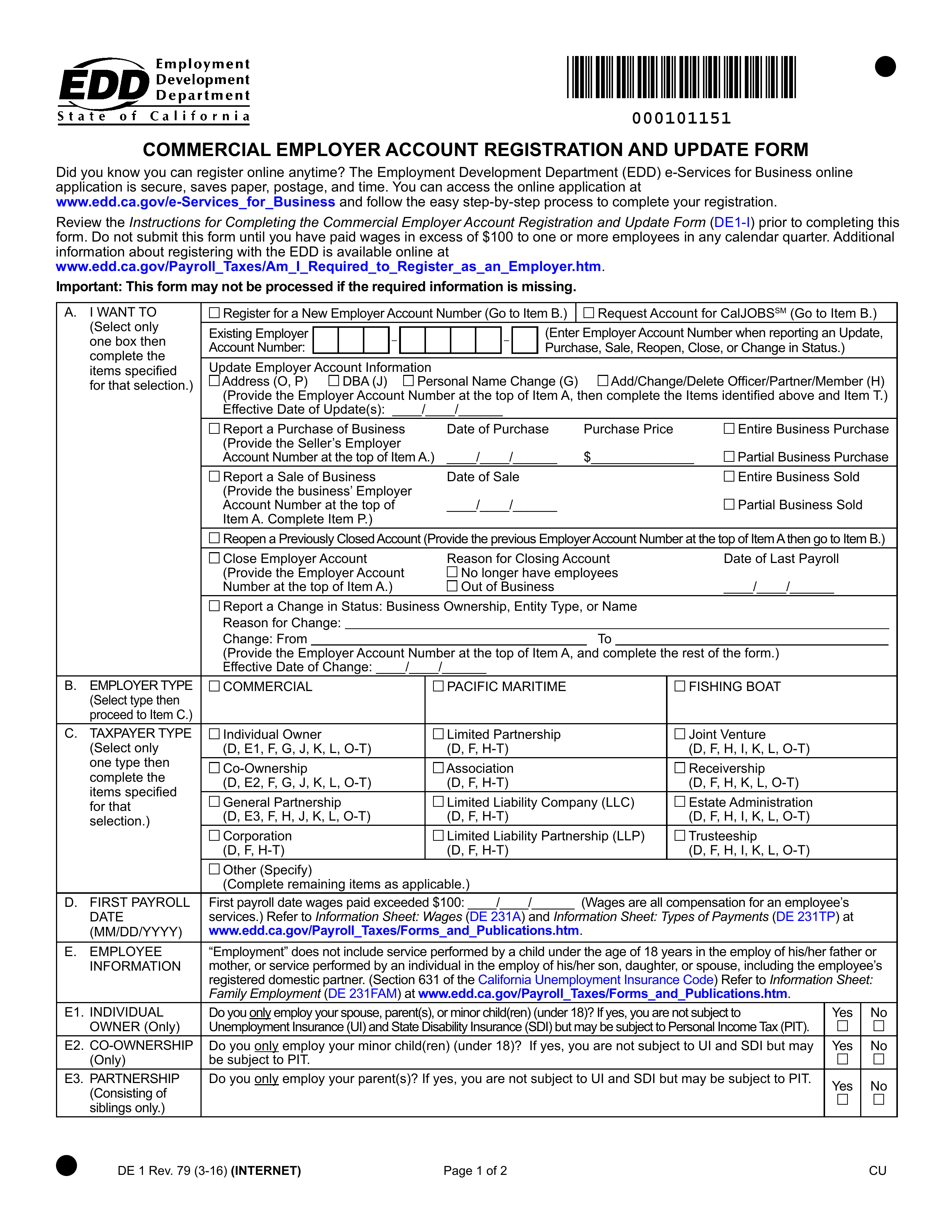

What is Form DE 4?

The DE 4, or Employee's Withholding Allowance Certificate, is a vital form for California employees. It informs employers about the appropriate amount of state income tax to withhold from their paychecks. By considering factors like marital status and the number of dependents, this form helps tailor the withholding to better match each employee's unique financial situation. Without submitting a DE 4, employers would default to withholding the maximum tax amount, which may not reflect the employee's actual tax liability. Properly completing this form can lead to more accurate tax withholdings.

What is Form DE 4 used for?

Form DE 4 is important for managing state income tax withholding. Here’s what it’s used for:

- Determine State Income Tax Withholding: Calculates the correct amount to withhold from your paycheck.

- Claim Allowances: Indicates the number of allowances you claim, affecting the withholding amount.

- Update Personal Information: Reflects changes in your situation, like marital status or dependents, for accurate withholding.

- Comply with Employer Responsibilities: Ensures your employer withholds the right amount based on your completed form.

How to fill out Form DE 4?

- 1

Enter your name, social security number, address, and city in the personal information section.

- 2

Choose your filing status: Single, Married (with two or more incomes), or Head of Household.

- 3

Determine the number of regular withholding allowances using Worksheet A.

- 4

If applicable, complete Worksheet B for estimated deductions and Worksheet C for additional withholding amounts.

- 5

Ensure your employer receives the completed form and updates it as necessary.

Who is required to fill out Form DE 4?

California employees are responsible for completing Form DE 4 to claim withholding allowances for state tax.

Once filled out, employers use this form to determine the correct amount of state income tax to withhold from the employee's wages, ensuring compliance with EDD guidelines.

When is Form DE 4 not required?

You do not need to complete Form DE 4 if you are not employed in California or if you are exempt from state income tax withholding. You're exempt if you owed no state income tax last year and do not expect to owe any this year. Additionally, if you submitted a valid federal W-4 form before 2020, you don’t have to submit a new DE 4 unless you change your withholding allowances.

When is Form DE 4 due?

The deadline for Form DE 4 is when an employee starts their job. It’s important for employers to have new hires complete this form to calculate state income tax withholding correctly. Employees should also update their DE 4 whenever there are changes in their personal or financial situations, like after getting married or having a child.

How to get a blank Form DE 4?

To obtain a blank Form DE 4, Employee's Withholding Allowance Certificate, simply visit our website. This form is issued by the California Employment Development Department (EDD), and we have a pre-loaded version ready for you to fill out. Remember, our platform helps with filling and downloading but does not support filing forms.

Do you need to sign Form DE 4?

You do need to sign Form DE 4, Employee's Withholding Allowance Certificate. You can either sign electronically or physically. This form is used by California employees to specify the number of withholding allowances they claim for state tax purposes and is usually completed without a signature. However, it's wise to check for any updates or changes to this requirement. Once you've filled out the form using PDF Guru, you can download it for your records, but remember, submissions are not supported on our platform.

Where to file Form DE 4?

Form DE 4 must be submited to the employer, who processes it internally for payroll purposes.

If you choose to file online, expect changes to reflect in payroll within 24 hours. For mail submissions, refer to the EDD website for the correct address.