What is a 1099-MISC Form?

Form 1099-MISC is an IRS document used to report certain types of payments made in the course of a business that are not regular wages. It’s commonly used to report payments such as rent, prizes, awards, and other types of miscellaneous income.

If you’re a business owner or self-employed, you may need to file this form for any individual or entity you paid $600 or more during the tax year for these reportable categories. Filing Form 1099-MISC helps ensure compliance with tax laws and allows the IRS to track income that may not be subject to standard tax withholding.

The form collects miscellaneous information about payments that don’t fall under regular wages or non-employee compensation.

What is 1099-MISC used for?

IRS Form 1099-MISC is essential for reporting various types of income. Here's what it's commonly used for:

- To report certain miscellaneous payments made in the course of a trade or business.

- To list rent or prizes and awards that are not for services performed.

- To indicate other income payments, medical and health care payments, crop insurance proceeds, or cash payments made under a notional principal contract to an individual, partnership, or estate.

- To report direct sales of at least $5,000 of consumer products to a buyer for resale anywhere other than a permanent retail establishment.

How to fill out a 1099-MISC

- 1

Identify the payer and recipient. Enter the payer’s and the recipient’s business name (if applicable), addresses, and Taxpayer Identification Numbers (TINs) in the designated boxes.

- 2

Fill in the amounts. Report the total amount paid to the recipient in the correct box, depending on the type of payment (rents, royalties, etc.).

- 3

Include federal income tax withheld. If applicable, enter any federal income tax withheld from payments to the recipient.

- 4

State information. If required, fill in the state tax withheld and the state/payer’s state number as required by your state tax department.

- 5

Review for accuracy. Double-check all entered information for accuracy to ensure compliance with IRS requirements.

- 6

Submit to the IRS. Mail or electronically submit the completed form to the IRS by the deadline, and provide a copy to the recipient.

Who is required to fill out Form 1099-MISC?

Businesses or individuals use Form 1099-MISC if they paid at least $10 in royalties or at least $600 in certain miscellaneous payments in the course of a trade or business.

When is a 1099-MISC not required?

Not everyone needs to complete a fillable 1099 Form. For instance, employees who receive a salary or hourly wage do not need this form because their income is reported on a W-2 Form. You also do not use Form 1099-MISC to report dividends or tax-exempt interest, which are reported on other IRS forms. Individuals or businesses purchasing merchandise for resale also do not require a 1099-MISC.

When is a 1099-MISC due?

For tax year 2025, the due date for furnishing Form 1099-MISC to recipients is January 31, 2026, for most payments, with a later recipient deadline only when amounts are reported solely in certain boxes such as box 8 or box 10 under IRS instructions. Copy A must be filed with the IRS by February 28, 2026, if filing on paper, or by March 31, 2026, if e-filing a digital 1099 Form. Non-employee compensation is reported on Form 1099-NEC instead, and that form is due to both the IRS and recipients by January 31.

How to get a blank Form 1099-MISC

To get a blank 1099 Form issued by the IRS, you can visit our platform PDF Guru, where the template is pre-loaded in our editor and ready to fill out. A fillable 1099-MISC Form allows payers to complete required fields consistently across all copies of the form. If you need a printable 1099 Form, you can complete the template and download it to file or share copies with recipients. Our website helps you fill out and download the form, although it doesn’t assist with filing it.

Do you need to sign a 1099-MISC?

There is no signature line on the MISC 1099 fillable Form, and the IRS does not instruct filers to sign it when submitting it to the IRS or furnishing it to recipients.

But always confirm with the latest guidelines. It's a good idea to verify with official sources.

Where to file Form 1099-MISC?

If you are required to file 10 or more information returns in total for the year (aggregating most information return types), you must file electronically, typically via an IRS-approved e-file provider or the IRS Information Returns Intake System (IRIS). If you are filing fewer than 10 information returns in total, you may file on paper or electronically. If filing by mail, send Copy A of each 1099-MISC with Form 1096 to the IRS — mail paper forms to the address specified in the IRS instructions.

What other tax forms are related to 1099-MISC?

