What is Form ST-101?

Form ST-101, the Sales Tax Resale Certificate, is an important document used in the United States for businesses that purchase goods for resale. It allows buyers to buy items without paying sales tax, since they will collect tax from customers when they sell those items. This form helps businesses save money and ensures that sales tax is only paid when the final consumer buys the product. Accurate completion of this form is essential to comply with tax laws and avoid penalties.

What is Form ST-101 used for?

Form ST-101 is an important document for businesses in New York:

- to allow businesses to purchase items tax-free.

- to certify that goods are for resale.

- to provide proof to vendors for tax-exempt purchases.

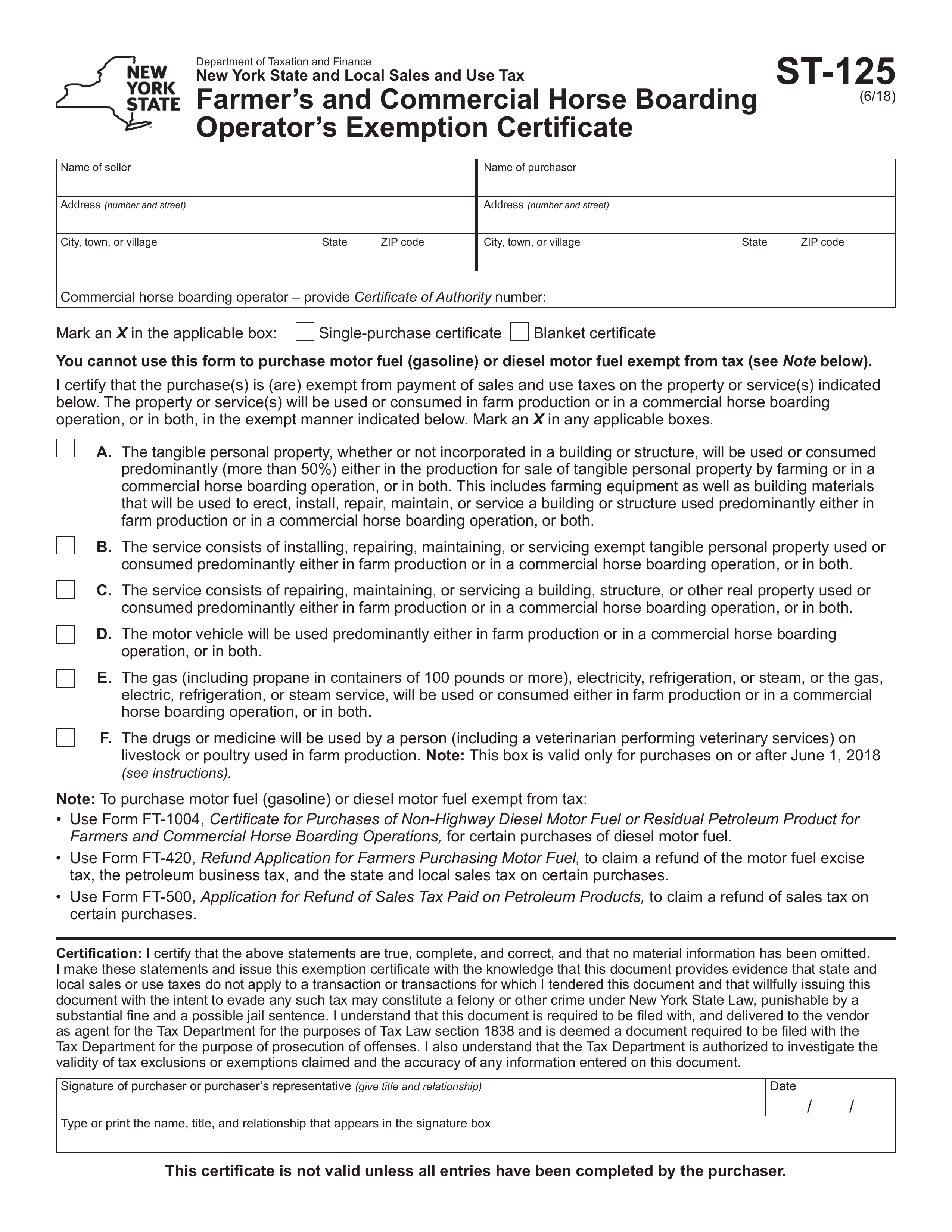

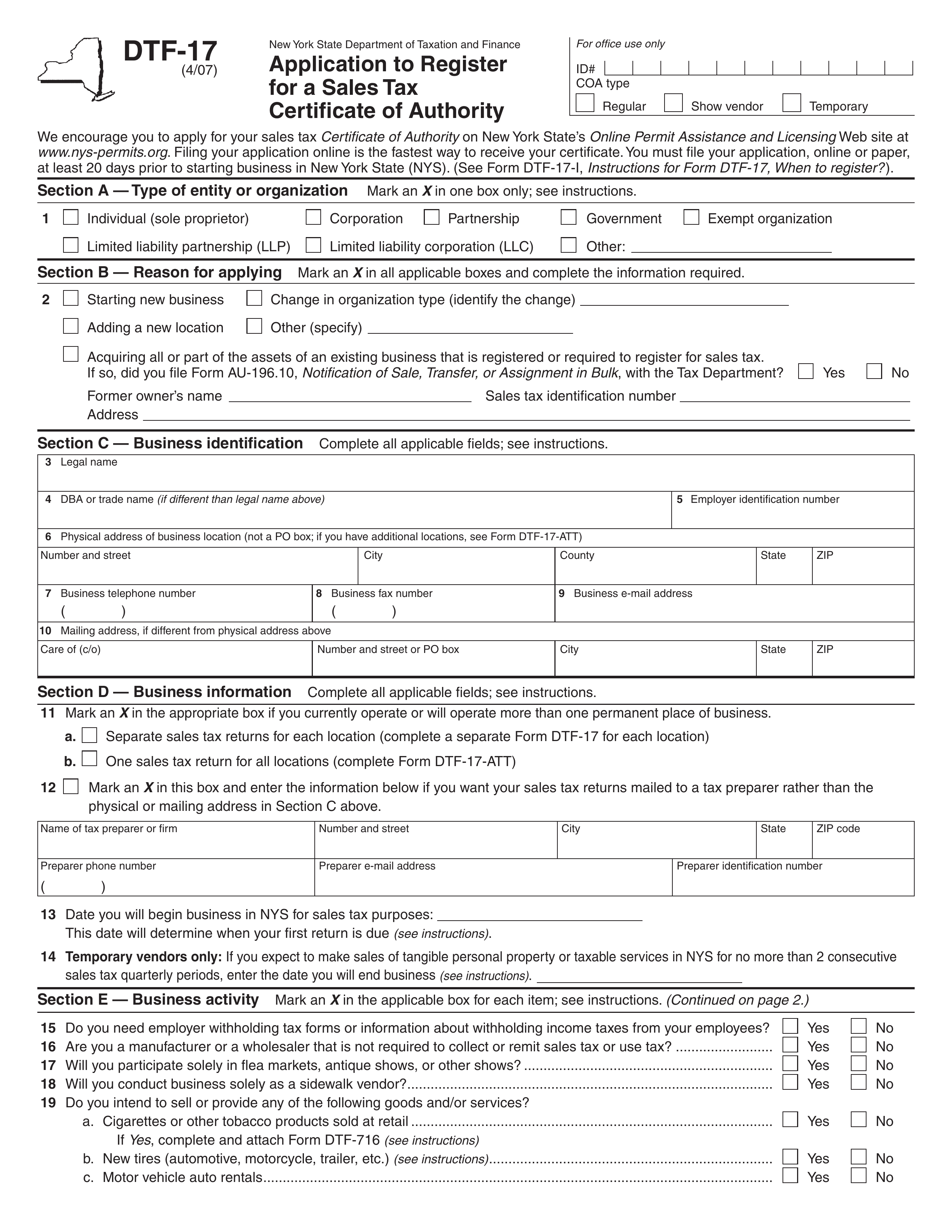

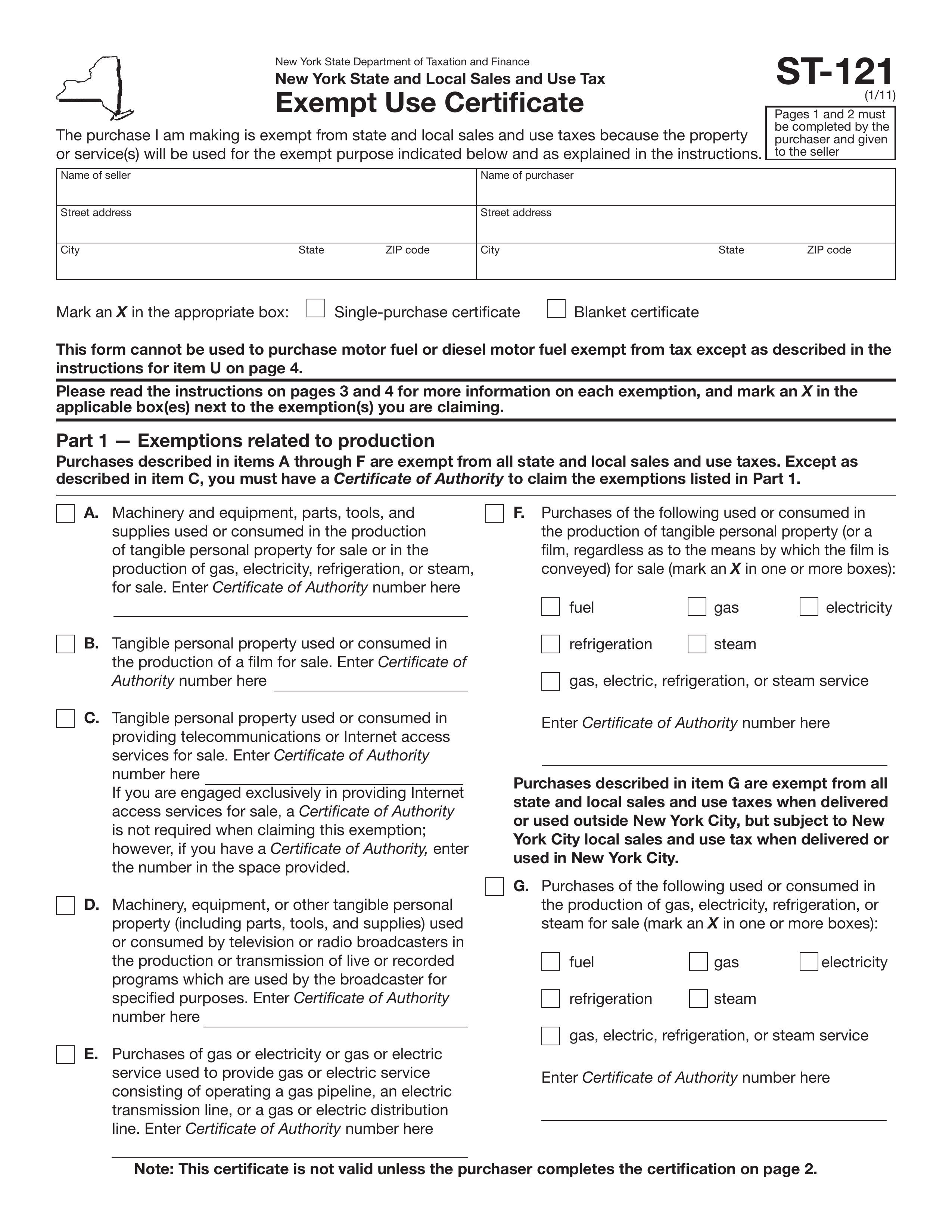

How to fill out Form ST-101?

- 1

Locate your business information in the form.

- 2

Fill in your name, address, and the type of business.

- 3

Provide the seller's information, including their name and address.

- 4

Indicate the type of property being purchased.

- 5

Sign the form with an electronic signature.

- 6

Download the completed form.

- 7

Submit the form to the seller to exempt sales tax.

Who is required to fill out Form ST-101?

Form ST-101 must be completed by retailers, wholesalers, and certain out-of-state sellers. It is used for resale purposes.

Afterward, this form is used by vendors to exempt sales from sales tax.

When is Form ST-101 not required?

Form ST-101 is not needed for purchases of goods that are not intended for resale. This includes items like office supplies or equipment that retailers use for their own operations.

Consumers also do not need to fill out this form when making purchases. Only businesses buying items for resale should complete Form ST-101.

