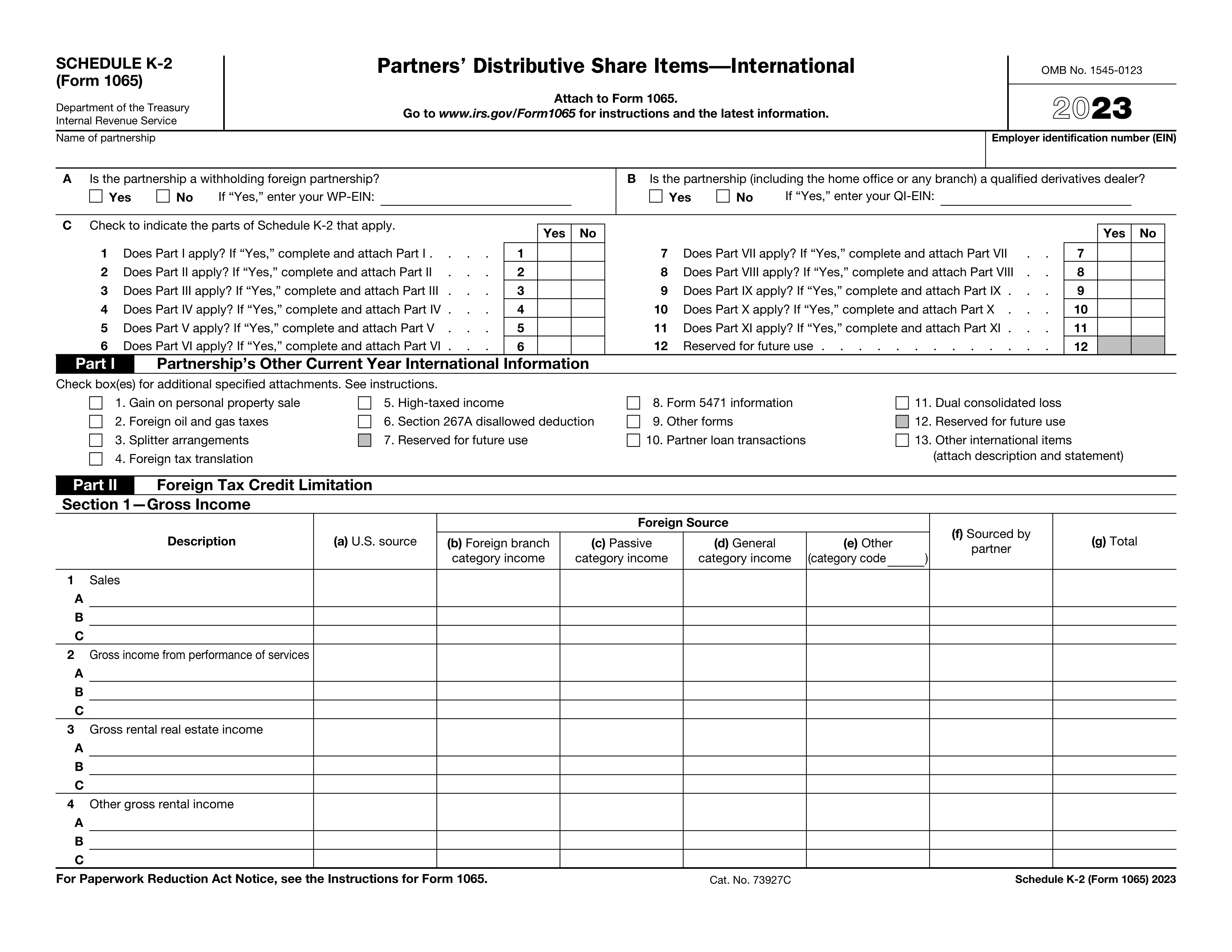

What is Form 1065 Schedule K-3?

Schedule K-3 (Form 1065) is an important tax form used by partnerships to report each partner's share of income, deductions, credits, and other tax items from international activities. It helps partners understand their tax obligations related to foreign income and ensures compliance with U.S. tax laws. By providing detailed information, this form allows partners to accurately prepare their own tax returns, making it essential for anyone involved in a partnership with international activities.

What is Form 1065 Schedule K-3 used for?

Schedule K-3 Form 1065 provides information for partners in partnerships with international activities. It is used to:

- to report foreign income and deductions.

- to share credits related to foreign taxes.

- to disclose other international tax items.

