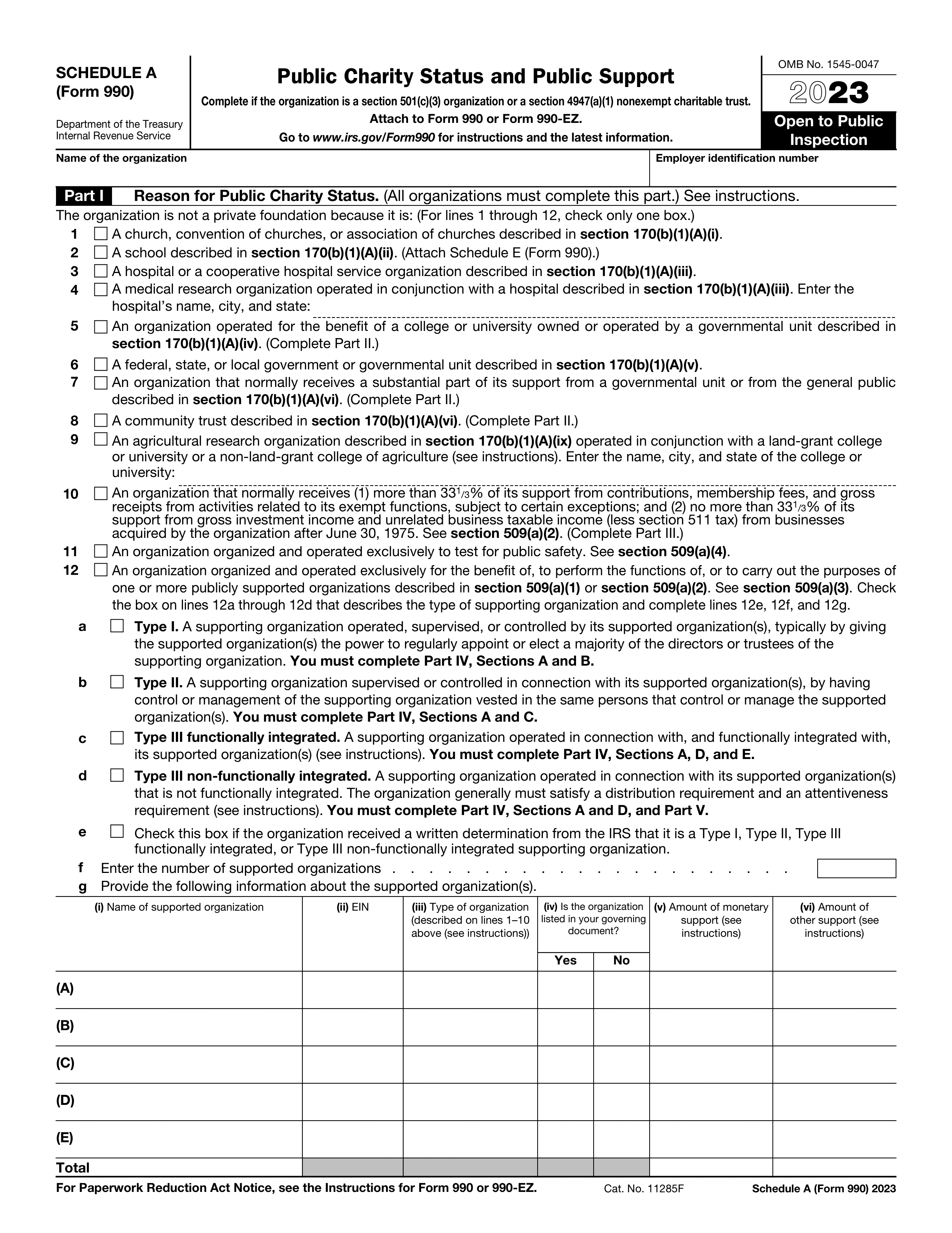

What is Schedule C?

Schedule C from Form 990 is used by tax-exempt organizations to report their political campaign and lobbying activities. This form is important because it helps the IRS ensure that organizations comply with rules regarding political involvement and lobbying efforts. By accurately filling out Schedule C, organizations provide transparency about their activities and funding, which is essential for maintaining their tax-exempt status. Understanding this form helps organizations adhere to legal requirements and fosters accountability in their community engagements.

What is Schedule C (Form 990) used for?

Schedule C is used by organizations to report their political campaign and lobbying activities. Here’s what it includes:

- to disclose political campaign expenditures.

- to report lobbying activities and expenses.

- to provide information on lobbying and political campaign efforts.

How to fill out Schedule C?

- 1

Review the instructions for Form 990 Schedule C.

- 2

Gather all relevant information about your organization’s political and lobbying activities.

- 3

Complete Part I by detailing political campaign activities, including amounts spent.

- 4

Fill out Part II with information on lobbying activities, clearly stating the expenses.

- 5

Check for accuracy, ensuring all figures and descriptions match your records.

- 6

Submit the completed form with your Form 990 by the due date.

Who is required to fill out Schedule C?

Nonprofits and tax-exempt organizations complete Schedule C for political campaign and lobbying activities. It's important for reporting their involvement in these areas.

After completion, the IRS and the public can access this form to review the organization's political spending and lobbying efforts.

When is Schedule C from Form 990 not required?

Organizations do not need to file Schedule C if they do not engage in political campaign activities or lobbying. Additionally, smaller tax-exempt organizations with gross receipts under $200,000 and total assets under $500,000 may be exempt from this requirement. Always check with the IRS guidelines to confirm eligibility and ensure compliance with all necessary reporting obligations.

When is Schedule C due?

The deadline for Schedule C is the 15th day of the 5th month after the end of your organization’s tax year. For example, if your tax year ends on December 31, the form is due on May 15.

If you need more time, you can file for an extension. However, keep in mind that the extension only applies to the filing date, not to any taxes owed.

How to get a blank Schedule C (Form 990)?

To get a blank Schedule C (Form 990), simply visit our platform, where the form is pre-loaded and ready for you to fill out. Once you complete the necessary fields, you can download your filled form.

Alternatively, the Internal Revenue Service (IRS) has the official Schedule C available for direct download from their website.

Do you need to sign Schedule C?

Schedule C (Form 990) does not require a signature according to official IRS guidelines. However, it's crucial to check the IRS website for any updates or changes that may affect this requirement.

Where to file Schedule C?

Filing Form 990 Schedule C requires submitting it alongside Form 990 or Form 990-EZ to the IRS. Ensure you gather all necessary information before filling it out.

Schedule C must be mailed with your Form 990 or Form 990-EZ. Currently, online submission directly to the IRS is not available.