What is Form 53-1?

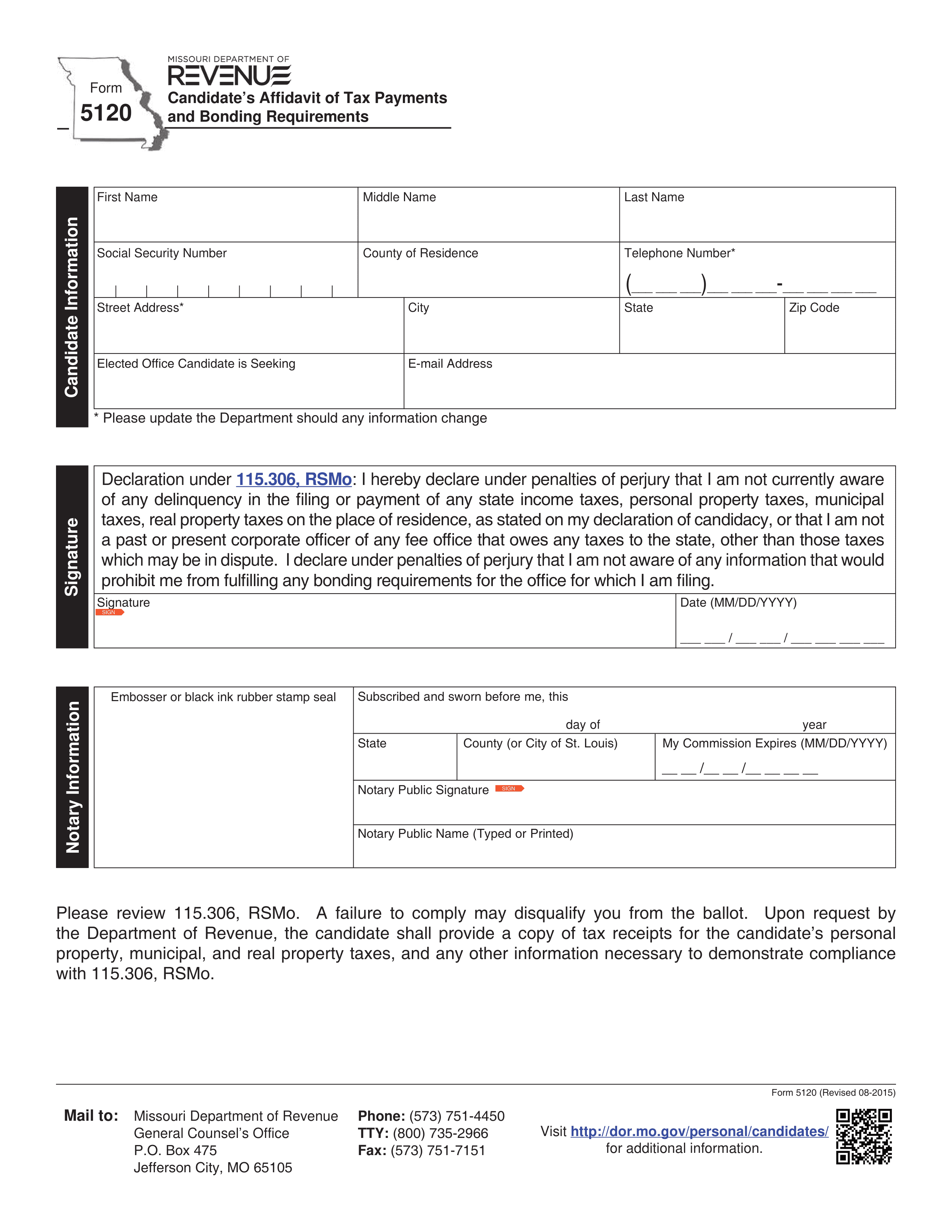

Form 53-1 from the Missouri Department of Revenue is essential for businesses that collect sales tax. This form acts as a comprehensive sales tax return, allowing businesses to report the sales tax they’ve collected during a specific period. It also helps in making adjustments for any overpayments or errors from previous filings. Completing this form accurately is crucial for compliance with state tax laws and avoiding potential penalties.

What is Form 53-1 used for?

Form Missouri Department of Revenue Form 53-1 is used to report sales tax collected. Here’s what it’s for:

- to report sales tax collected.

- to remit sales tax to the state.

- to report adjustments, including overpayments.

How to fill out Form Missouri Department of Revenue Form 53-1?

- 1

Open the form in the PDF editor.

- 2

Fill in your personal information, including name and address.

- 3

Provide the required financial details as prompted on the form.

- 4

Review all entries for accuracy.

- 5

Create an electronic signature if needed.

- 6

Download the completed form to your device.

- 7

Submit the form by mailing it to the address specified on the form.

Who is required to fill out Form 53-1?

Businesses and organizations in Missouri are responsible for completing Form 53-1 to report sales tax. This is essential for compliance with state tax regulations.

After completion, the Missouri Department of Revenue uses the form for processing sales tax returns and maintaining accurate records.

When is Form 53-1 not required?

If you are not a Missouri business collecting sales tax, you do not need to file Form 53-1. This form is specifically for businesses that have sales tax collection obligations.