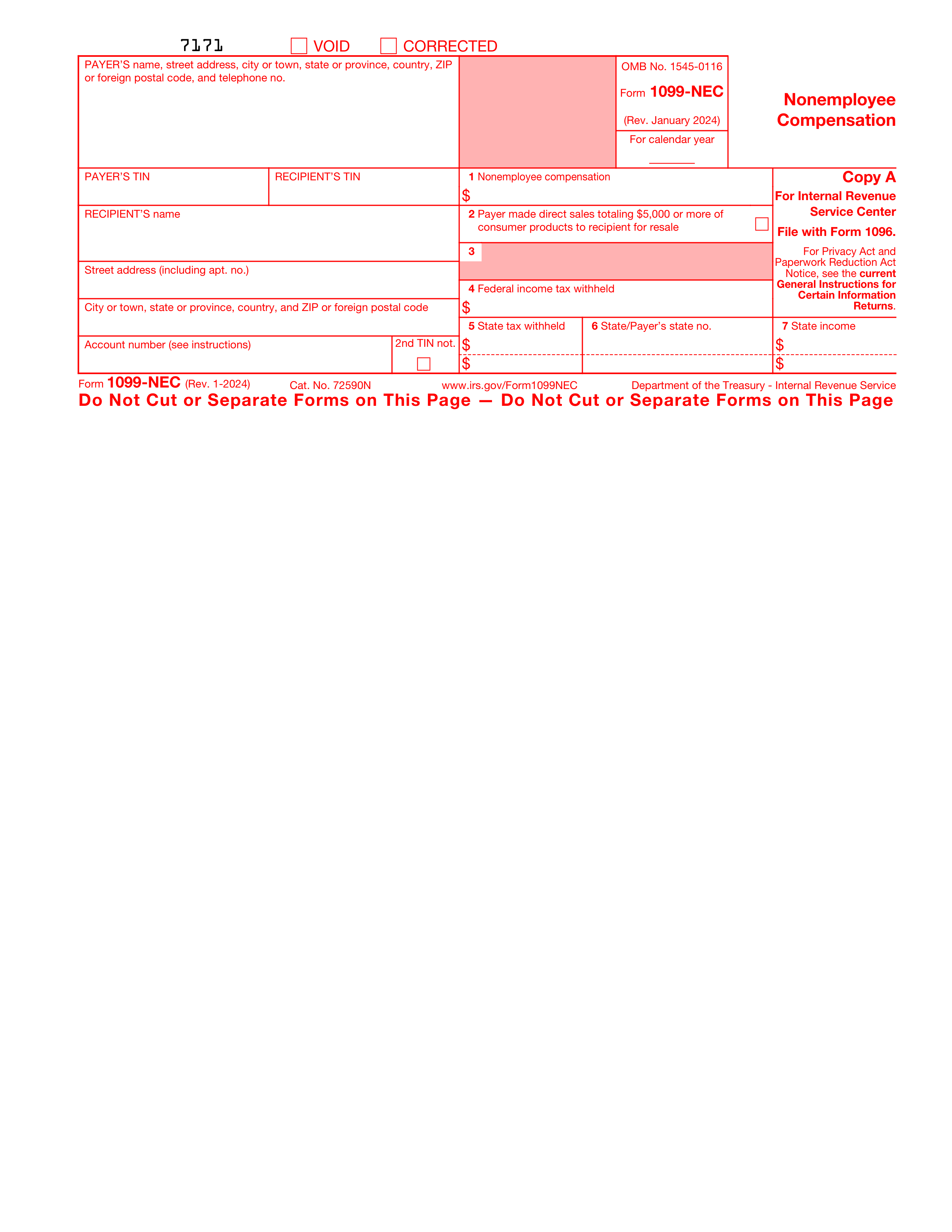

Form 1099-NEC

Report non-employee compensation of $600 or more (2025–2026) using the basic taxpayer details you collected on Form W-9.

Who uses it: Businesses that pay freelancers, independent contractors, and other non-employees.

Form W-9

Collect a payee’s legal name, address, and Taxpayer Identification Number (TIN) before you issue a 1099-MISC or 1099-NEC.

Who uses it: Businesses and individuals who need accurate information to report payments to the IRS.

Form 1096

Summarize and transmit paper copies of certain information returns, including Forms 1099-MISC and 1099-NEC, to the IRS.

Who uses it: Businesses that file 1099 forms by mail instead of electronically.