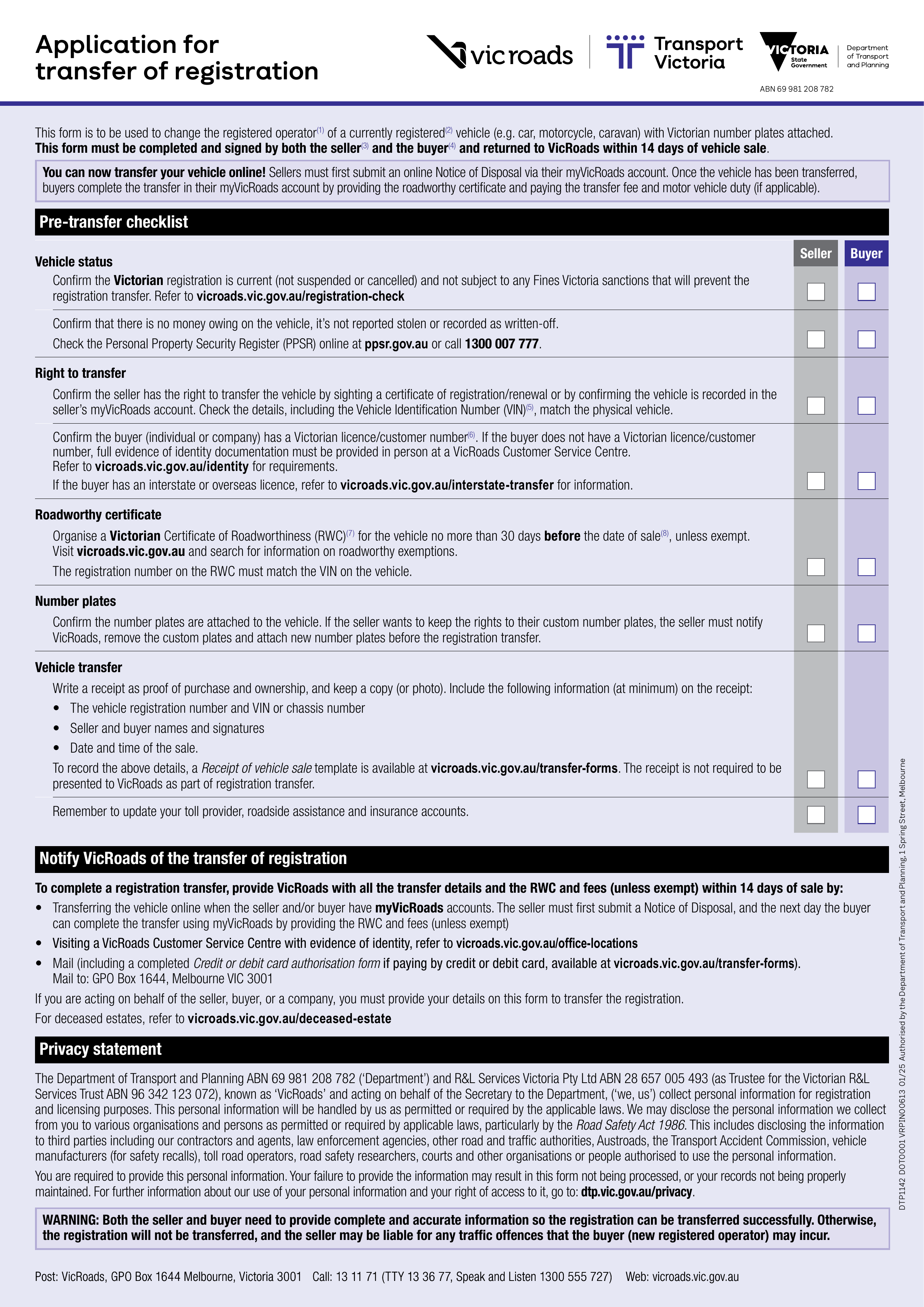

What is Form MR1?

The MR1 form is essential for registering your vehicle and obtaining Compulsory Third Party (CTP) insurance in South Australia. This form helps ensure that all vehicles on the road are insured to cover any damages or injuries they may cause. To fill out the MR1, you will need to provide personal details, such as your name and address, along with specific information about your vehicle, including the vehicle identification number. Completing this form is a crucial step in protecting both drivers and pedestrians in the event of an accident.

What is Form MR1 used for?

Form MR1 is essential for vehicle owners in Australia. Here's what it's used for:

- Registration of Motor Vehicles: To register your vehicle under the Motor Vehicles Act 1959.

- Compulsory Third Party (CTP) Insurance: To apply for insurance covering third-party liability in case of an accident.

- Proof of Financial Responsibility: To show that you have the means to cover costs during the registration period.

How to fill out Form MR1?

- 1

Fill in Required Details: Complete all necessary fields, including vehicle information and insurance details.

- 2

Provide Supporting Documents: Attach required documents, such as the vehicle registration and insurance policy.

- 3

Pay the Fee: Make sure to pay the required registration fee to ensure the application is processed.

Who is required to fill out Form MR1?

The APPLICATION FOR REGISTRATION AND COMPULSORY THIRD PARTY INSURANCE, Form MR1, is typically filled out by vehicle owners, motor vehicle dealers, and body corporates.

After completion, state authorities use the form to verify details for vehicle registration and insurance compliance as per the Motor Vehicles Act 1959.

When is Form MR1 not required?

Form MR1 is not required for vehicles that are exempt from third-party insurance. This includes vehicles used solely for agricultural or forestry purposes, those permanently off the road, and certain vehicles used for specific charitable or educational activities. Always check if your vehicle qualifies for these exemptions to avoid unnecessary paperwork.

When is Form MR1 due?

The deadline for Form MR1 is within 14 days after bringing a vehicle into the UK permanently. Be sure to include evidence of insurance and identification with your application. If you are a body corporate, remember to provide your Australian Company Number (ACN) instead of an Australian Business Number (ABN).

How to get a blank Form MR1?

To get a blank Form MR1, simply visit our platform. We have the form pre-loaded in our PDF editor for you to fill out. Remember, PDF Guru helps with filling and downloading forms, but it does not support filing them.

How to sign Form MR1?

To sign Form MR1, you must provide a handwritten or manually generated signature, as electronic or digital signatures are not acceptable. After filling out the form using PDF Guru, download it and print a copy to sign. Remember to check for any updates to the signing requirements before submission. While PDF Guru helps you prepare and download the form, it does not facilitate submission or sharing.

Where to file Form MR1?

To submit Form MR1 for registration and compulsory third party insurance, you have two options. The quickest method is to file online using the WebFiling service, which costs £15.

If you prefer to file by mail, print the form on full-size A4 paper. This method costs £24, and you must ensure it reaches Companies House within 21 days of the charge creation date.