What is Form 1042?

Form 1042, known as the Annual Withholding Tax Return for U.S. Source Income of Foreign Persons, is a tax form used by the IRS. It is essential for reporting taxes withheld on specific income paid to foreign individuals or entities. Withholding agents, which include partnerships, corporations, and individuals, must file this form to disclose the taxes they've withheld. This process ensures that foreign entities contribute their fair share of U.S. taxes on income earned within the United States, allowing the IRS to effectively track and collect these taxes.

What is Form 1042 used for?

Form 1042 is essential for handling taxes on payments to foreign persons. Here’s what it’s used for:

- Reporting Tax Withheld: Reports taxes withheld on U.S. income paid to foreign entities.

- Compliance with IRS: Ensures adherence to IRS rules on withholding.

- Tracking Payments: Documents payments like scholarships, grants, and royalties.

- Submission to IRS: Sends reported information to the IRS for record-keeping.

How to fill out Form 1042?

- 1

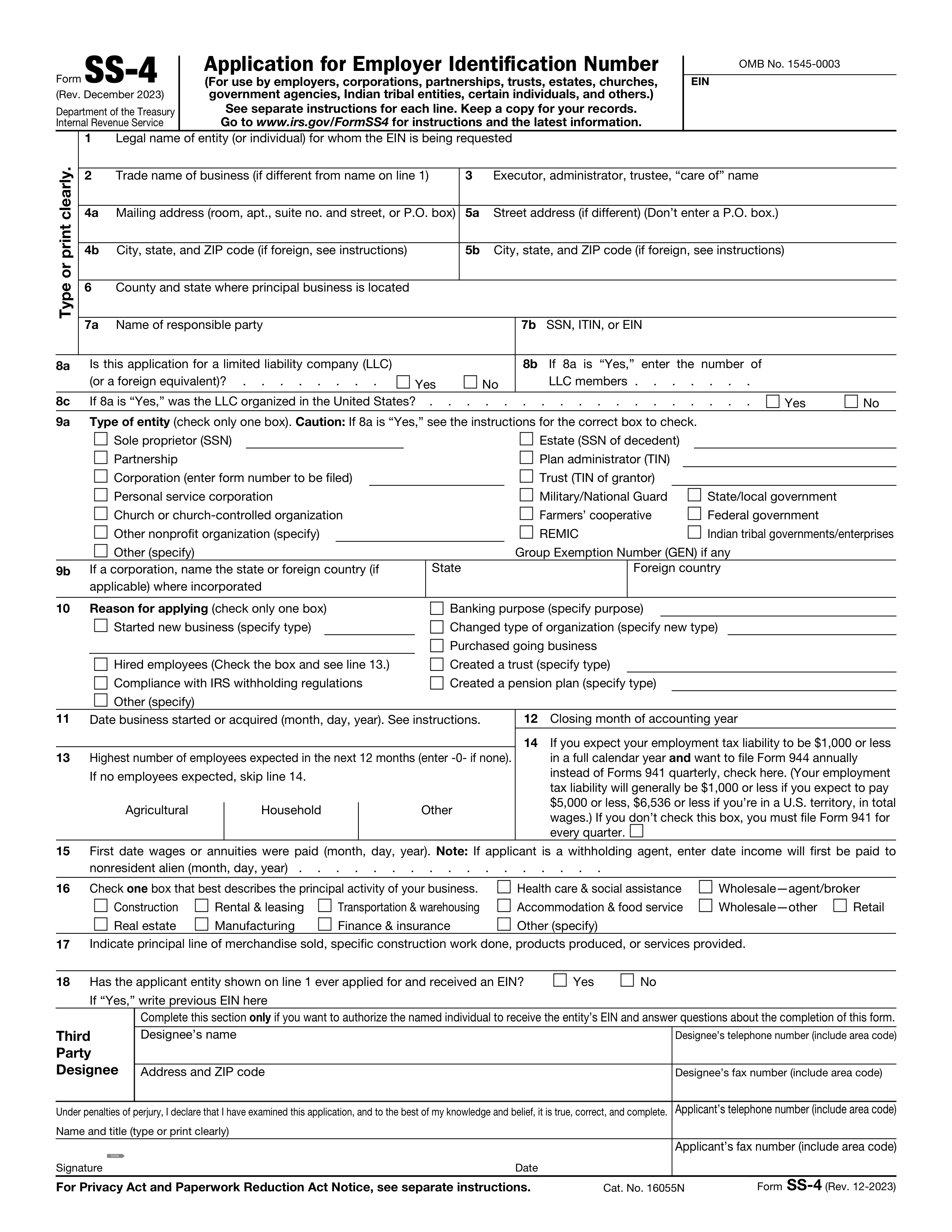

Obtain your Employer Identification Number (EIN) for filing.

- 2

Report your federal tax liability for payments made during the quarter-monthly period.

- 3

Designate your tax liability as either chapter 3 or chapter 4.

- 4

Provide the appropriate withholding agent status codes for chapter 3 and chapter 4.

- 5

File Form 1042-S if it is required, even when filing Form 1042 electronically.

Who is required to fill out Form 1042?

Domestic or foreign withholding agents, including partnerships, corporations, individuals, associations, and custodians/brokers, must complete Form 1042. This form is necessary for reporting amounts subject to withholding on payments made to foreign persons.

