What is Form ST-125?

Form ST-125 is the Farmer's and Commercial Horse Boarding Operator's Exemption Certificate. It's important because it allows farmers and horse boarding operators in New York to purchase certain goods without paying sales tax. This form helps support agricultural businesses by reducing costs. To use this exemption, you must fill out the form accurately and provide it to sellers when making tax-exempt purchases. Keeping this form handy can save money and ensure compliance with tax laws.

What is Form ST-125 used for?

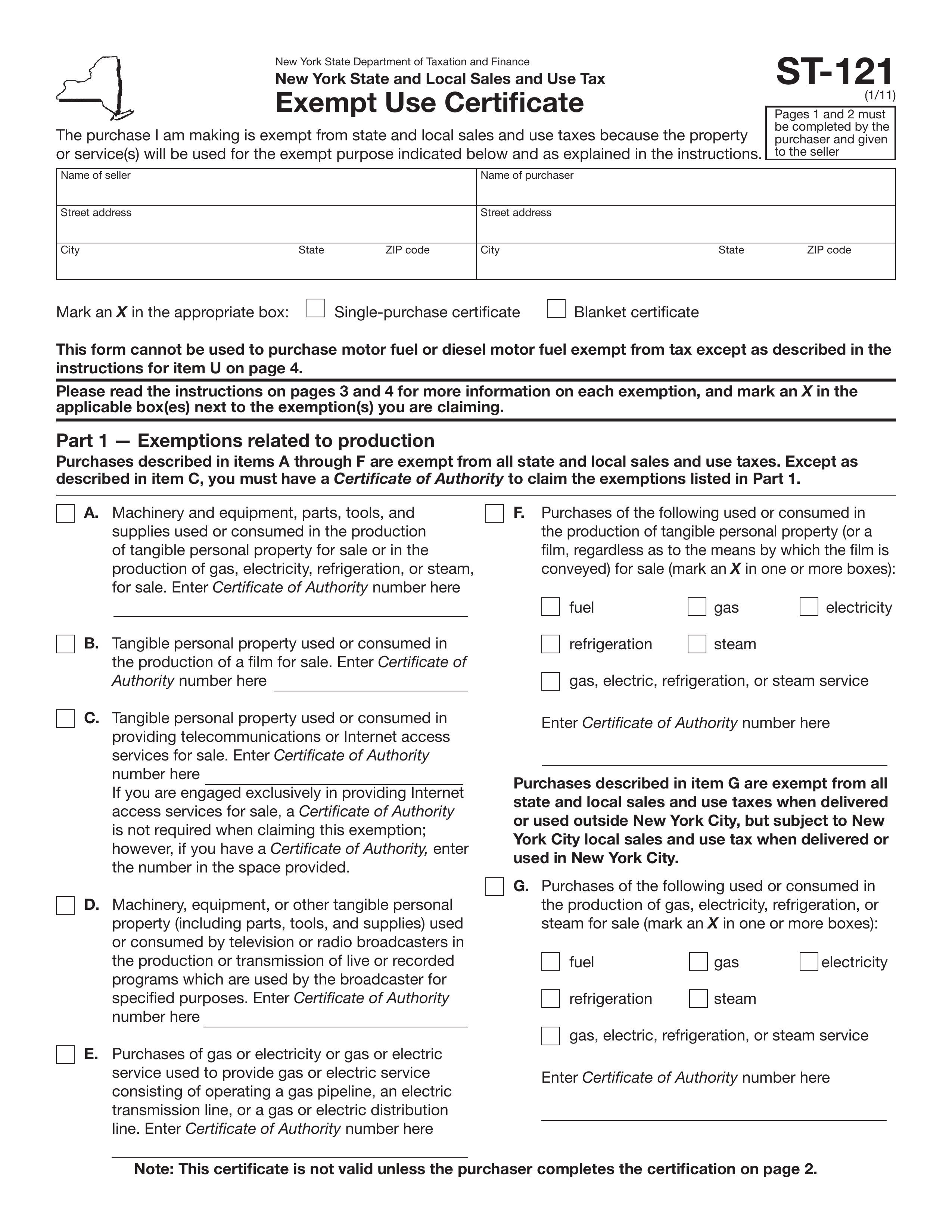

Form ST-125 is used by farmers and horse boarding operators to claim sales tax exemptions:

- to provide proof of eligibility for sales tax exemption.

- to purchase qualifying items without paying sales tax.

- to support agricultural and equestrian operations financially.

