What is Form T776?

Form T776, the Statement of Real Estate Rentals, is a tax form required in Canada for reporting income and expenses related to rental properties. This form allows property owners to declare their rental income and claim deductions for eligible expenses, such as mortgage interest and property taxes. Accurately completing Form T776 is essential for landlords to comply with tax regulations and maximize their deductions, which can significantly influence their overall financial health. Understanding this form is key to effective tax management for rental property owners.

What is Form T776 used for?

Form T776 is important for anyone renting out property. Here’s what it’s used for:

- Reporting Rental Income: To declare income earned from renting real estate or other properties.

- Claiming Expenses: To deduct various expenses related to the rental property, such as advertising, interest, insurance, and utilities.

- Calculating Net Income or Loss: To determine the total net income or loss from rental activities.

- Identifying Co-Ownership: To report income and expenses for co-owners or partners in a rental property.

- Capital Cost Allowance: To calculate and report capital cost allowance (CCA) for the rental property.

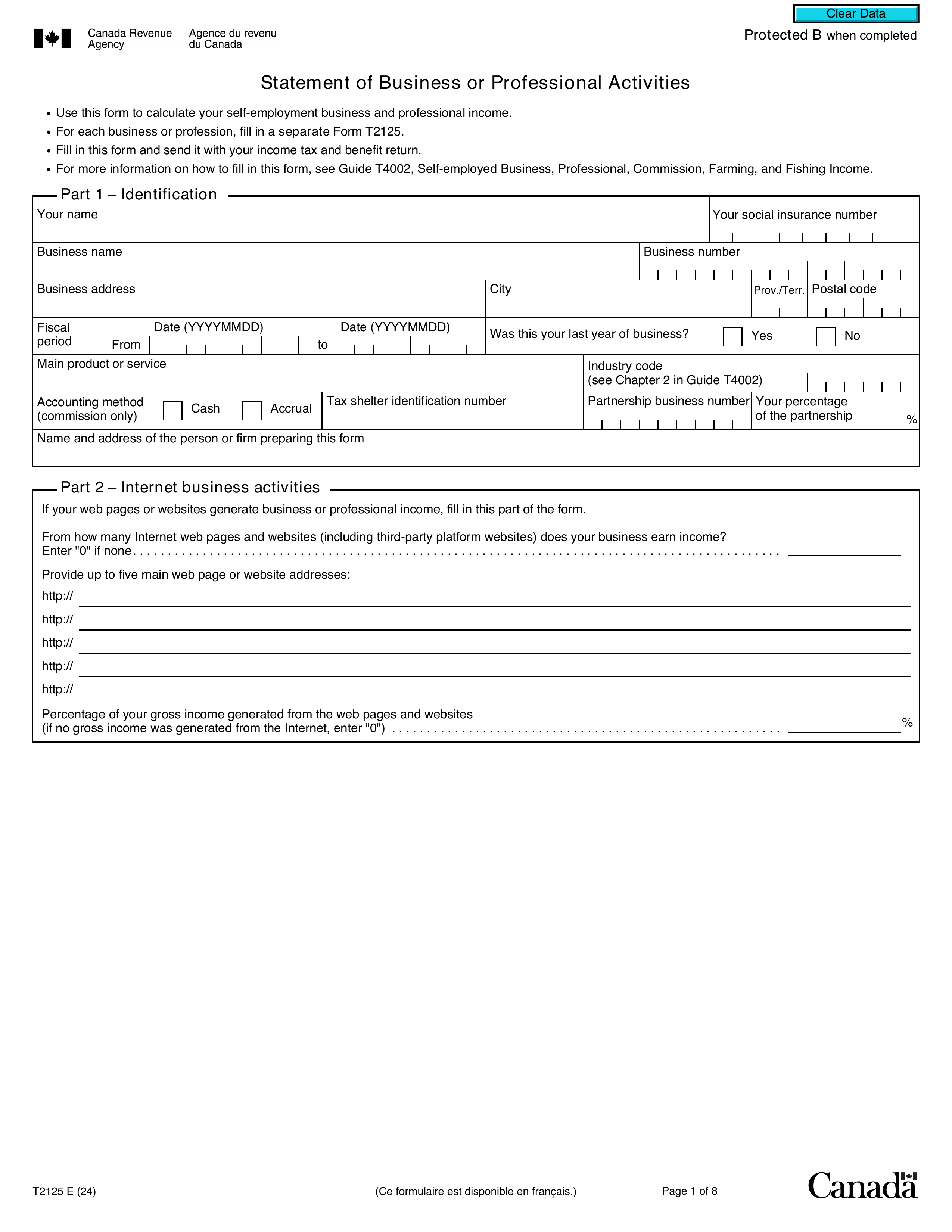

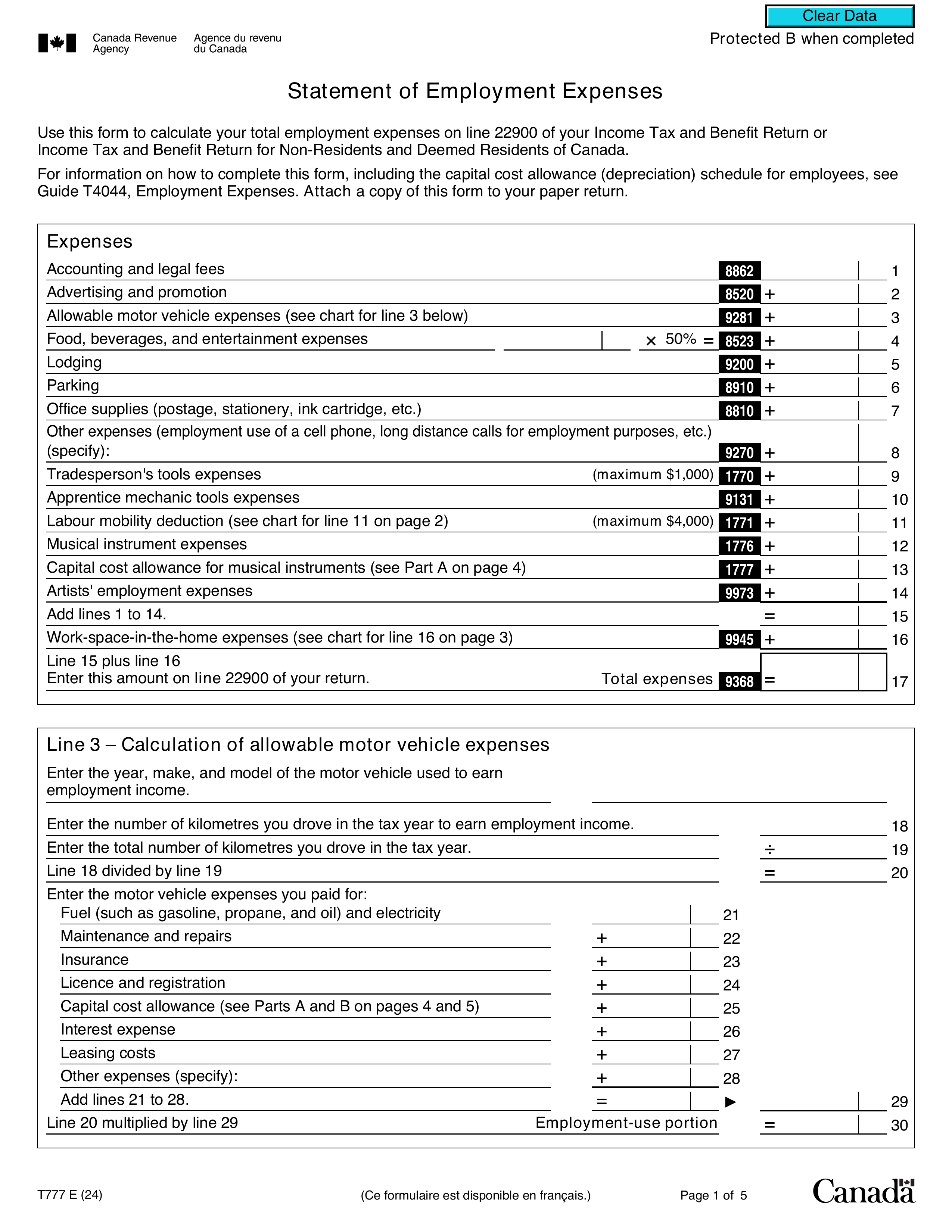

How to fill out Form T776?

- 1

Enter Your Information: Fill in your name and social insurance number at the top.

- 2

Fiscal Period: Input the start date (January 1 or acquisition date) and end date (December 31).

- 3

Ownership Details: Provide your ownership percentage and details about co-owners or partners.

- 4

Rental Income: Report gross rents on line 8141 and calculate net rental income by deducting expenses.

- 5

Expenses: List all rental expenses and their personal use percentages.

- 6

Review and Complete: Check that all sections are filled out accurately before downloading.

Who is required to fill out Form T776?

