What is Form 8832?

Form 8832 is important for businesses wanting to choose or change their tax classification, such as electing to be taxed as a corporation instead of a partnership. This choice can impact how much tax a business pays and its reporting requirements. It's needed by entities that are eligible and wish to alter how the IRS taxes them.

What is Form 8832 used for?

Form 8832 is essential for businesses deciding on their tax classification. It offers flexibility and strategic financial planning.

- To change the tax classification of an entity

- To classify a newly formed entity for tax purposes

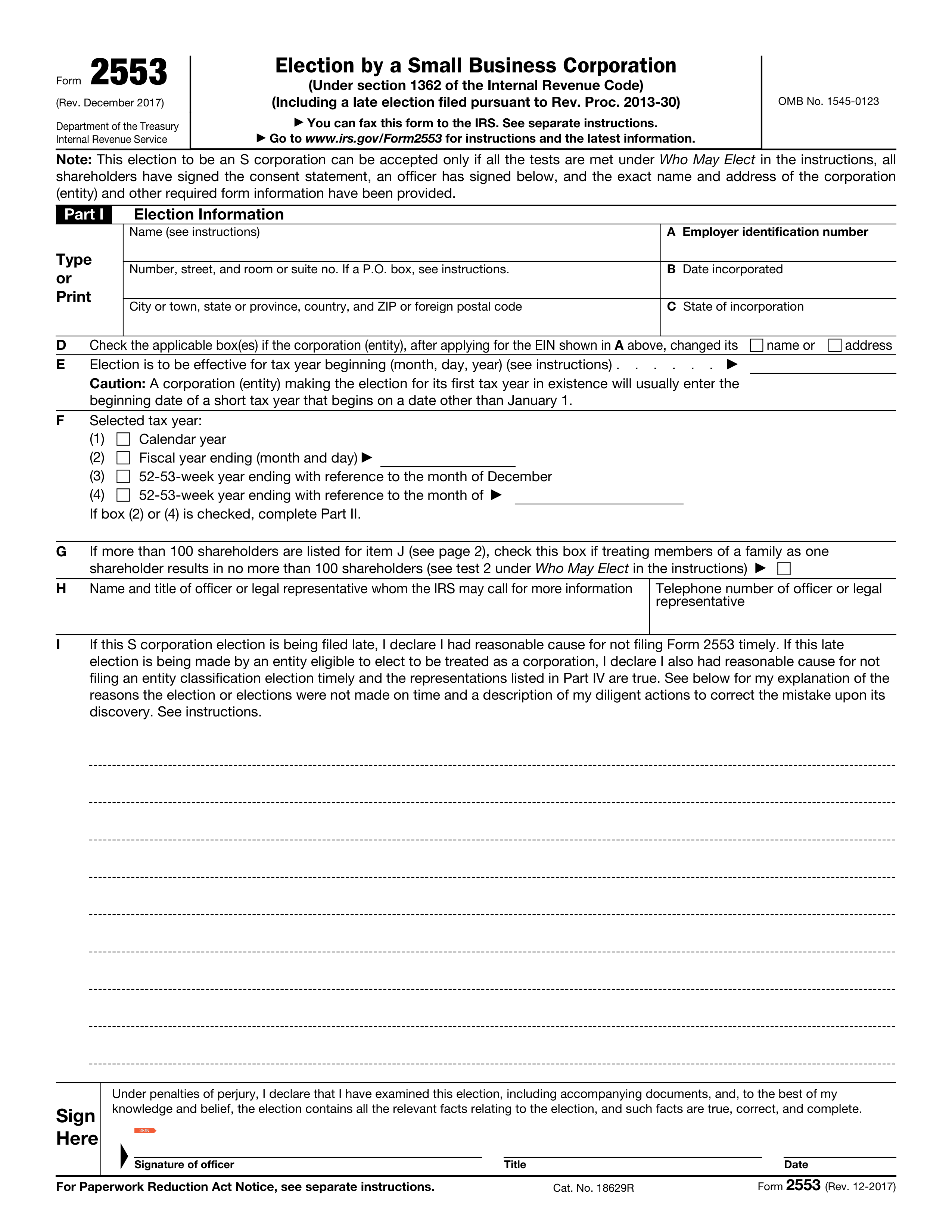

How to fill out Form 8832?

- 1

Start by entering the entity's name and taxpayer identification number at the top.

- 2

Select the classification the entity elects to adopt.

- 3

Fill in the effective date of the election.

- 4

Provide the name and title of the signing officer.

- 5

Review all information for accuracy.

- 6

Sign and date the form.

Who is required to fill out Form 8832?

Entities such as LLCs and partnerships fill out Form 8832 to choose their tax classification.

The IRS uses Form 8832 to process the entity's tax classification choice, impacting its tax obligations.

When is Form 8832 not required?

Certain businesses and individuals might find they don’t need to complete Form 8832. Sole proprietors and single-member LLCs that have not opted to be taxed as a corporation wouldn’t need this form.