When is Form 1042 not required?

Form 1042 is not required for foreign persons acting as withholding agents. These individuals are exempt from the electronic filing requirement for Forms 1042 during calendar years 2024 and 2025. If you fall into this category, you do not need to file this form. Always check current regulations to ensure compliance.

When is Form 1042 due?

The deadline for Form 1042 is March 15th of the following year. If March 15th falls on a weekend or legal holiday, the due date shifts to the next business day. If you need more time, a six-month extension is available, but be aware that late filing may incur penalties based on how long the form is overdue.

How to get a blank Form 1042?

To get a blank Form 1042, simply visit our website where the Internal Revenue Service provides it. Our platform has this form pre-loaded in our editor, ready for you to fill out. Remember, PDF Guru assists with filling and downloading but not filing forms.

How to sign Form 1042?

To sign Form 1042, you should use a handwritten signature, as this is the standard requirement by the IRS. Although PDF Guru allows you to fill out and download the form, it does not support submission. For forms that permit electronic signatures, such as Form 2848, be sure to check the latest updates from the IRS. Once you've completed the form with PDF Guru, you can download it and handle any submission steps elsewhere.

Where to file Form 1042?

You can submit Form 1042 either by mail or electronically. If mailing, send it to the IRS by March 17, 2025.

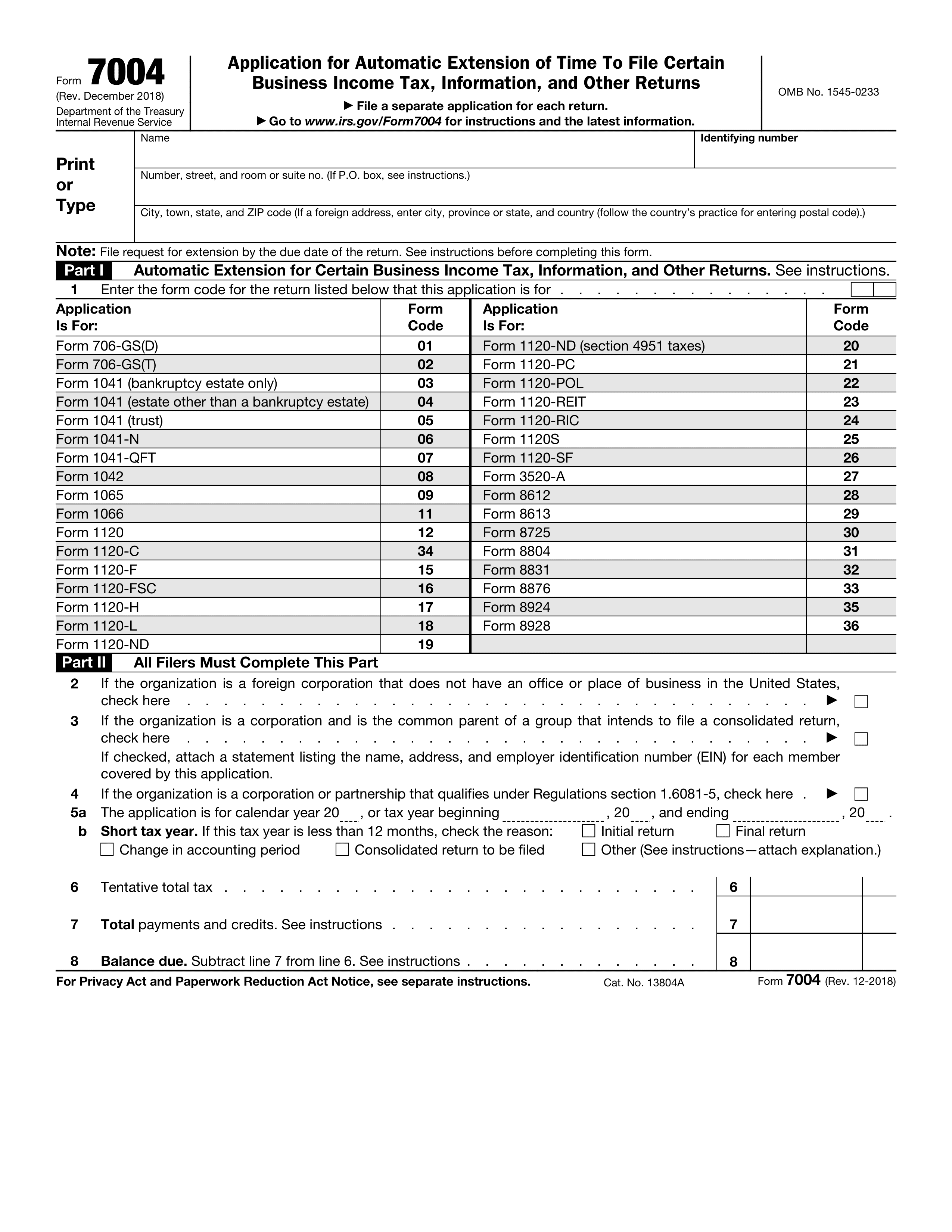

Certain withholding agents must file electronically, but foreign persons are not required to do so for tax year 2024. For an extension, submit Form 7004.