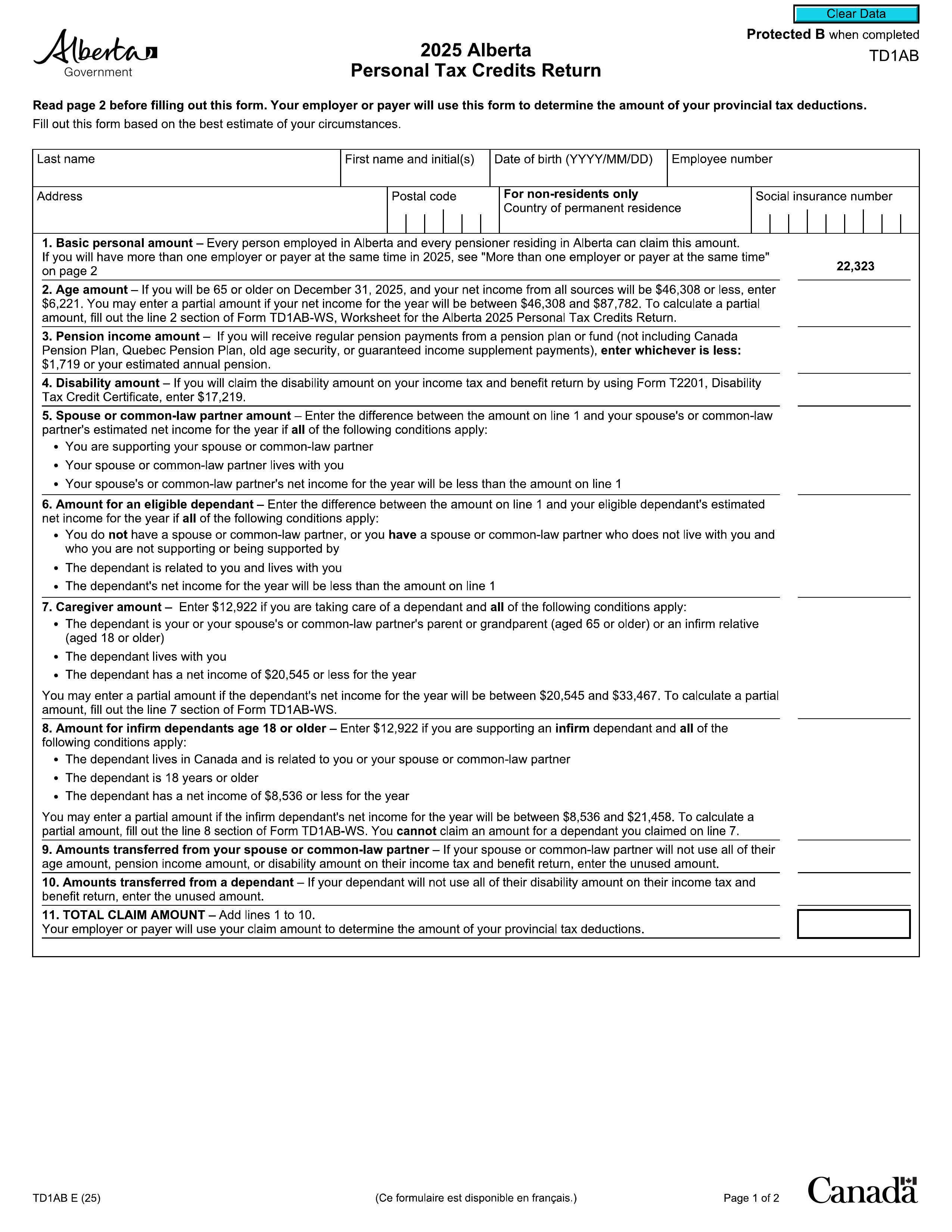

What is Form TD1ON?

Form TD1ON, the Ontario Personal Tax Credits Return, is essential for informing your employer about the appropriate amount of income tax to deduct from your salary. By listing the tax credits you anticipate claiming, this form helps lower the tax withheld from your paychecks. Completing it accurately ensures that you don’t face unexpected tax bills when filing your taxes and allows you to retain more of your earnings throughout the year. Understanding and filling out this form is crucial for effective tax management.

What is Form TD1ON used for?

Form TD1ON is essential for managing your Ontario personal tax credits. Here’s what it’s used for:

- New Employer or Payer: For employees starting with a new employer.

- Tax Credit Changes: To adjust personal tax credit amounts.

- Zone Deduction: To claim deductions for living in specific areas.

- Increased Tax Deduction: To raise the tax deducted from your paycheck.

- Additional Exemptions: To claim extra Ontario tax exemptions like education and disability amounts.

How to fill out Form TD1ON?

- 1

Fill in your personal information at the top of the form.

- 2

Enter the basic personal amount.

- 3

Claim any additional tax credits you qualify for.

- 4

Indicate if you have more than one employer, if applicable.

- 5

Review the document and sign it.

- 6

Date the form.

Who is required to fill out Form TD1ON?

Individuals working in Ontario or pensioners residing in Ontario are responsible for completing Form TD1ON. This is required when they have a new employer or payer, want to change claimed amounts, or wish to increase tax deductions at source.

Employers or payers use the completed TD1ON form to determine the correct provincial tax deductions from an employee's pay. They must keep this form for each employee to ensure compliance with CRA regulations.

When is Form TD1ON not required?

You don't need to complete Form TD1ON if your situation hasn't changed since your last submission. This applies if you’re not starting a new job, haven’t changed employers, or if your tax credit amounts remain the same. Only fill it out when your employment circumstances or tax credits change.

When is Form TD1ON due?

The deadline for Form TD1ON is not fixed, as it is not a deadline-based form. Employees in Ontario should complete it when starting a new job, changing previous claims, or wanting to adjust tax deductions at source. It’s important to submit this form to your employer whenever these situations arise.

How to get a blank Form TD1ON?

To get a blank Form TD1ON, simply visit our website. The Canada Revenue Agency issues this form, and we have it pre-loaded in our editor for you to fill out. Remember, our platform aids in filling and downloading but not filing forms.

Do you need to sign Form TD1ON?

You need to sign Form TD1ON after filling it out. This signature is necessary before submitting the form to your employer or payer. For the latest updates or any changes to requirements, it's a good idea to check official sources. With PDF Guru, you can easily fill out the form and download it for your records, but remember that we don’t support submission.

Where to file Form TD1ON?

To submit Form TD1ON, Ontario Personal Tax Credits Return, provide it directly to your employer. You can print and fill it out or fill it online if your employer offers that option.

Employers must securely store and manage the tax data of their employees. Make sure to submit your completed form promptly to ensure proper tax withholding.