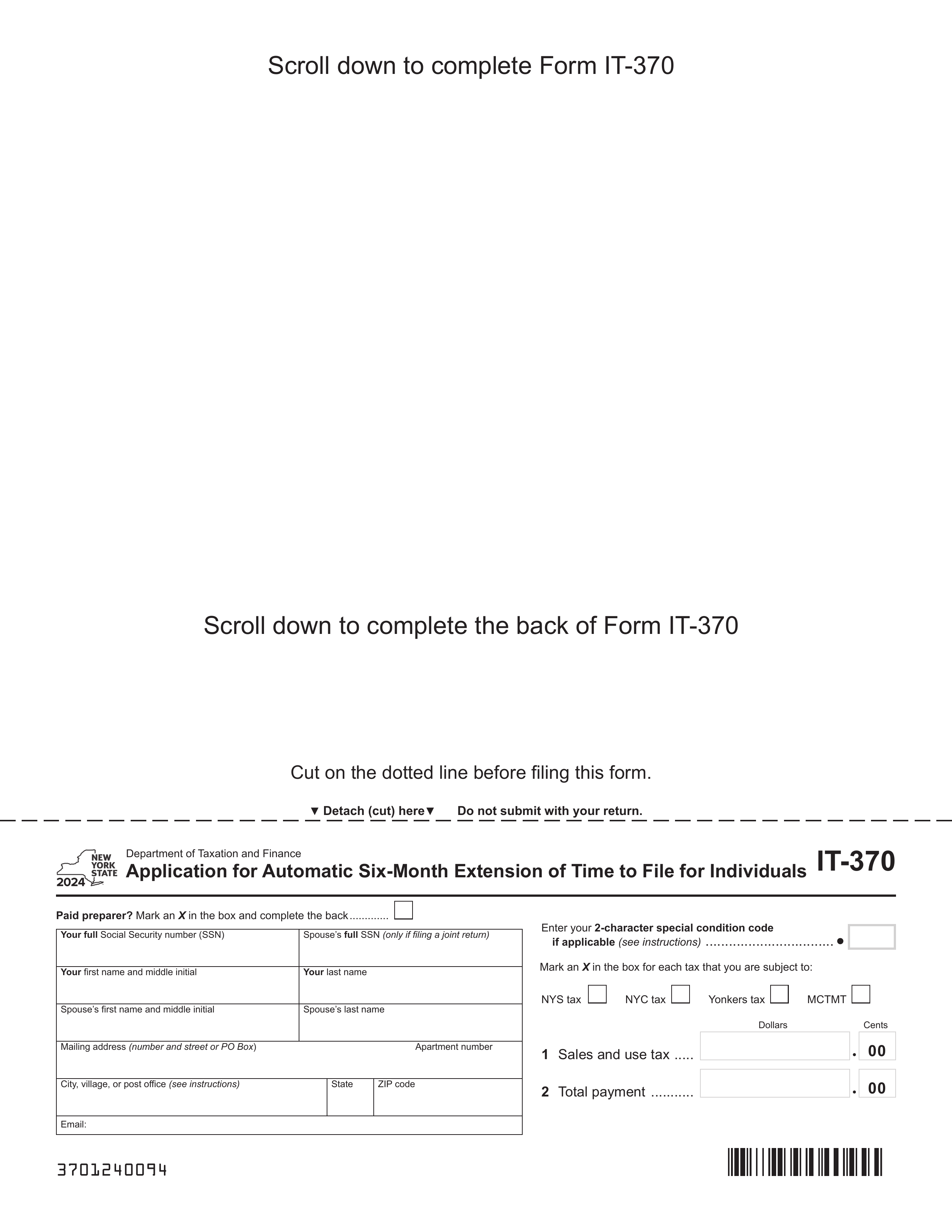

When is Form ST-101 due?

The deadline for Form ST-101 is at the time of purchase for single transactions. If you're using it as a blanket certificate for multiple transactions, you must provide it before your first purchase. Additionally, it should be submitted within 90 days after delivery of the property or performance of the service.

The seller needs to keep the completed Form ST-101 on file for at least three years after the due date of their sales tax return or the date the return was filed, whichever is later. This ensures all records are maintained properly for tax purposes.

How to get a blank Form ST-101?

You can find a blank version of this form pre-loaded in our editor on our website, ready for you to fill out and download.

Form ST-101 is issued by the New York State Department of Taxation and Finance.

How to sign Form ST-101 online?

To sign Form ST-101 using PDF Guru, first, click the "Fill Form" button to load the blank form in the PDF editor. Fill in all necessary fields, including your name and other required information.

Once you have completed the form, create a simple electronic signature. After signing, click "Done" to download your completed form. Always check official sources for specific signature requirements.

Where to file Form ST-101?

Form ST-101 must be submitted to the seller at the time of purchase.

Submission methods: mail, in-person or electronic.