Partnerships also typically do not use Form 8832 as they are already classified under the default tax classification. It’s essential to understand your business structure and tax classification to determine if this form is unnecessary for your situation.

When is Form 8832 due?

The deadline for Form 8832 is within 75 days of the date you want your classification to take effect.

It's important to plan accordingly to meet this timeline. Submitting your form within this window ensures your desired classification is recognized by the IRS for tax purposes.

How to get a blank Form 8832?

To get a blank form 8832, visit our platform where the template is pre-loaded in our editor, ready for you to fill out. After completing the form, you can download it for your use, remembering that our website helps with filling out and downloading the form, but not with submitting it.

How to sign Form 8832 online?

To sign form 8832 on PDF Guru, first complete all required sections. After finishing, look for the signature field.

Next, create a simple electronic signature in PDF Guru. Follow prompts to apply it to the form.

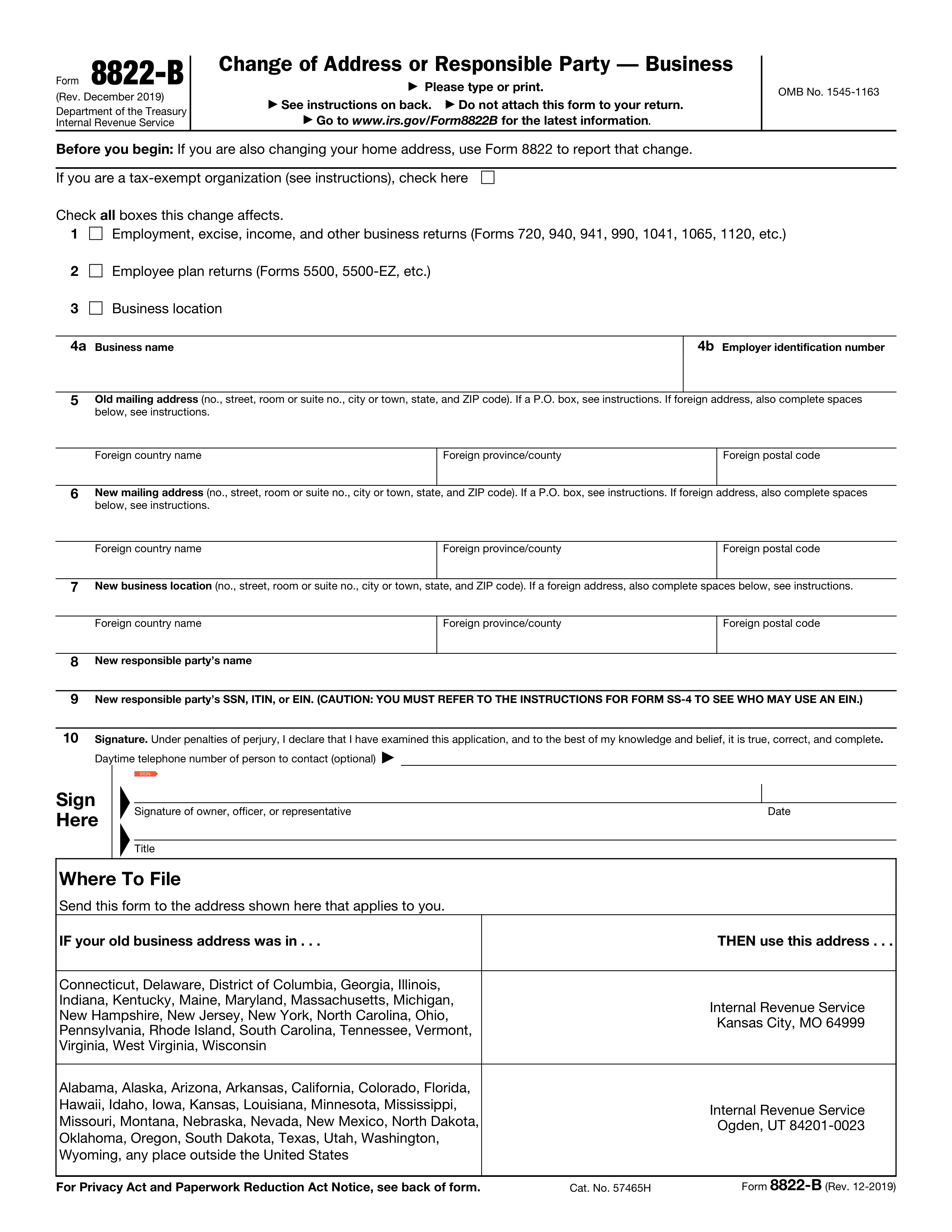

Where to file Form 8832?

Form 8832 can be submitted by mail to the IRS. This is one option for businesses choosing to classify their tax entity.

Some forms, including 8832, cannot be submitted online. Always check the latest IRS guidelines for the most current information.