What is Form 8948?

Form 8948, Preparer Explanation for Not Filing Electronically, is a document that tax return preparers file to clarify why a tax return is submitted on paper rather than electronically. This form is essential for complying with the IRS's electronic filing rules and allows preparers to justify exceptions, such as a taxpayer's preference for paper filing or issues with technology. By using this form, preparers ensure that all relevant information is properly documented, maintaining compliance with IRS requirements.

What is Form 8948 used for?

Form 8948 is important for tax preparers filing returns on paper. It explains why they are not filing electronically:

- Taxpayer Request: The taxpayer prefers to file on paper.

- Religious Objection: The preparer is part of a religious group that opposes electronic filing.

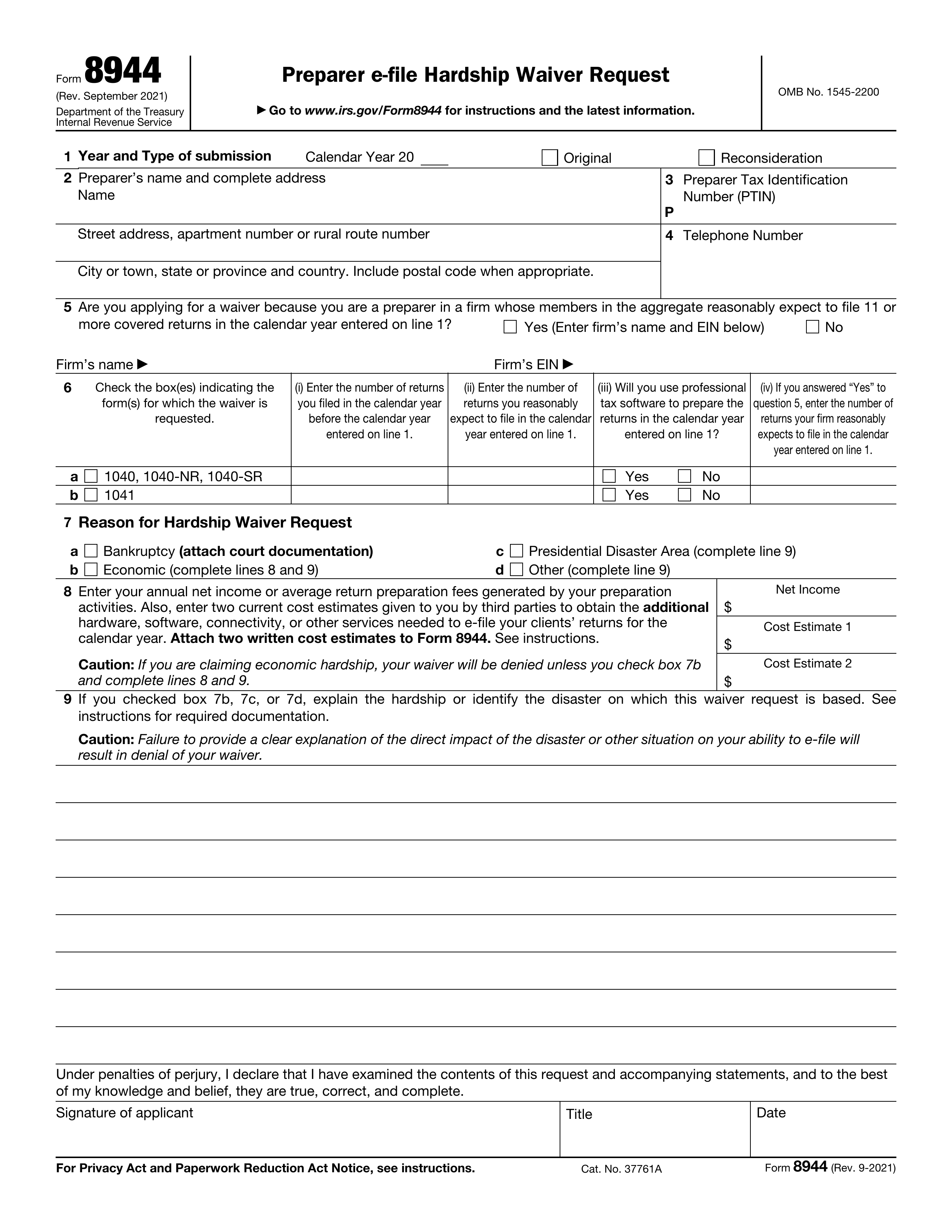

- Approved Waiver: There’s an approved waiver from the e-file requirement.

- Electronic Filing Rejection: The IRS rejected the e-file and the issue wasn’t resolved.

- Unsupported Software: The preparer’s software can’t handle the required Forms or Schedules.

- Non-U.S. Citizen Ineligibility: The preparer is a non-U.S. citizen without a social security number living abroad.

How to fill out Form 8948?

- 1

Identify if the return is a covered return that cannot be e-filed.

- 2

Check the applicable box for the reason not to file electronically.

- 3

Enter the taxpayer’s name, tax year, and identifying number in the specified fields.

- 4

Fill in the preparer’s name and PTIN.

- 5

Attach Form 8948 with the paper tax return.

- 6

Have the client sign Form 8948 to acknowledge the manual filing.

Who is required to fill out Form 8948?

Specified tax return preparers are responsible for completing Form 8948. This includes preparers who expect to file 11 or more covered returns during the year, as well as those who are part of a firm.

After completing the form, the preparer attaches it to the paper tax return and provides it to the taxpayer for their signature, ensuring acknowledgment of the manual filing.

When is Form 8948 not required?

Form 8948 isn't required when the return can be e-filed with the IRS using software that supports all forms and schedules. It's also unnecessary if the IRS rejects the return due to e-filing restrictions. Additionally, foreign preparers without an SSN, working for an eligible firm, do not need to file this form.

When is Form 8948 due?

The deadline for Form 8948 is the same as the due date for the related paper tax return. This form must be submitted with the paper return when a tax preparer explains why the return cannot be filed electronically. It is essential to include it if the return qualifies for exceptions, such as undue hardship or technology issues.

How to get a blank Form 8948?

To get a blank Form 8948, Preparer Explanation for Not Filing Electronically, simply visit our website. The Internal Revenue Service (IRS) issues this form, and we have a blank version ready for you to fill out. Remember, our platform helps with filling and downloading forms, but not filing them.

Do you need to sign Form 8948?

No, you do not need to sign Form 8948. While the taxpayer must sign the tax return, the preparer must provide a copy of Form 8948 to the taxpayer for their signature, but the preparer does not sign the form. To manage this form effectively, you can use PDF Guru to fill it out and download it for your records. Always check for the latest updates regarding forms and requirements.

Where to file Form 8948?

Form 8948 must be attached to your paper tax return and mailed to the IRS. It cannot be submitted online.

Don’t forget to include a signed statement with your copy, explaining your choice to file on paper. This helps clarify your filing decision.