What is Form DTF-17?

Form DTF-17, Claim for Credit for Tax Paid to Another State, is important for taxpayers who have paid income tax to another state. This form allows you to claim a credit on your New York State taxes, so you’re not taxed twice on the same income. By filling out DTF-17 accurately, you can reduce your tax bill, ensuring you keep more of your hard-earned money. Understanding and using this form can help you manage your tax obligations effectively.

What is Form DTF-17 used for?

Form DTF-17 helps taxpayers avoid double taxation on income earned in multiple states:

- to claim a credit for state taxes paid.

- to reduce the amount owed in your home state.

- to ensure compliance with state tax laws.

How to fill out Form DTF-17?

- 1

Gather all necessary information, including your personal details and tax paid to another state.

- 2

Locate the fields on Form DTF-17 that require your input.

- 3

Fill in your name, address, and the amount of tax paid.

- 4

Review all entries for accuracy.

- 5

Add your electronic signature.

- 6

Click Done to download your completed form.

- 7

Submit the form to the appropriate tax authority as instructed.

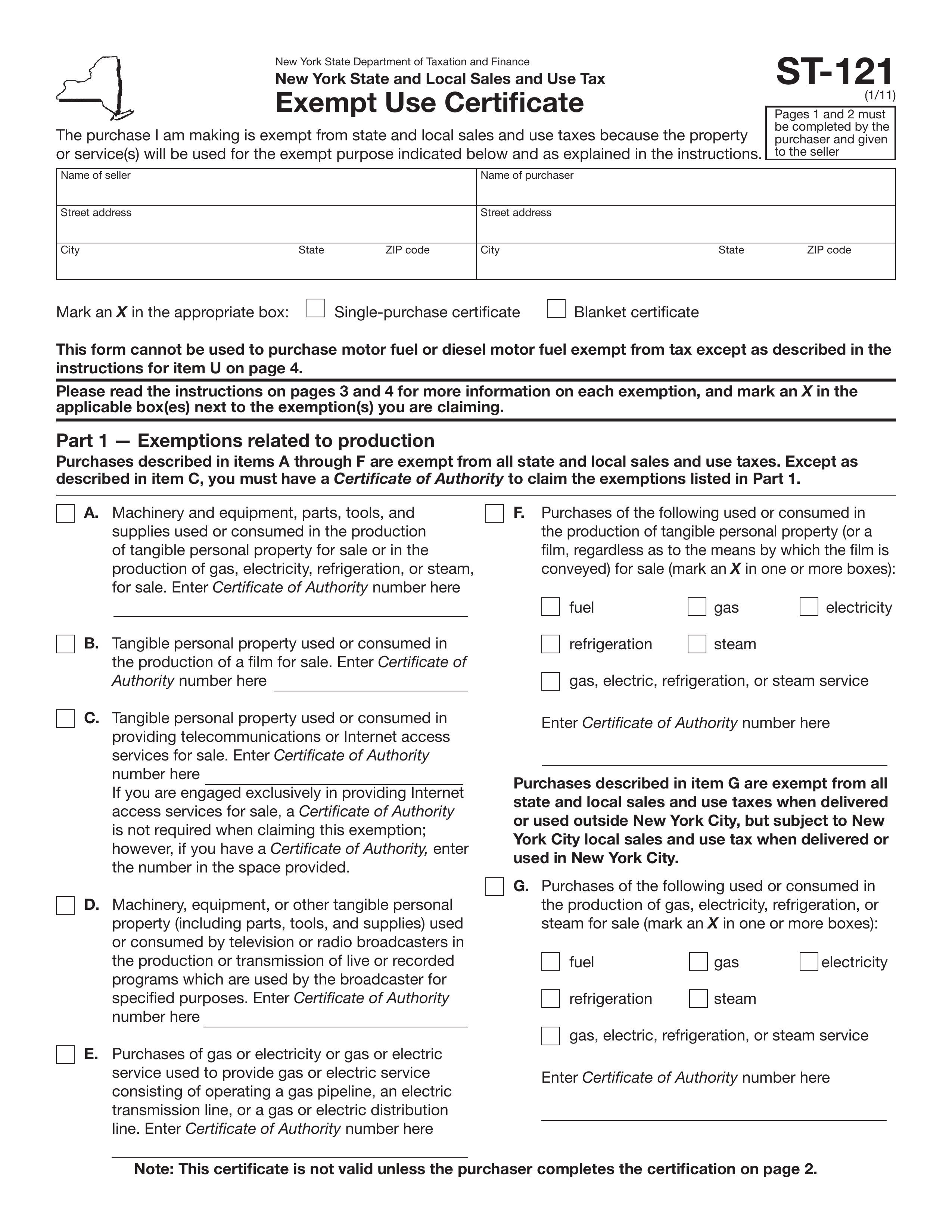

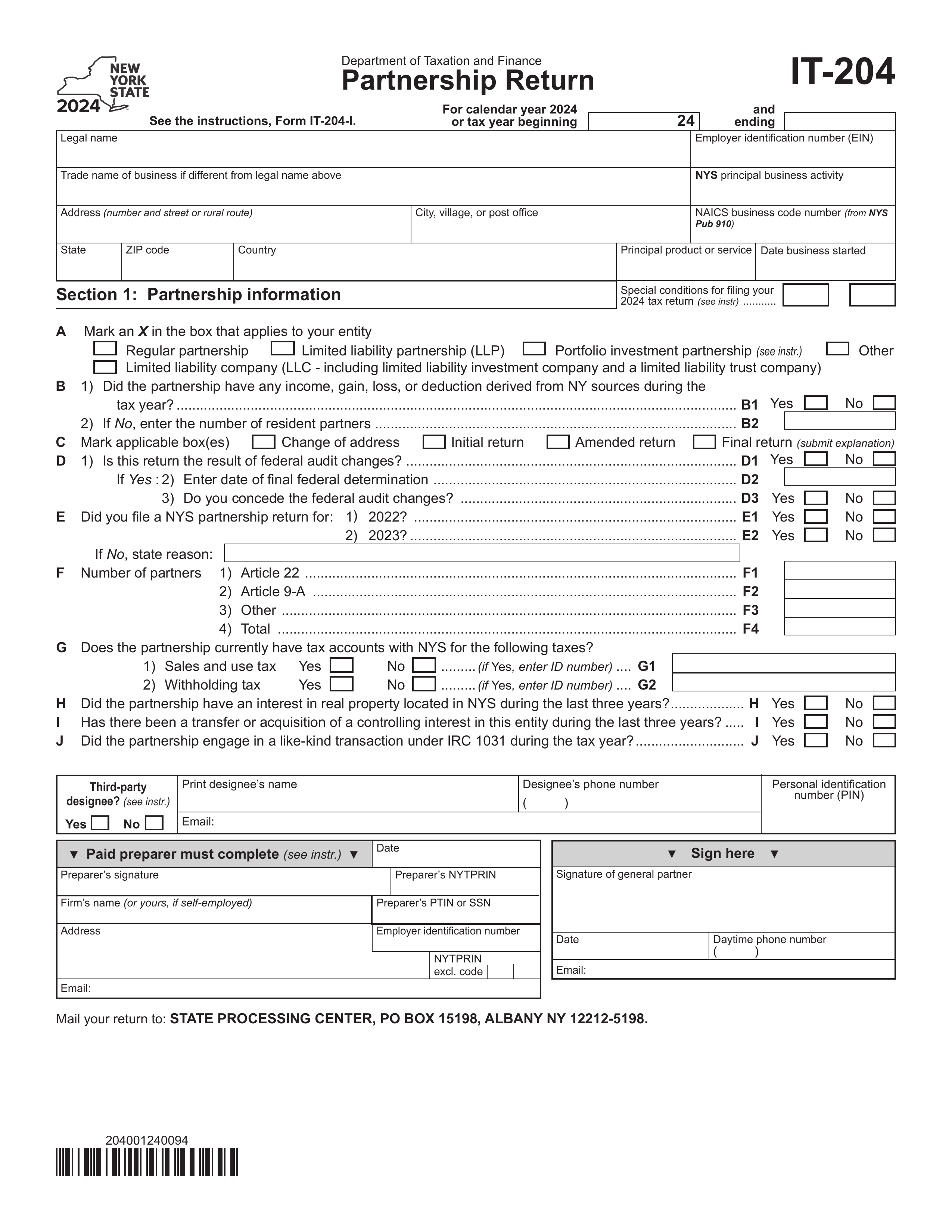

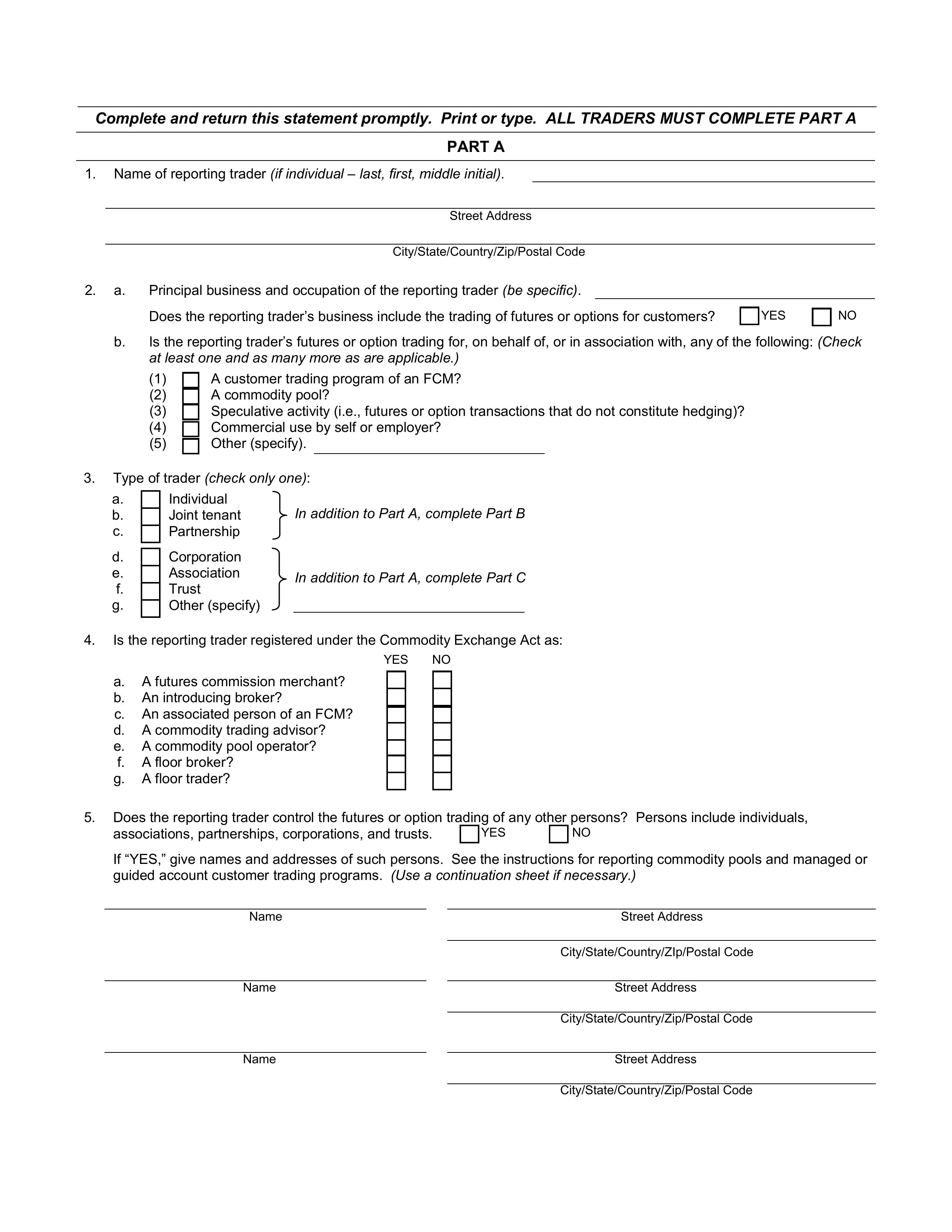

Who is required to fill out Form DTF-17?

Form DTF-17 must be completed by businesses selling goods or services in New York State. It’s for tax collection and exemption purposes.

Afterward, the form is used by businesses to claim tax credits for taxes paid to other states.

When is Form DTF-17 not required?

Form DTF-17 is not necessary if your business is already registered for sales tax in New York State.

Additionally, if you do not intend to make taxable sales or offer taxable services within New York State, you can skip this form. Businesses with activities that are exempt from sales tax also do not need to file this form.

