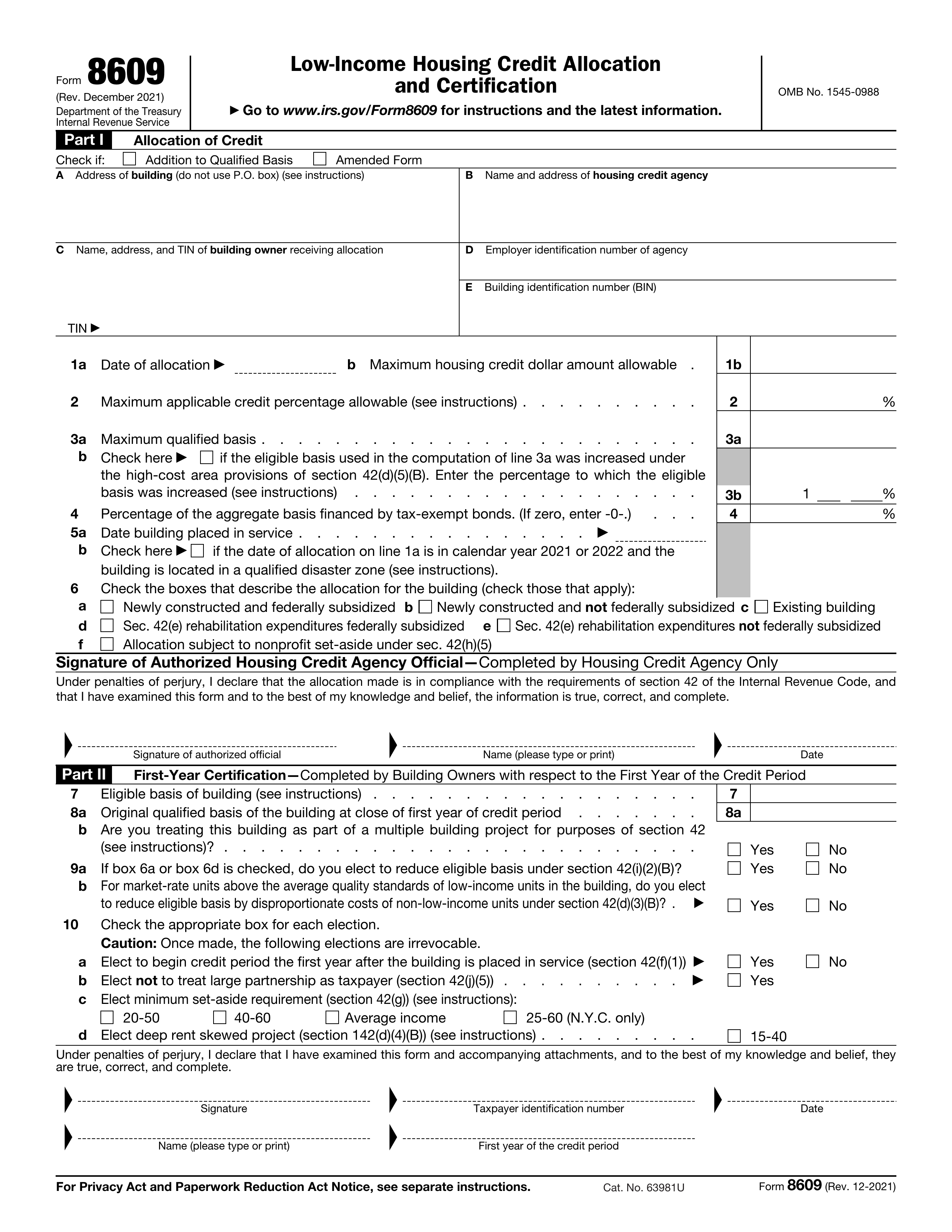

How to fill out Form 8806?

- 1

Gather information about both corporations, including their names, addresses, and EINs.

- 2

Complete Part I for the reporting corporation, ensuring you include the name, address, and EIN.

- 3

Fill out Part II for the acquiring corporation with the required details.

- 4

Provide information about the acquisition in Part III, including the transaction date.

- 5

Review the form for accuracy and completeness.

- 6

Check official sources for the latest signature requirements before submission.

- 7

Submit the form to the IRS within 45 days of the transaction.

Who is required to fill out Form 8806?

Corporations involved in acquisitions or substantial changes in capital structure are responsible for completing Form 8806. This includes those providing cash, stock, or other property to shareholders during these transactions, often with the help of tax professionals or accountants.

Afterward, shareholders use Form 8806 for tax reporting. Tax professionals and the IRS also reference it to ensure compliance with tax regulations related to corporate changes.

When is Form 8806 not required?

Form 8806 is unnecessary for transactions reported under section 6043(a). If all shareholders receiving cash, stock, or property qualify as exempt recipients, filing isn't required either. Corporations transferring assets that don't result in a substantial change in capital structure also do not need to submit this form. Always check your specific situation to determine if you must file.

When is Form 8806 due?

The deadline for Form 8806 is 45 days after the acquisition of control or a major change in capital structure. If this event occurs earlier, it must be filed by January 5th of the following year. Missing the deadline can lead to penalties of up to $500 each day, with a total cap of $100,000.

How to get a blank Form 8806?

To obtain a blank Form 8806, simply visit our website. We have it pre-loaded in our editor for you to fill out. Remember, our platform helps with filling and downloading forms, but not filing them.

The IRS issues this form.

How to sign Form 8806?

To sign Form 8806, you can use a handwritten or electronic signature, as the IRS allows electronic signatures provided they are made with the intent to sign. With PDF Guru, you can fill out the form and create a simple electronic signature for it. Don’t forget to check for the latest updates on the form. Remember, while PDF Guru helps you prepare and download your form, submission is not supported.

Where to file Form 8806?

To submit Form 8806, send it via fax to the IRS at 844-249-6232. Mailing is no longer an option for this form.

Make sure to file within 45 days of the transaction to avoid penalties. Keep a copy for your records.