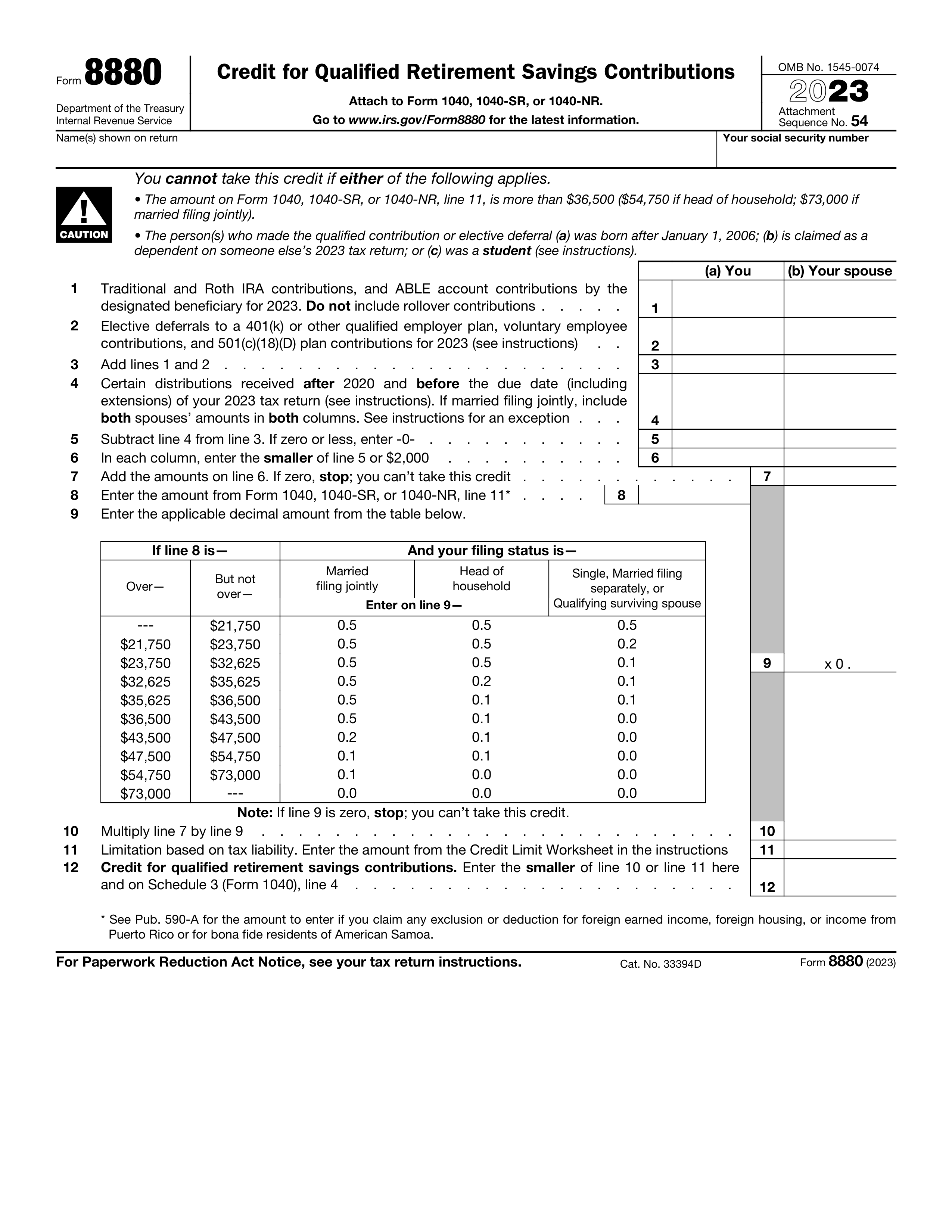

What is an 8880 form?

Form 8880 is important for individuals looking to claim the Retirement Savings Contributions Credit. It's designed for those who have contributed to retirement plans, like IRAs or 401(k)s, and meet certain income criteria. Filling out this form can help lower the amount of tax you owe or increase your refund, making it valuable for eligible taxpayers aiming to save for retirement. It's especially useful for low to moderate-income earners looking to boost their retirement savings while benefiting from tax savings.

What is an 8880 form used for?

Form 8880 is a crucial document for individuals seeking to claim a tax credit. It's designed for those who contribute to retirement savings.

- To claim the Credit for Qualified Retirement Savings Contributions.

- To report contributions to eligible retirement plans.

- To calculate and claim a nonrefundable credit on your tax return.

How to fill out an 8880 form?

- 1

Start by entering your name and Social Security Number at the top of the form.

- 2

In Part I, input your total contributions to a retirement account.

- 3

For Part II, calculate your credit rate based on your income.

- 4

Complete Part III to determine your credit amount.

- 5

Review all sections for accuracy before downloading the document.

Who is required to fill out an 8880 form?

Form 8880 is filled out by individuals looking to claim the Retirement Savings Contributions Credit on their tax return. This often includes low to moderate-income earners who contribute to retirement accounts.

After submission, the IRS uses Form 8880 to determine the taxpayer's eligibility for the credit and calculate the correct credit amount to be applied to their tax obligations.

When is an 8880 form not required?

Form 8880 is not necessary for individuals who did not make any contributions to a retirement plan, such as an IRA or a workplace retirement plan, during the tax year.

Also, taxpayers who are not eligible for the Retirement Savings Contributions Credit, possibly due to their income level being above the threshold, do not need to complete this form.

When is an 8880 form due?

The deadline for Form 8880 is April 15 of the following year. This form needs to be filed along with your tax return. Keep in mind that contributions to retirement accounts can be made until the end of the calendar year for workplace plans, and until tax day (April 15) for IRAs.

How to get a blank 8880 form?

Our platform offers an IRS-issued blank template for Form 8880, which is pre-loaded in our editor for your convenience. You don't need to search for or download the template from anywhere else. With PDF Guru, you can fill out and download the form, although we don't assist in submitting it.

How to sign 8880 form online?

To sign form 8880 online with PDF Guru, begin by opening the form in the PDF editor. Fill out the required fields first.

Next, use the electronic signature feature to add your signature. Once done, click "Done" to proceed with downloading your signed form.

Where to file an 8880?

Form 8880 is for claiming the Credit for Qualified Retirement Savings Contributions. It can be submitted by mail with your tax return to IRS.

If you e-file your taxes, you can include Form 8880 in your electronic submission.