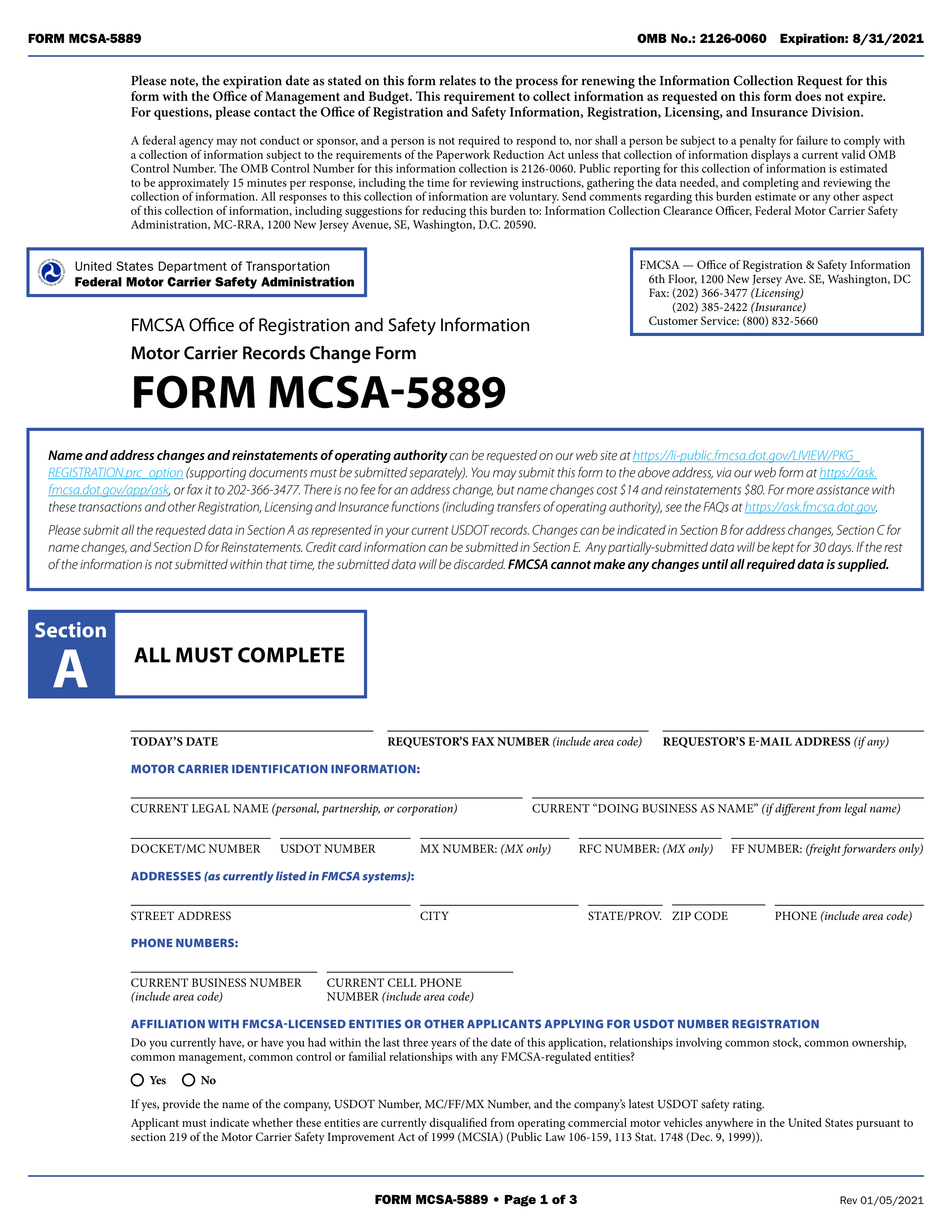

Additionally, if there are no changes to report for a specific period or if you have already submitted a request for changes that is still being processed, you may not need to file this form. For updates related to USDOT numbers without changes in operating authority, use the MCS-150 Update instead.

When is Form 53-1 due?

The deadline for Missouri Department of Revenue Form 53-1 is typically the 15th day of the month following the end of the reporting period. For example, if you are reporting for the month of January, the form is due by February 15.

It's important to keep track of these deadlines to avoid penalties. Make sure to check the Missouri Department of Revenue website for any updates or changes to submission dates.

How to get a blank Form 53-1?

To get a blank Missouri Department of Revenue Form 53-1, simply visit our platform and click on the Fill Form option. The form will load in our editor, allowing you to fill it out directly without needing to download a template from elsewhere.

How to sign Form 53-1 online?

To sign Missouri Department of Revenue Form 53-1 online using PDF Guru, first, fill out the necessary fields in the form using the PDF editor. Once you have completed the form, click on the "Fill Form" option to load the blank version.

After filling in all required information, you can create a simple electronic signature if the form accepts it. For specific signature requirements, consult official sources to ensure compliance with state regulations.

Where to file Form 53-1?

You can file Missouri Department of Revenue Form 53-1 by mail. Be sure to send it to the correct address listed on the form to avoid delays.

Currently, this form cannot be filed online. Always check the Missouri Department of Revenue's official website for any updates on filing options.