What is Form NR4?

The NR4 form, or Statement of Amounts Paid or Credited to Non-Residents of Canada, is essential for Canadian payers, including corporations and financial institutions, to report income paid to non-residents. This form helps ensure compliance with Canadian tax regulations by detailing payments made to non-residents. It plays a vital role in enabling the Canada Revenue Agency (CRA) to monitor cross-border transactions, promoting transparency and accuracy in tax reporting. Understanding and correctly filling out this form is crucial for non-resident income reporting.

What is Form NR4 used for?

Form NR4 is essential for non-residents dealing with Canadian income. Here’s what it’s used for:

- Reporting Income: Reports amounts paid or credited to non-residents by Canadian payers.

- Withholding Tax: Documents any tax withheld on these payments, even if not required.

- Compliance: Ensures adherence to Canadian tax regulations by providing a statement to the non-resident and the CRA.

- Transparency: Offers clarity in cross-border transactions for accurate tax reporting.

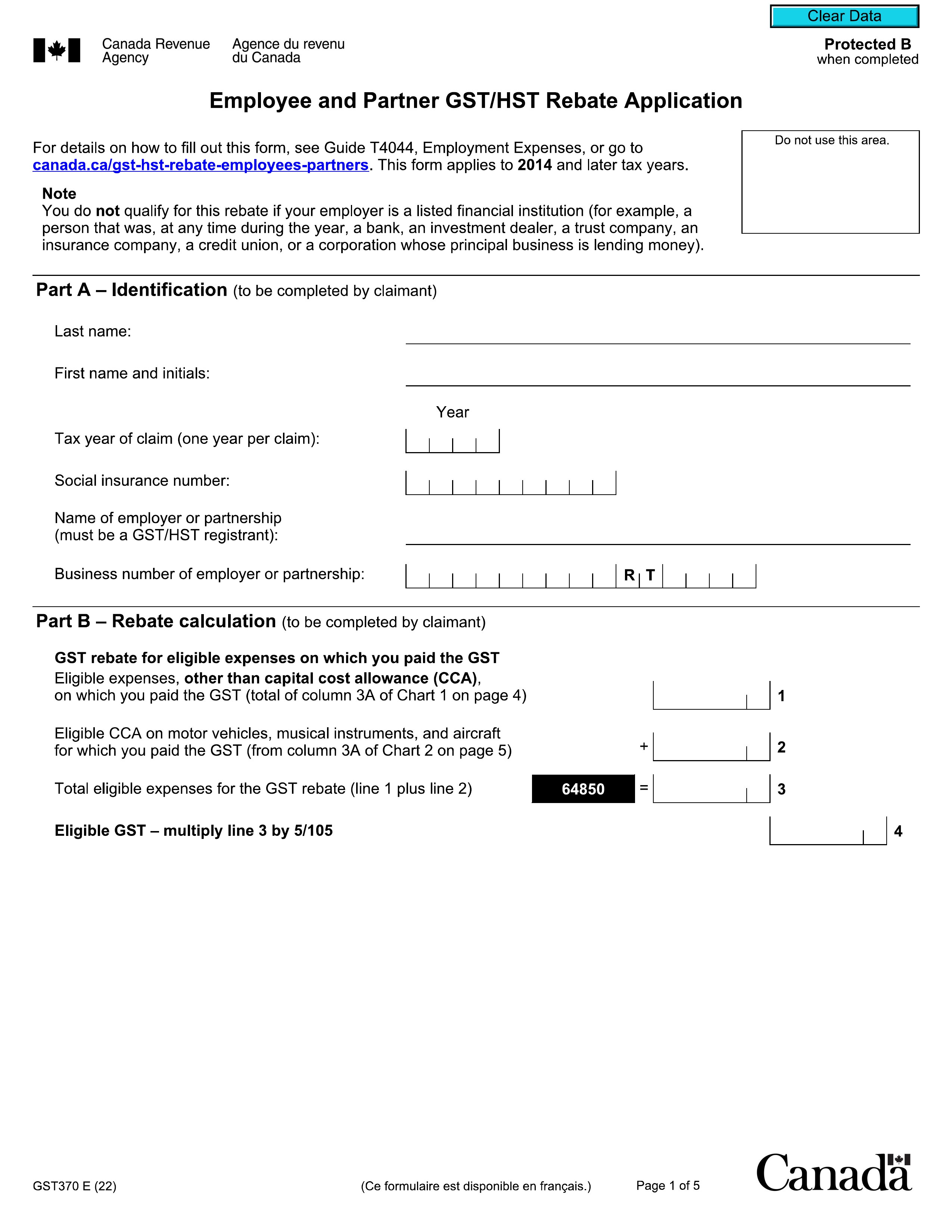

How to fill out Form NR4?

- 1

Identify Recipients: Fill out an NR4 slip for each non-resident you paid amounts subject to withholding tax.

- 2

Enter Recipient Information: Input the last name, first name, and initial for individuals or the corporation's name.

- 3

Report Gross Income: Enter amounts of $50 or more. For amounts less than $50 with tax withheld, report both the gross income and tax withheld.

- 4

Fill in Boxes:

- Box 10: Enter the calendar year.

- Box 11: Enter the recipient code.

- Box 12: Enter the country code.

- Box 13: Enter the tax identification number.

- Box 14/24: Enter the income code.

- 5

Include Payer Information: Add the payer identification number, if applicable.

Who is required to fill out Form NR4?

Canadian payers and withholding agents are responsible for completing Form NR4. They must fill it out for each non-resident to whom they paid or credited amounts as specified in Part XIII of the Income Tax Act.

After completion, the Canada Revenue Agency (CRA) uses this form to monitor income and taxes withheld from non-residents. Property managers also utilize NR4 slips for reporting to non-resident owners for tax filing purposes.

When is Form NR4 not required?

Form NR4 is not required when the gross income paid or credited to a non-resident is under $50 and no tax was withheld. If you're exempt from withholding tax due to the Income Tax Act or a bilateral tax treaty, you also don’t need to complete an NR4 slip.

When is Form NR4 due?

The deadline for Form NR4 is the last day of March following the calendar year it applies to. If March 31 falls on a weekend or public holiday, it is due the next business day. The Canada Revenue Agency (CRA) considers your return filed on time if it is received or postmarked by the due date.

How to get a blank Form NR4?

To get a blank Form NR4, simply visit our platform. The form, issued by the CRA, is pre-loaded in our editor for you to fill out directly. Keep in mind that while we aid in filling and downloading, we do not support filing the forms.

Do you need to sign Form NR4?

You do not need to sign Form NR4. This form serves as a reporting requirement for employers and withholding agents and does not require a signature. However, it's always a good idea to check for the latest updates to ensure compliance. With PDF Guru, you can fill out the form, download it, and manage your documents effectively, but remember that submission isn't supported.

Where to file Form NR4?

To submit Form NR4, visit the CRA's website to file online. Follow the prompts to enter all required information accurately.

Alternatively, you can mail the completed form to the CRA address designated for non-resident tax returns. Ensure your mailing details are correct to avoid delays.