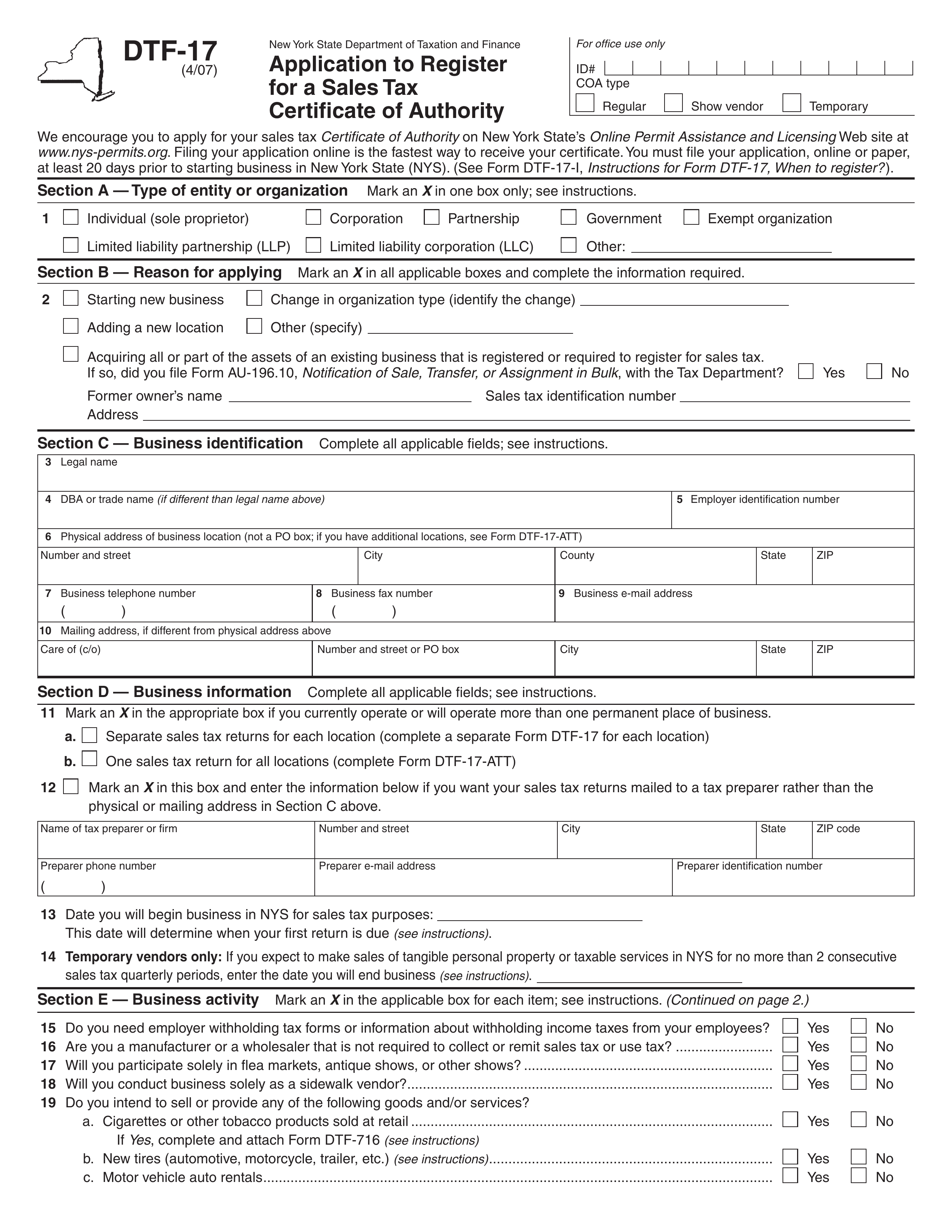

How to fill out Form ST-125?

- 1

Open Form ST-125 in the PDF editor.

- 2

Fill out your name and address in the designated fields.

- 3

Provide your sales tax number, if applicable.

- 4

Indicate the type of exemption you are claiming.

- 5

Sign the form using an electronic signature.

- 6

Download the completed form for your records.

- 7

Submit the form to the vendor or relevant authority as required.

