What is Form 6781?

Form 6781, Gains and Losses From Section 1256 Contracts and Straddles, is essential for investors to report profits and losses from particular financial contracts, including regulated futures, foreign currencies, and some options. This form aids in tracking the year-end value of these investments, treating them as if sold. It designates 60% of any gains or losses as long-term and 40% as short-term, ensuring accurate tax calculations and compliance with IRS regulations. Understanding this form is crucial for effective tax reporting.

What is Form 6781 used for?

Form 6781 is important for specific financial reporting:

- Reporting Gains and Losses: It reports gains and losses from Section 1256 contracts like futures and options.

- Mark-to-Market Rules: It helps comply with mark-to-market rules for financial transactions.

- Straddle Reporting: It reports gains and losses from straddles, which offset risks from each other.

- Tax Compliance: It ensures accurate tax reporting for investors in these instruments.

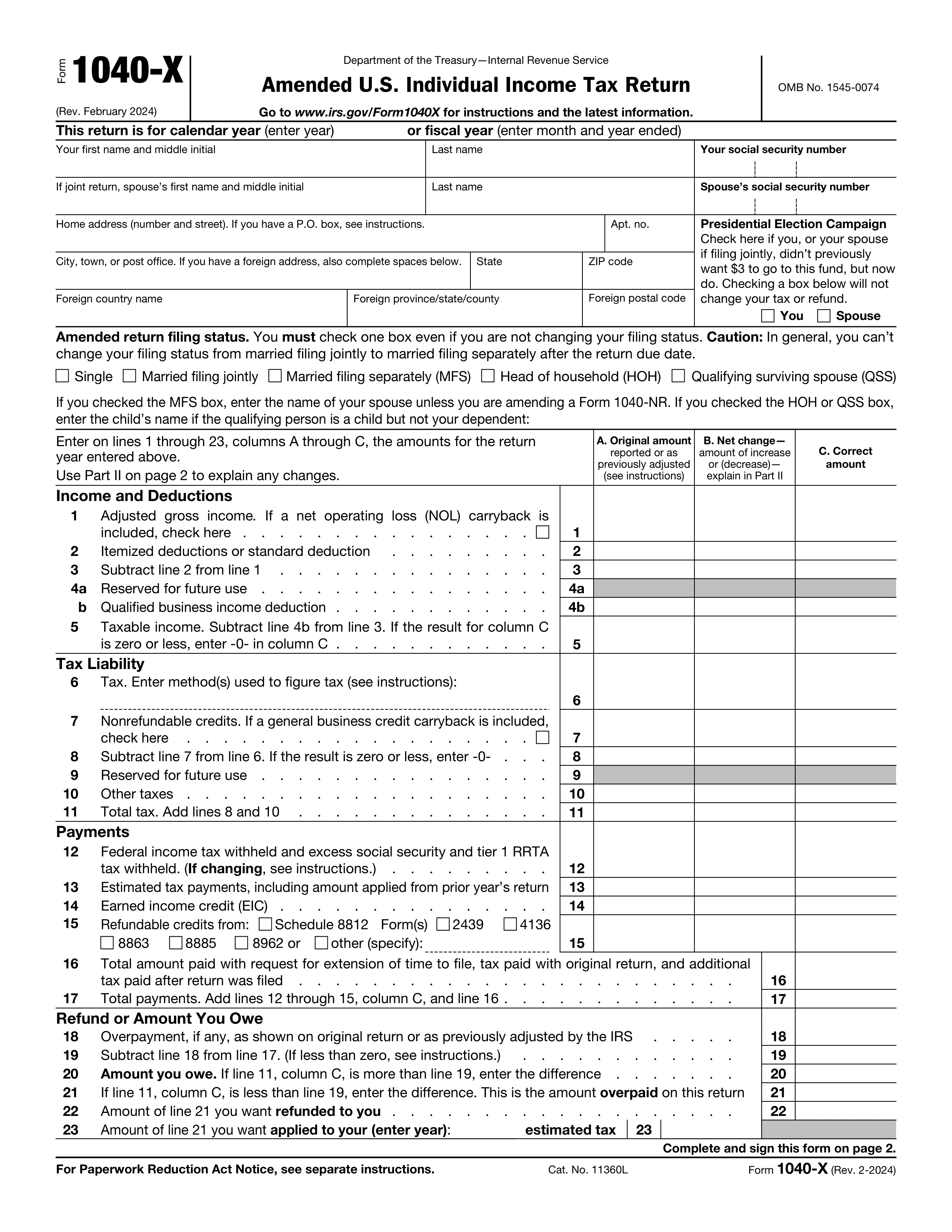

How to fill out Form 6781?

- 1

Enter your name and identifying number at the top of the form.

- 2

Check the applicable election boxes (A, B, C, or D).

- 3

Complete Part I: Section 1256 Contracts Marked to Market (lines 1-9).

- 4

Fill out Part II: Gains and Losses From Straddles (lines 10-13).

- 5

If needed, complete Part III: Unrecognized Gains From Positions Held on Last Day of Tax Year (line 14).

- 6

Attach a separate statement for straddle components if required.

Who is required to fill out Form 6781?

Individuals and businesses trading Section 1256 contracts, including regulated futures, foreign currency, and nonequity options, must complete Form 6781.