Individuals and businesses earning rental income from real estate, including sole proprietors, partnerships, and property-owning businesses, are responsible for completing Form T776.

Those who must fill out Form T776 include anyone renting out houses, apartments, rooms, or office spaces, ensuring compliance with tax regulations while reporting income and expenses.

When is Form T776 not required?

You do not need to file Form T776 if you do not earn rental income from real estate or other properties. It is also unnecessary if you have no related expenses, like property taxes or maintenance costs. Additionally, if you rent out a room in your home and earn minimal income, this form may not be required. Always consult a tax professional for personalized advice.

When is Form T776 due?

The deadline for Form T776 is April 30 of the following year for most individuals. If you are self-employed, you can file until June 15, provided your spouse or common-law partner is not self-employed.

How to get a blank Form T776?

To get a blank Form T776, simply visit our platform. The Canada Revenue Agency issues this form, and we have a blank version pre-loaded in our editor for you to fill out. Remember, PDF Guru aids in filling and downloading but does not support filing forms.

Do you need to sign Form T776?

You do not need to sign Form T776, as it is used for reporting rental income and expenses without a signature requirement. However, it's always a good idea to check for the latest updates. With PDF Guru, you can fill out the form, download it for your records, and handle any additional steps required elsewhere. Just remember, PDF Guru does not support form submission.

Where to file Form T776?

You can submit Form T776, Statement of Real Estate Rentals, either by mail or through NETFILE. If mailing, address it to your region's specific CRA location.

For online submissions, use NETFILE to send your return directly to the CRA. Ensure all information is complete and accurate before you file.