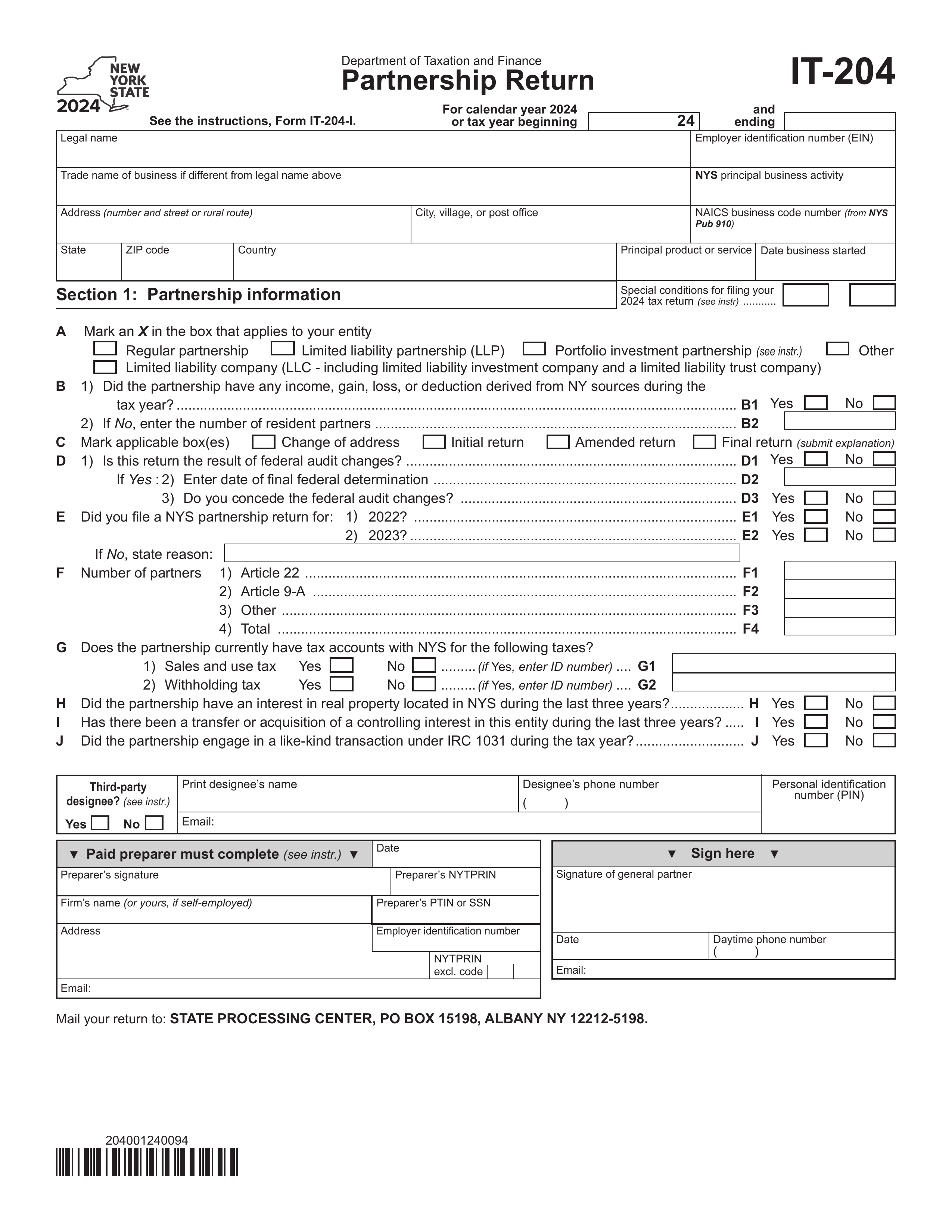

Who is required to fill out Form ST-125?

Form ST-125 must be completed by farmers and commercial horse boarding operators. Farmers must be engaged in farm production for sale, while boarding operators must manage at least seven acres and board at least 10 horses, earning $10,000 or more annually.

After completion, the form is used by vendors to exempt qualifying purchases from sales tax.

When is Form ST-125 not required?

Form ST-125 isn't necessary for purchases of property or services not primarily used (over 50%) in farm production or commercial horse boarding.

Additionally, it doesn't apply to purchases of motor fuel, as these require specific forms like FT-1004, FT-420, or FT-500. Any purchases unrelated to farm or boarding activities also do not need this exemption certificate.