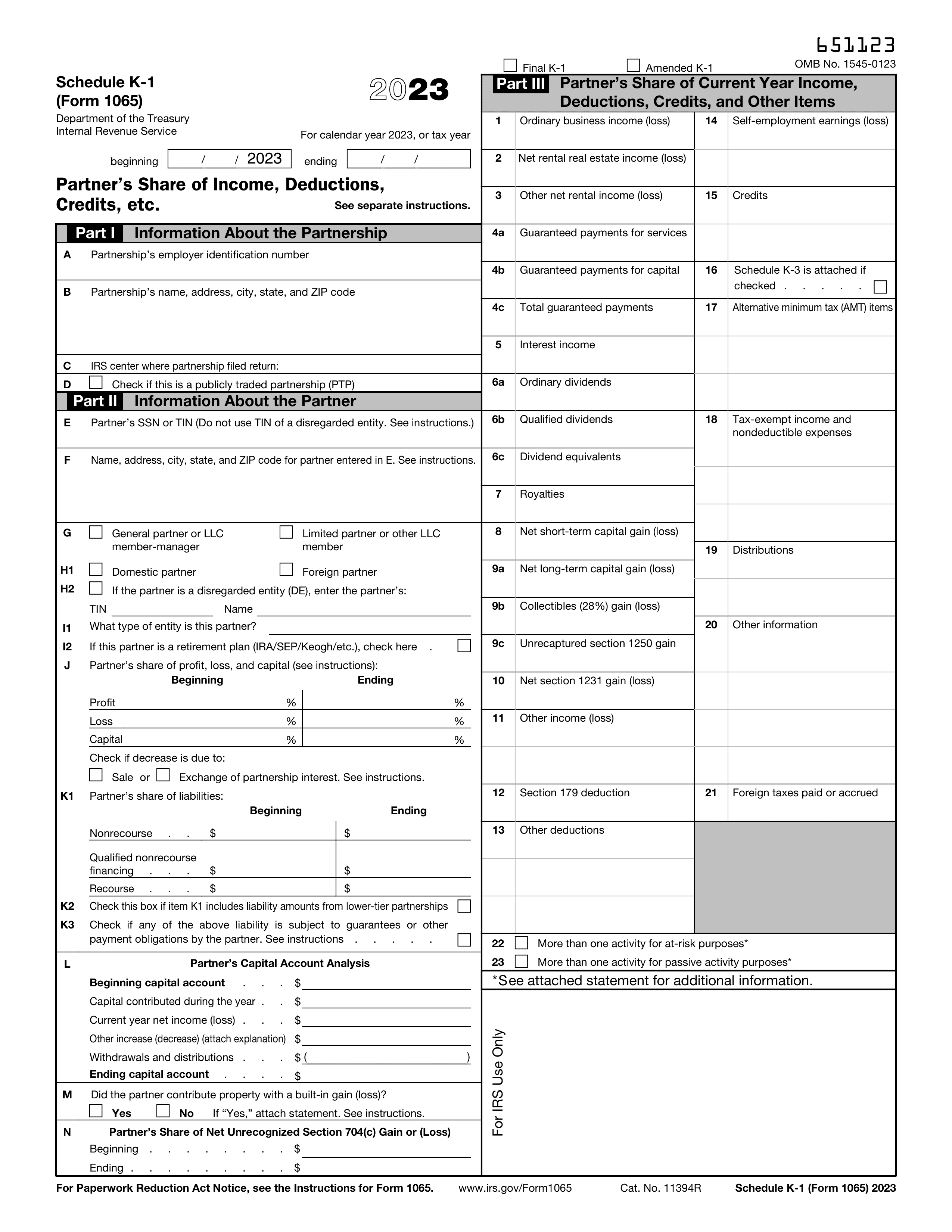

How to fill out Form 1065 Schedule K-3?

- 1

Review the instructions for Schedule K-3 on the IRS website to understand requirements.

- 2

Enter your partnership’s name, address, and EIN accurately in the designated fields.

- 3

Fill in the partner's information, including share percentage and income details.

- 4

Complete sections on deductions and credits, ensuring all amounts are correct.

- 5

Double-check all entries for accuracy against your records.

- 6

Save your completed form for future reference.

Who is required to fill out Form 1065 Schedule K-3?

Partnerships with foreign partners are responsible for completing Schedule K-3 Form 1065 for international tax purposes. This form helps report the partner’s share of income, deductions, and credits.

After completion, partners use the form to accurately report their share of income on their individual tax returns.

When is Form 1065 Schedule K-3 not required?

If a partnership does not have any foreign partners or foreign activities, it typically does not need to file Schedule K-3. Additionally, if the partnership is not engaged in international business or does not have any income, deductions, or credits related to foreign sources, they can skip this form. Always check the IRS guidelines for your specific situation to ensure compliance.

When is Form 1065 Schedule K-3 due?

The deadline for Schedule K-3 Form 1065 is March 15 if you file your partnership return on time. If you file for an extension, you have until September 15 to submit the form.

It's important to keep track of these deadlines to avoid penalties. Make sure to gather all necessary information about your partnership income and deductions well before these dates.

How to get a blank Form 1065 Schedule K-3?

To get a blank Schedule K-3 Form 1065, simply visit our website. The form is pre-loaded in our editor, ready for you to fill. After completing the necessary fields, you can download your filled form for your records.

Do you need to sign Form 1065 Schedule K-3?

The Schedule K-3 Form 1065 does not require a signature according to available IRS guidelines. However, it's always wise to confirm with the IRS for the latest updates.

Tax regulations can change, and verifying information helps minimize any risk of misinformation. Always check IRS resources to ensure compliance with current rules.

Where to file Form 1065 Schedule K-3?

Filing Schedule K-3 can be done electronically through tax software that supports Form 1065. Check with the software for details.

Alternatively, you can mail the completed Schedule K-3 to the IRS. Ensure you send it to the correct address based on your location.