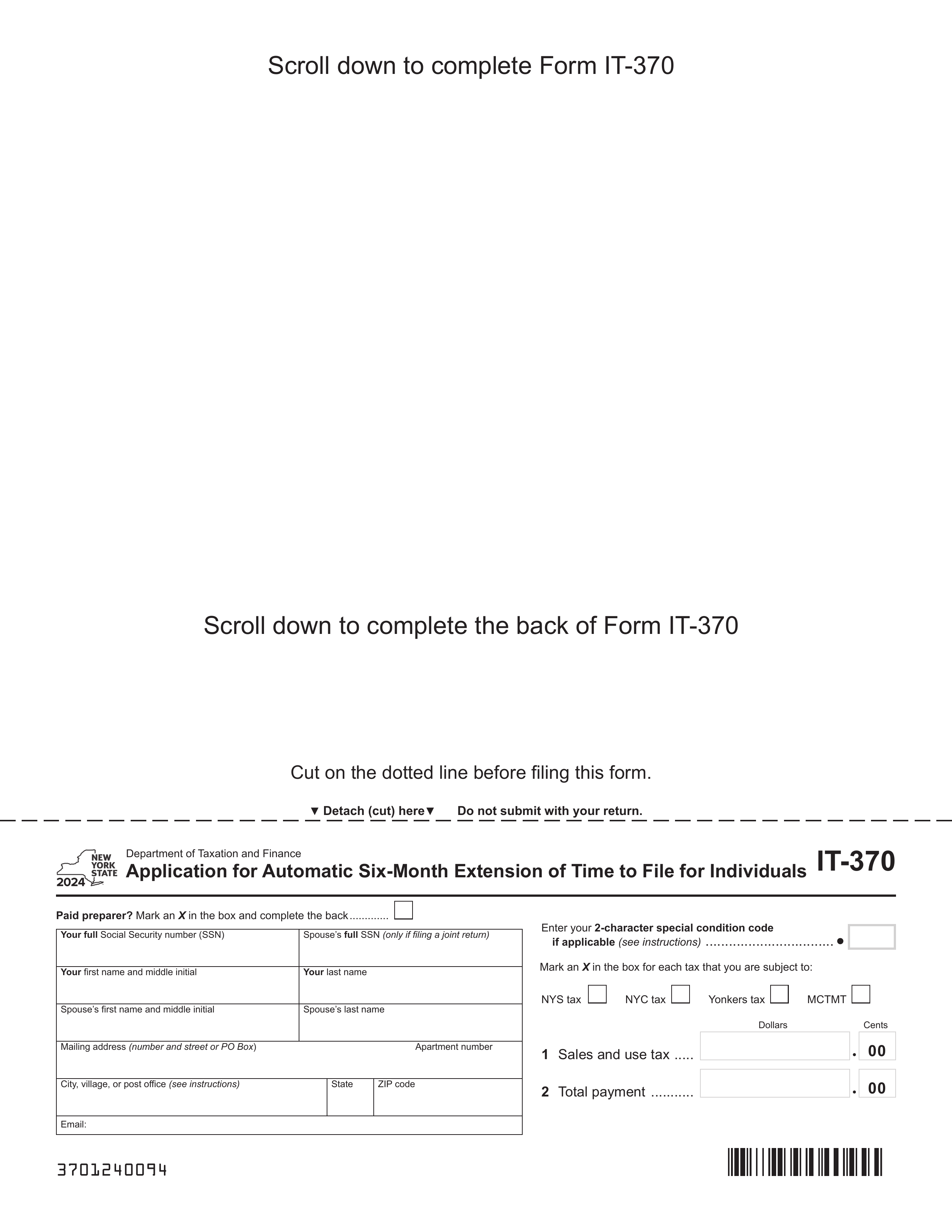

When is Form DTF-17 due?

The deadline for Form DTF-17 is at least 20 days before you start making taxable sales or providing taxable services in New York State. It is also due at least 20 days before you begin issuing or accepting New York State exemption documents.

Additionally, you must submit Form DTF-17 no more than 90 days before you start doing business in New York State or acquire business assets. Make sure to keep these timelines in mind to avoid any issues with your tax credits.

How to get a blank Form DTF-17?

You can access a blank version of this form pre-loaded in our editor on our platform, ready for you to fill out and download.

Form DTF-17 is issued by the New York State Department of Taxation and Finance.

How to sign Form DTF-17 online?

To sign Form DTF-17, start by accessing PDF Guru. Click on "Fill Form" to load the blank version of DTF-17 in the PDF editor. Fill in all required fields, then create a simple electronic signature using the tools provided.

After completing the form, click "Done" to download your filled version. Remember to check official sources for any specific signature requirements to ensure compliance.

Where to file Form DTF-17?

Form DTF-17 must be submitted to the New York State Tax Department.

Submission methods: mail or online.