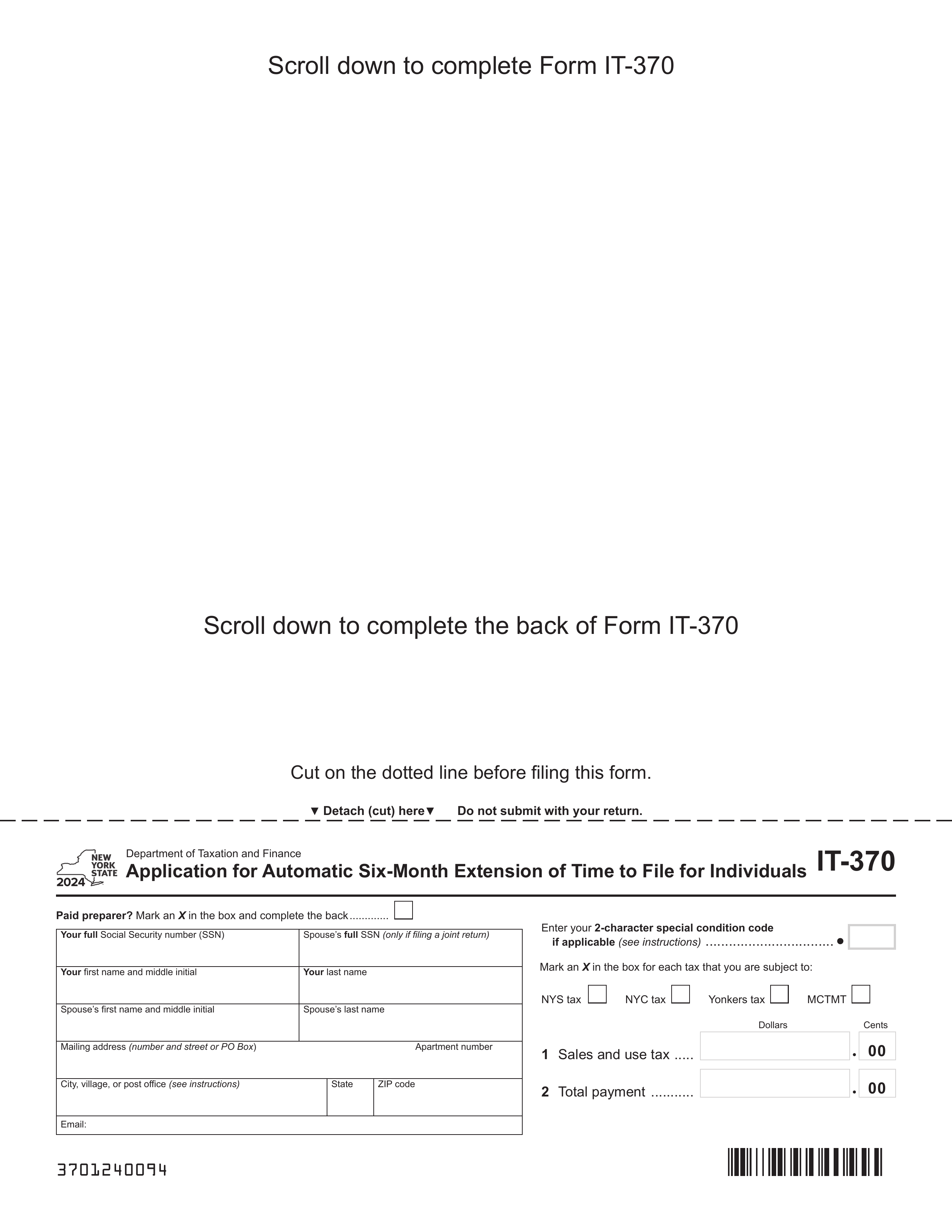

When is Form ST-125 due?

The deadline for Form ST-125 is when the purchaser provides it to the seller: at the time of purchase for single-purchase certificates, before the first purchase for blanket certificates covering multiple transactions, and no later than 90 days after the delivery of the property or performance of the service.

It's important to keep these timeframes in mind to ensure you meet the requirements. Not providing the form on time can lead to additional taxes or penalties, so always check your dates carefully.

How to get a blank Form ST-125?

To get a blank ST-125, which is issued by the New York State Department of Taxation and Finance, simply visit our platform. We have a pre-loaded version ready for you to fill out.

Remember, our website helps with filling and downloading forms but does not support filing.

How to sign Form ST-125 online?

To sign Form ST-125, first open the PDF Guru platform and select the option to fill the form. Once the blank version loads in the PDF editor, complete all required fields. After filling out the form, you can create a simple electronic signature by following the provided instructions within the platform.

Once you've added your signature, click the "Done" button to download the completed form. For specific signature requirements, consult official sources like the IRS or state tax authorities to ensure compliance with regulations.

Where to file Form ST-125?

Form ST-125 must be submitted to the seller at the time of purchase.

Submission methods: mail, in-person or electronic.