Investors and traders holding these contracts use Form 6781 to report their gains and losses for tax compliance, ensuring accurate representation of their financial activities.

When is Form 6781 not required?

Form 6781 isn’t required for individuals without Section 1256 contracts or who don’t participate in straddle transactions. If you have no gains or losses from these investments, you don’t need to file it. Additionally, positions involved in hedging transactions or straddles set up before October 22, 2004, also do not require this form.

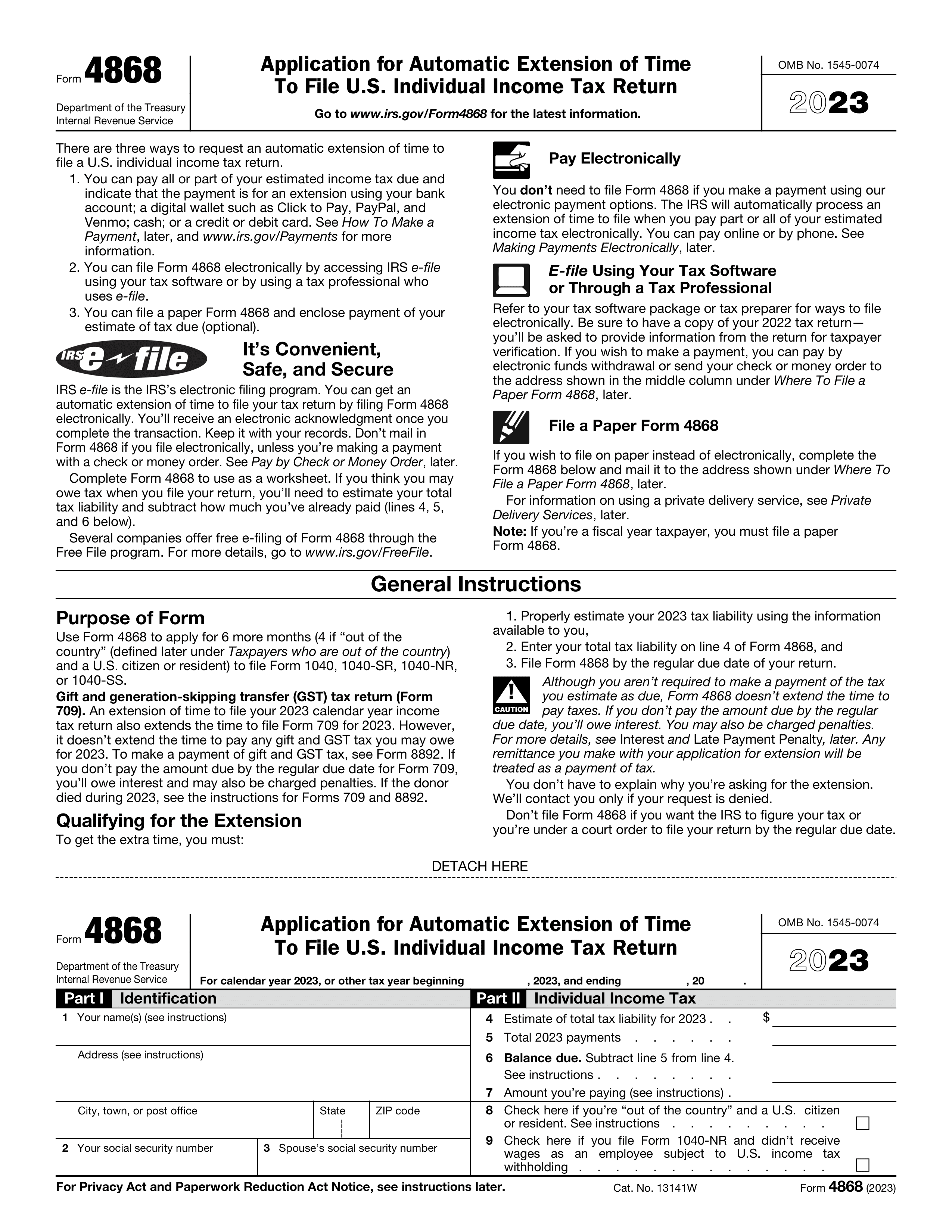

When is Form 6781 due?

The deadline for Form 6781 is typically April 15th each year. This form must be filed by the tax filing deadline to report gains and losses from Section 1256 contracts and straddles. Ensure you complete it annually to accurately account for any actual or potential gains and losses incurred throughout the year.

How to get a blank Form 6781?

To get a blank Form 6781, simply visit our website. The Internal Revenue Service issues this form, and we have a blank version pre-loaded in our editor, ready for you to fill out. Remember, our platform helps you fill and download forms, but not file them.

How to sign Form 6781 online?

To sign Form 6781, you can create a simple electronic signature using a typed name in the signature block, a scanned image of your handwritten signature, or a signature input from an electronic pad. The IRS accepts these methods, but it's a good idea to check for the latest updates. Use PDF Guru to fill out and download the form, then handle any submission steps outside of our platform.

Where to file Form 6781?

Form 6781 must be attached to your tax return. Make sure to include it when submitting your paperwork.

To file, mail your completed form to the address specified for your state or international location on the IRS website.